| Home | About Us | Contribute | Bookstore | Advertising | Subscribe for Free NOW! |

| News Archive | Features | Events | Recruitment | Directory |

| FREE subscription |

| Subscribe for free to receive each issue of Semiconductor Today magazine and weekly news brief. |

News

12 December 2008

Decline in European semiconductor industry endangering half a million jobs

Earlier this week, during the 3rd SEMI Brussels forum, SEMI Europe (the European branch of global industry association Semiconductor Equipment and Materials International) presented EU officials with its SEMI White Paper, which warns that the decline in the European semiconductor industry could put as many as halve a million European jobs at risk. It also makes six recommendations calling on EU and national policymakers urgently to invest to support the industry, given its primary importance to the health and global competitiveness of the EU economy.

Equipment & materials suppliers contribute €9bn and semiconductor device makers €20bn (€29bn collectively) directly to the EU economy and provide around 215,000 direct jobs (105,000 in equipment & materials; 110,000 device making), which rises to half a million jobs including indirect jobs. The European semiconductor industry value chain provides a significant contribution to the gross domestic product of 11 EU countries, particularly Austria, Belgium, France, Germany, Ireland, Italy, the Netherlands, and the UK. For example, in Germany, 80% of its exports are dependant on ICT, and semiconductors enable 10% of its GDP. However, the importance of this value chain to EU growth and competitiveness goes beyond the industry itself, and is instrumental in providing European firms in key industries (e.g. energy, transportation, telecoms, defence, aerospace, medical equipment and biotechnology) with the products that help them to remain competitive in globalized markets. One estimate puts the semiconductor industry at the origin of 90% of innovations made in these key sectors of the European economy.

However, despite comprising 45 countries with 37% of the world's GDP, Europe's share of the global semiconductor device market fell by almost a quarter, from 21% in 2001 to just 16% in 2007 (the smallest share of any region). European semiconductor manufacturing has also been contracting again by almost 25% in just two years from 2005 to 2007. Also, on 19 November the Semiconductor Industry Association in the USA predicted a slump in global semiconductor sales for 2009 which risks exposing Europe’s position further.

The decline of market share, despite the continuous increase in total volumes sold, is also a reflection of the role played by manufacturing, which is differentiating and moving away from Europe due largely to the unfavorable global economic conditions. European semiconductor equipment and materials suppliers are mostly small- and medium-sized indigenous European businesses that rely on a future European semiconductor industry to guarantee their own future and that of the 105,000 European jobs they represent.

“If semiconductor manufacturers leave Europe, indigenous equipment & materials producers will face an uncertain future,” said Franz Richter, chairman of the SEMI European Advisory Board. “The current economic crisis and rising unemployment underscore the urgent need to safeguard jobs in the European semiconductor industry. Supporting a robust and competitive semiconductor industry in Europe is critical to keeping jobs in Europe across all industries and supporting key European economies,” he adds.

SEMI says that the Brussels forum showed that there are opportunities ahead that Europe can and must grasp to stay competitive, requiring leadership and coordination in terms of devising sector-specific industrial innovation policy solutions at both EU and EU Member State level.

During the forum, the SEMI European Advisory Board hence made eight visits to the European Parliament and Commission (DG Trade, DG Information Society and Media, DG Enterprise and Industry, DG Internal Market), meeting over 40 officials, including Viviane Reding, the European Commissioner for Information Society and Media, to express the need to support a more competitive European semiconductor industry.

In particular, at the forum, on behalf of the European Semiconductor Industry Association (ESIA), Enrico Villa (senior advisor to the CEO and COO of device maker STMicroelectronics NV) highlighted how major European OEMs' semiconductor spending worldwide in 2006 was $14.7bn for wireless applications (a 34% share of the global total, with as much as $9.4bn in Europe), $6.7bn for automotive applications (a 43% share), and $1.5bn for medical applications (a 52% share), compared to just $4bn for computers & peripherals (an 8% share). Europe therefore presents a major semiconductor market for applications such as wireless, where compound semiconductor technology can increasingly provide a refuge for device makers hit by the consumer-driven downturn in silicon markets.

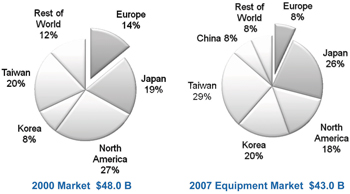

Graphic: Decline in European semiconductor equipment market.

![]() Search: Semiconductor equipment

Search: Semiconductor equipment

Visit: www.semi.org/BrusselsForum

Visit: www.semi.org/europewhitepaper