| Home | About Us | Contribute | Bookstore | Advertising | Subscribe for Free NOW! |

| News Archive | Features | Events | Recruitment | Directory |

| FREE subscription |

| Subscribe for free to receive each issue of Semiconductor Today magazine and weekly news brief. |

News

23 June 2009

LCD backlight LEDs to grow from 8bn in 2008 to 34bn in 2012

The number of LEDs used in TFT LCD backlights (in sizes ranging from 1” to more than 70”) will rise more than 300% from 8bn in 2008 to 34bn in 2012, forecasts DisplaySearch in its report Display LEDs: Lighting Up the Display World.

A total of 70.8bn LEDs were shipped in 2008 (see table). In particular, there are two categories of LEDs used in display applications: active outdoor displays, which used 11bn LEDs (15% of the total), and LCD backlights, which consumed 8bn (11%). Within LCD backlight applications, five key types are adopting LEDs: small/medium, notebook PC, desktop monitors, industrial applications, and most notably TV. In the TFT LCD market, LEDs have been a hot topic especially due to their rapid adoption in notebook PC displays and their potential in LCD TV panels.

Application |

2007 |

2008 |

2009 |

2010 |

2011 |

2012 |

Backlight for |

127 |

532 |

3503 |

6,230 |

8,193 |

8,873 |

Backlight for |

0 |

5 |

145 |

585 |

1,032 |

1,789 |

Backlight for |

16 |

150 |

1,461 |

4,890 |

10,525 |

15,102 |

Backlight for |

4 |

189 |

475 |

701 |

879 |

1,114 |

Backlight for |

6,662 |

7,253 |

6,046 |

6,768 |

7,059 |

7,244 |

Sub-total for |

6,809 |

8,129 |

11,630 |

19,174 |

27,688 |

34,122 |

Active Outdoor |

8,755 |

10,947 |

11,584 |

12,941 |

16,809 |

24,481 |

Signal |

1,512 |

2,125 |

2,582 |

2,925 |

3,302 |

4,991 |

Automotive |

3,665 |

4,587 |

5,371 |

6,213 |

7,582 |

10,681 |

Illumination |

3,606 |

4,755 |

6,148 |

7,919 |

10,679 |

14,882 |

Others |

44,314 |

40,245 |

38,491 |

46,716 |

51,504 |

77,854 |

Total |

68,662 |

70,788 |

75,806 |

95,887 |

117,564 |

167,011 |

Table 1: LED Demand by Application (millions of units). Source: DisplaySearch.

With the fast growth in LED outdoor displays and backlights, DisplaySearch forecasts that in 2012 display LEDs will claim a 34.7% share of the global 167bn unit LED market - including 24bn (14.7%) for active outdoor display and 34bn (22%) for LCD backlights - making display LEDs the largest market segment.

Low-current LEDs will be the mainstream type used in large-area LCD backlights, due to cost, thermal management and luminance efficiency requirements. In contrast, high-power LEDs, with a driving current higher than 350mA (more than 1W), are not well suited for LCD backlights due to thermal issues, and will mainly be used in general lighting applications that require high brightness.

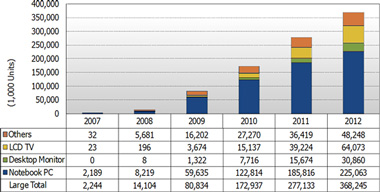

Table 2: Large-size (10”+) LED backlight shipments by application (thousands). Source: DisplaySearch.

Shipments of LED backlights for large-size (10”+) TFT LCDs will amazing 25-fold from 2008 to more than 368m in 2012, forecasts DisplaySearch (Figure 1). Side-view LEDs enable slim design and dominate small/medium LCD backlights. In contrast, large-size (10”+) LCD backlights typically use top-view LEDs. With the increased penetration of LED backlights in notebook PCs and increasingly TVs, top-view LED shipments will pass side-view in 2010.

The penetration rate of LED backlights in notebook PCs will reach 52% in 2009 and grow rapidly to 81% in 2010, forecasts DisplaySearch. In LCD TV, the penetration rate will ramp up from 3% (3.6 million units) in 2009 to 10% (15 million units) in 2010. Leading LCD TV brands including Samsung, Philips, Sharp, Sony, Toshiba, Vizio and LG are planning increased use of LED backlights starting in second-half 2009. A driving factor is the change in LED backlight structure from direct to edge light type, which reduces the cost premium over cold-cathode fluorescent lamp (CCFL) backlights. Finally, LED backlights in desktop monitors are expected to reach 31m units in 2012.

Eyeing the growing LED needs for their panels, nearly all panel makers are participating in the LED business through new LED firms or investments in existing manufacturers. DisplaySearch reckons that Nichia and Toyota Gosei will continue to dominate the market for blue and white LEDs for LCD backlights over the next three years due to their strong patent portfolios and customer relationships. However, Samsung LED, Stanley, Citizen, Showa Denko, Seoul Semiconductor and Osram are targeting growth in LED backlights for LCD TVs. Finally, Taiwanese manufacturers such as Lite-On, Chi-Mei Lighting, Lighthouse and Everlight are entering the backlight market with low-cost structures.

The report also forecasts that LED revenues for outdoor displays will reach $1bn in 2009 and grow to $1.5bn in 2012. The use of LED outdoor displays in the 2008 Beijing Olympics provided international visibility, and such events will be a driving force for growth in the coming years, says DisplaySearch.

“LEDs will create new growth for the TFT LCD industry due to characteristics such as lowering power consumption, meeting green requirements, adding dimming capability, improving color performance, and enabling slim and light form factors for LCD panels and applications,” notes Yoshio Tamura, VP of DisplaySearch and the component research team leader. “TFT LCDs also provide new vigor to the LED industry, as they open up broader applications requiring higher quality and more advanced technology... The interaction between the LCD and LED industries can be viewed as a key development in electronics in the coming decades.”

See related items:

Large-area LED-backlit LCD panel shipments pass 10m units in Q1, reaching 12% penetration

Penetration of LED-backlit LCD-TVs to grow 13-fold by 2013

Backlighting demand produces 'flood of orders' for Taiwan's LED chip makers

LED-backlit notebook PC shipments grow 62% in Q4/2008

![]() Search: LED backlighting

Search: LED backlighting

Visit: www.displaysearch.com