| Home | About Us | Contribute | Bookstore | Advertising | Subscribe for Free NOW! |

| News Archive | Features | Events | Recruitment | Directory |

News

24 March 2010

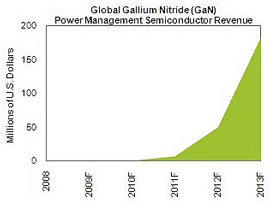

GaN power management chip market to grow to $183m by 2013

Driven by rapid growth in the high-end server, notebook, mobile handset and wired communication segments, the gallium nitride (GaN) power management semiconductor market will rise from virtually nil in 2010 to $183.6m by 2013, according to market research firm iSuppli Corp.

Driven by rapid growth in the high-end server, notebook, mobile handset and wired communication segments, the gallium nitride (GaN) power management semiconductor market will rise from virtually nil in 2010 to $183.6m by 2013, according to market research firm iSuppli Corp.

“GaN is an emerging process technology for power management chips that recently moved beyond the university-based testing phase and into the commercialization stage,” says analyst Marijana Vukicevic. “The technology represents an attractive market opportunity for suppliers by providing their customers with capabilities that may be out of the reach of present semiconductor process materials,” she adds.

iSuppli believes that, over the past two years, several events have occurred that have made GaN the rising star in power management semiconductors. First, the use of silicon has reached its practical limits in power management semiconductors, says Vukicevic. Furthermore, there have been major breakthroughs in growing GaN layers on silicon. Power designers also want to develop more efficient systems and to update their high-voltage products to waste less electricity, she adds.

Component suppliers have recently begun offering GaN parts. For example, power semiconductor device maker International Rectifier Corp of El Segundo, CA, USA released its first GaN technology-based point-of-load (POL) solutions in February, while Efficient Power Conversions Corp (EPCC), also of El Segundo, is placing all its bets on GaN technology, releasing 10 power MOSFET devices this month.

The adoption of GaN devices will be driven by the improved efficiency and small form factors enabled by the material, reckons iSuppli. Such benefits are in particularly high demand for portable electronic products (e.g. mobile PCs and smart phones) as well as providing advantages for power-hungry electronic equipment such as enterprise servers and wired communications infrastructure equipment.

However, adoption of GaN technology for these applications in 2010 and 2011 will be slow due to the high cost of parts using the material, says iSuppli. “As the technology advances and the cost of manufacturing GaN technology drops in 2012 and 2013, the technology will begin to steal market share away from conventional MOSFETs, driver ICs and voltage regulator ICs,” forecasts Vukicevic.

“The first adoption of GaN devices most likely will be among servers, which always demand high-performance devices and often are one of the first product areas to accept new technologies that improve performance,” she adds. “Over the next three years, the bulk of device volume likely will be driven by notebooks, as the power savings and smaller form factor delivered by GaN will be in high demand.”

![]() Search: GaN

Search: GaN

Visit: www.isuppli.com