- News

12 April 2011

LED fab equipment spending triples in 2010, driven by China

With the wide adoption of LED technology in LCD backlight applications, the LED industry has now advanced into the growth stage of its life cycle, reckons global industry association Semiconductor Equipment and Materials International (SEMI) in its quarterly ‘Opto/LED Fab Forecast’, which tracks more than 250 opto/LED fabs activities worldwide, with detail information on fab construction and equipment spending, key milestone dates, capacity and ramp-up schedule. To better serve the soaring demand, the industry has attracted a huge amount of capital pouring into the LED supply chain, from equipment and materials to epitaxy/chip fabrication and packaging capacity.

Last year, SEMI recorded three-fold growth in equipment spending for LED fabs, from $606m in 2009 to $1.78bn in 2010. It expects this spree to continue this year, growing 40% to $2.5bn. However, if some of the projects do not ramp up as quickly as planned, there may be some spending ‘delay’ to 2012. Still, SEMI says that it remains optimistic about investment in 2012 exceeding $2.3bn worldwide.

Last year, SEMI recorded three-fold growth in equipment spending for LED fabs, from $606m in 2009 to $1.78bn in 2010. It expects this spree to continue this year, growing 40% to $2.5bn. However, if some of the projects do not ramp up as quickly as planned, there may be some spending ‘delay’ to 2012. Still, SEMI says that it remains optimistic about investment in 2012 exceeding $2.3bn worldwide.

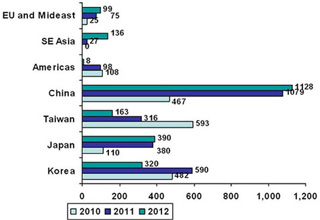

Figure 1: LED equipment spending by region (in $USm). Source: SEMI Opto/LED Fab Forecast March 2011.

Regional equipment spending shows an aggressive investment trend from China, notes SEMI. Supported by subsidy programs from local governments, new LED fab projects have blossomed in the past two years in different cities in China with investors from various backgrounds. The country hence accounts for almost 50% of overall equipment spending.

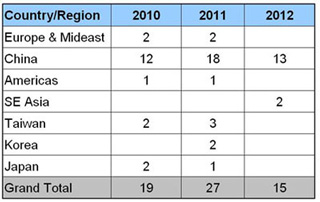

Regarding new LED fabs, SEMI recorded 19 new fabs that started operation in 2010 and it expects to see another 27 begin operation this year. Their geographic distribution is mostly in Asia, especially China, Taiwan, and Korea. For 2012, with current information on hand, SEMI counts 15 new fabs coming online, mostly in China. So, in total over 2010–2012, 61 new LED fabs should have become operational globally, it is reckoned.

Regarding new LED fabs, SEMI recorded 19 new fabs that started operation in 2010 and it expects to see another 27 begin operation this year. Their geographic distribution is mostly in Asia, especially China, Taiwan, and Korea. For 2012, with current information on hand, SEMI counts 15 new fabs coming online, mostly in China. So, in total over 2010–2012, 61 new LED fabs should have become operational globally, it is reckoned.

Table 1: LED fabs starting operation. Source: SEMI Opto/LED Fab Forecast March 2011.

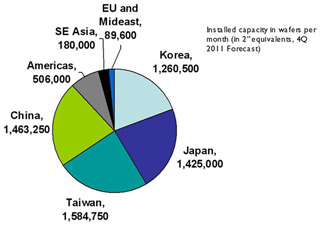

Global LED fab capacity reached 4.35 million wafers per month (wpm, 2”-wafer equivalent). “We expect strong demand from LCD backlight to continue to drive the capacity growth in 2011, with a 50% increase to 6.51 million wpm (2” equivalent),” says report author Clark Tseng. Taiwan and China are the two leading regions by LED epi/chip capacity in 2011, followed by Japan and Korea. However, in view of the upcoming fabs from China, China’s LED capacity is expected to grow from 1.4 million wpm in 2011 to 2.3 million wpm in 2012 (2” equivalent), becoming the capacity leader.

Figure 2: LED fab capacity by region, 2011. Installed capacity in wafers per month (2” equivalents, Q4/2011 forecast). Source: SEMI Opto/LED Fab Forecast March 2011.

Figure 2: LED fab capacity by region, 2011. Installed capacity in wafers per month (2” equivalents, Q4/2011 forecast). Source: SEMI Opto/LED Fab Forecast March 2011.

Current investment momentum is clearly driven by strong demand from LCD backlighting in the short and medium term, and by anticipation of LED adoption in the general lighting market in the longer term, comments SEMI. However, there is one other important factor that came into play — government subsidies, it adds. “We may see some cutback on metal-organic chemical vapor deposition (MOCVD) subsidy from local governments in China, and this certainly will have some impact on the scale of LED investments,” says Tseng. “However, with the announcement of the China government’s 12th Five Year Plan, it is believed that the China government will continue to foster the LED market as a whole, which will help the LED market in a more balanced approach,” he concludes.

GaN LED market to grow 38% in 2011

Penetration of LED backlights into LCD TVs to grow from 21% to 53% in 2011

Large-size LED-backlit LCD panels to reach 67% market share in 2011

LED pricing pressure extending into Q1/2011

Booming MOCVD market gathers pace

www.semi.org/en/Store/MarketInformation/OptoLEDFabForecast

Join Semiconductor Today's LinkedIn networking and discussion group