- News

18 March 2011

UV LED market to grow at nearly 30% to over $100m in 2016

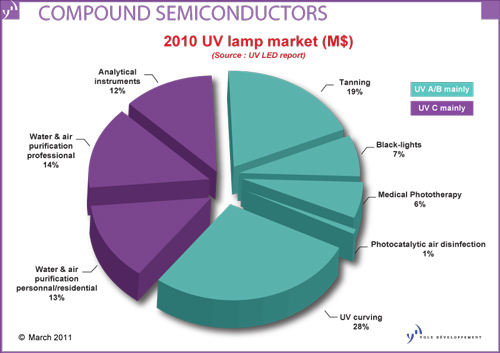

Due to their compactness, lower cost of ownership and environmentally friendly composition, UV LEDs have started and will continue to replace traditional mercury lamps in current applications, and will also open up many new applications (especially portable ones), according to market research firm Yole Développemement in its new ‘UV LED report’, which provides an analysis of the UV LED industry along with major market metrics of the current traditional UV lamp business. The UV LED market is hence expected to increase at an annual growth rate of almost 30% from $25m to more than $100m in 2016.

In 2010, most UV LEDs that were sold continued to be those emitting at UVA/B wavelengths (especially in the upper wavelength range of 365–400nm). More than 90% of the UV LED market (outside of R&D) consisted of UV curing, counterfeit detection, medical and instrumentation applications, requiring UV A/B sources. In contrast, UVC LEDs are currently mainly sold for R&D and scientific instrumentation purpose.

UVA (400–315nm light wavelength) business is currently the main UV LED market and will remain so for at least the next 5 years, forecasts Yole, comprising about 90% of the market in 2010 and about 80% in 2016.

Key applications for UVA lamps are UV curing, document/banknote verification, and photocatalyst air purifiers. Of these, the most dynamic and important is clearly UV curing, where UV LEDs can certainly compete with traditional mercury lamps.

Firstly, the market is large ($120m) and growing at about 10% annually due to the advantages for UV curing technology over traditional technology (speed, green coating).

Secondly, over the past five years many new players have emerged throughout the value chain. Among traditional mercury lamps suppliers, Heraeus Noble light launched a UV LED product line in 2010. Of pure UV-LED curing system players, Phoseon is leading the UV curing market. Meanwhile, traditional UV curing system market leaders (including IST Metz, Hoenle, and Nordson Baldwin) have also adopted UV LEDs.

Finally, between 2009 and 2011 the available power output has doubled to 16W/cm2, and the emission source width is now up to 2m, which is comparable to the performance of mercury lamps.

“This booming market attracts well known visible spectrum LED manufacturers from Taiwan and China, who see that UV LEDs have added-value complementary products: SemiLEDs has greatly increased its sales, as have Tekcore and Huga,” says Dr Philippe Roussel, senior project manager at Yole. “This will help to reduce significantly the cost of the products,” he adds.

Potential high-volume applications for UVC LEDs are water and air purification. Yole says that it had assumed that these markets would start up in 2010, but no new commercial UVC LEDs have been released in the last two years. However, numerous research results have been published during this period that show impressive improvements in optical power output: up to 30-fold compared to 2008. Yole hence expects that, after having solved the efficiency, lifetime and cost challenges, the UVC LED will arrive in 2014 for those key applications.

A key enabling substrate for UVC LEDs is single-crystal aluminum nitride (AlN). The first results for AlN-based UVC LEDs were released in 2010, and these show that AlN will specifically improve the lifetime of the devices. This substrate dynamic is confirmed by the arrival of new players in USA and Europe, concludes Yole.

“This report presents the detailed major market metrics of the current traditional UV lamp business, describing the targeted applications, the key players, the volumes and related market size of each segment,” explains Yann de Charentenay, market & technology analyst at Yole. “It gives the possible total accessible market for UV LEDs, highlighting the strengths and weaknesses of this technology over the current established products,” he adds.

Join Semiconductor Today's LinkedIn networking and discussion group