- News

10 April 2013

Report analyses how best to make progress with HCPV technology

New insight into the state of and prospects for the high-concentrating photovoltaic (HCPV) sector is available in the latest report published by technology market analyst firm Yole Développement.

The report presents what the company identifies as “the key factors to improve the bankability of HCPV installation projects” – with new analysis to guide strategic business decisions related to this technology. Yole has also updated its 2011 analysis of market data for wafers, epiwafers and installation as well as the costs of HCPV modules and systems.

Yole assess that, as of March, about 120 HCPV installations have been installed throughout the world, accounting for a total capacity of 130MW. This is only about 1/1000 of the total current installations of flat-plate PV, represented mainly by crystalline silicon.

The analyst comments that the main advantage of HCPV over flat-plate PV is its greater efficiency; HCPV can surpass 40% at cell level, reaching about 30% at module level, which is not achievable by conventional PV technologies. Yole says that the high efficiency of HCPV systems will be the key driver for this technology in the future.

The analyst comments that the main advantage of HCPV over flat-plate PV is its greater efficiency; HCPV can surpass 40% at cell level, reaching about 30% at module level, which is not achievable by conventional PV technologies. Yole says that the high efficiency of HCPV systems will be the key driver for this technology in the future.

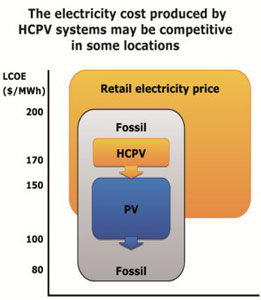

The report states, “In order to increase the differentiation between HCPV and its strong competitor, conventional flat-plate PV, HCPV cell efficiency needs to be significantly increased – but without significantly increasing manufacturing costs – and overall system costs must be reduced.” The report adds, “HCPV’s high system efficiency, together with its high electricity production (kWh/kW installed), makes HCPV levelized cost of electricity (LCOE) competitive with that generated by fossil-fueled power plants in certain sunny locations.”

Most technology challenges identified early, at the beginning of HCPV development, have already been resolved, Yole continues. However, today’s relatively weak HCPV market development is related not only to the technology issues, but also to the lack of financing and low interest among potential customers.

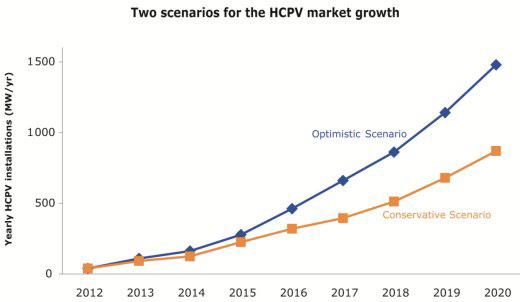

To speed up market growth, Yole assess that the bankability of HCPV projects must be improved at all levels, including technology development and testing, and minimizing the uncertainty about the solar resources at the future installation site, among other things. The report considers the factors that can improve the bankability of HCPV installation projects and help the HCPV market to grow. Based on future technological achievements and improved bankability, two possible scenarios – conservative and optimistic – are proposed for the likely patterns in HCPV market evolution during 2013-2020.

Vertical integration or subcontracting

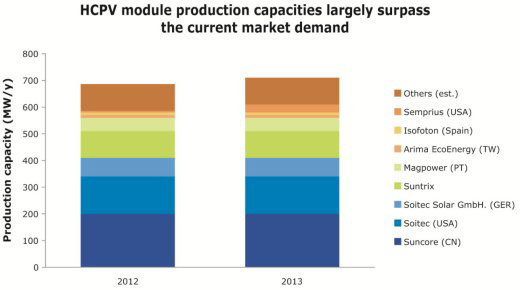

Yole assess that the HCPV market is today very restricted and there is “no place for less-competitive players”. Several companies have recently stopped or reduced their HCPV activities due to either strong competition or after losing interest in a relatively small and low-margin market – “such as HCPV is today”.

Market leaders are not yet established, and new companies with innovative technology or business models may take a lead in the future. As shown in the report, with rising market volume, there will be an increasing trend for vertical integration in the near future. Although more vertical integration is associated with a higher business risk, it enables better control of the system performance and total system costs.

“Their at least partial vertical integration, together with 100MW+ in-house production capacities, may enable companies such as Suncore or Soitec to gain a significant advantage compared to their competitors,” comments Milan Rosina, Market & Technology Analyst, Photovoltaics, at Yole.

“An alternative approach is to subcontract most of the business and thus lower a company’s capital needs while at the same time transfer most of the business risk to subcontractors,” he adds. “This approach is advantageous for small companies with limited sources of financing. In this report, we have analyzed both approaches.”

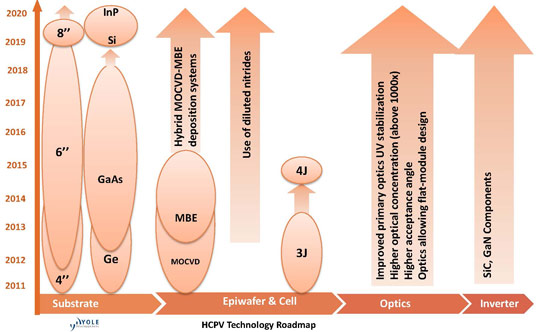

Technology choices in the next 5 years

The performance of each individual element of an HCPV system says nothing about the performance of the whole system, Yole cautions: “All elements need to be carefully optimized and matched in order to get optimal system performance”.

The report also provides a detailed overview of all HCPV components necessary to understand the challenges related to HCPV systems, including: wafer, epiwafer, solar cell, receiver module, concentrating optics, HCPV module, inverter and tracking system.

Furthermore, the analysis of different technical approaches (Ge versus GaAs wafers, PMMA versus SOG optics, etc) allows identification of the main technology trends as well as materials and manufacturing techniques used. Yole adds that this approach can help to evaluate the potential of different HCPV components for cost reduction and performance enhancement. The report also deals with manufacturing challenges (manual versus automated module assembly, main factors to lower manufacturing costs, etc).

By Matthew Peach, Contributing Editor