- News

28 May 2013

SiC power device market grows at 38% year-on-year, despite 2012’s overall power electronics downturn

Starting in late 2011, the power electronics downturn in 2012 was quite severe, exhibiting a 20% drop. The market suffered from the global economic downturn, combined with external factors such as China controlling what happened in some selected markets (e.g. wind turbine or rail traction projects that have been cancelled or postponed). Nevertheless, the silicon carbide (SiC) device market has kept on growing with a +38% increase year-on-year, according to the report ‘SiC Market 2013: Technology and Market for SiC Wafers, Devices and Power Modules’ from market research firm Yole Développement, which spans the entire value-chain, covering all SiC applications in the low-, medium- and high-power ranges up to 2020. The report also includes a bill-of-material analysis, to compare silicon versus SiC-based system costs, and a cost-reduction roadmap for SiC device manufacturing at different process steps.

SiC technology is now commonly accepted as a reliable and pertinent alternative to the silicon world, says Yole. Most power module and power inverter manufacturers have already included it in their roadmap as an option or as a firm project. However, time-to-market differs from application to application as a function of value proposals for cost, specifications, availability etc.

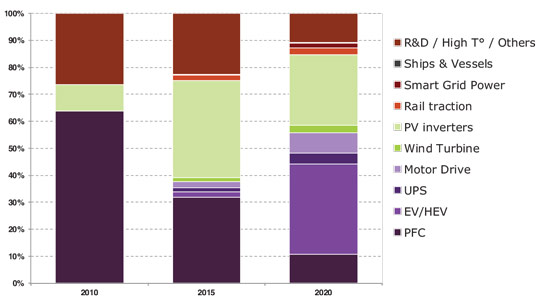

Despite a quite depressed market last year, photovoltaic (PV) inverters have proven their appetite for SiC devices in 2012, comprising the biggest consumer of SiC devices together with power factor correction (PFC).

In 2011 and 2012 the SiC diode sector was the most buoyant due to micro-inverter applications. However, Yole is confident that both JFETs and MOSFETs will quickly catch-up and become dominant in revenue by 2016.

The market for SiC devices (bare die or packaged discretes) reached about $75m in 2012, with Infineon and Cree again dominant. However, little by little the competition is grabbing market share, with STMicroelectronics and Rohm closing the gap.

Over 30 players worldwide, several new entrants, and one closure

More than 30 companies worldwide have now established a dedicated SiC device manufacturing capability with related commercial and promotion activities, reckons Yole. Virtually all other existing silicon-based power device makers are also more or less active in the SiC market, but at different stages.

Last year saw the ramp-up of some companies, such as Rohm, MicroSemi, GeneSiC and STMicro, facing the two giants Cree and Infineon, presaging a new market shape in the coming years.

Four new companies - Raytheon, Ascatron, IBS (Ion Beam Services) and Fraunhofer IISB (Institute of Integrated Systems and Device Technoiogy) - have decided, almost simultaneously, to launch SiC foundry services or contract manufacturing services. The establishment of this business model addresses demand from future SiC fabless and design houses that may seek specific manufacturing partners. This will also probably act as a possible second source for integrated device manufacturers (IDMs) in cases of production overshoot.

In Asia, Panasonic and Toshiba are now clearly identified as credible contenders, along with Mitsubishi Electric, now developing SiC power modules. Also, Fuji Electric’s new SiC line is now running within the Japanese national program. No Chinese device maker has emerged yet but, according to the huge investment plan in R&D, Yole suspects that new IDMs will soon enter the business.

In the USA, Global Power Device and USCi have now exited stealth mode and have strongly affirmed their intentions to take market share, notes Yole.

Ultimately, the unexpected closing down of SemiSouth in October 2012 created chatter about the SiC business (which had been quite stable until then). Several reasons have been disclosed that explain this decision (e.g. over-sized company, market laking too long to take-off etc), however we cannot ignore that it discredits to some extent the normally-off (Noff) JFET technology, says Yole. Only the future will tell, it adds.

Reshaping from discretes to modules

Yole now sees the SiC industry being reshaped, starting from a discrete device business and now mutating into a power module business. Originally, this was initiated by Powerex, MicroSemi, Vincotech and GeneSiC with hybrid Si/SiC products. Then, other players such as Mitsubishi, GPE and, more recently, Rohm have reached the market with full-SiC modules.

Yole forecasts that this trend will become dominant in the coming years as integrators require power modules in most of their mid- and high-power systems (generally starting at >3kW).

Yole does forecast that SiC-based power module demand could exceed $100M by 2015 and top ~$800m in 2020, depending on whether or not the auto industry will adopt SiC.

Next critical challenges: cost reduction, packaging and multi-sourcing

SiC equates to high-frequency and high-temperature operation. That said, capturing these two added-values remains an issue, as no existing set of technologies can fully fulfill that request yet. The path to success for large-scale SiC implementation will necessarily be through new packaging solutions, says Yole. Numerous bottlenecks need to be unlocked, such as chip bonding, metallic contact techniques, gel filling, encapsulant, and electro-magnetic interference (EMI), the firm adds.

Power device integrators generally rely on two or even three sources to reduce supply-chain risks. In SiC, it is now easy operating multi-sourcing for diodes, though not yet for transistors, notes Yole. MOSFETs, JFETs and BJTs must be available from at least two companies with similar specifications, it concludes.

Electric vehicle go-slow hits SiC power devices