- News

3 March 2014

Aixtron's quarterly revenue rises 10% in Q4/2013, but demand remains subdued

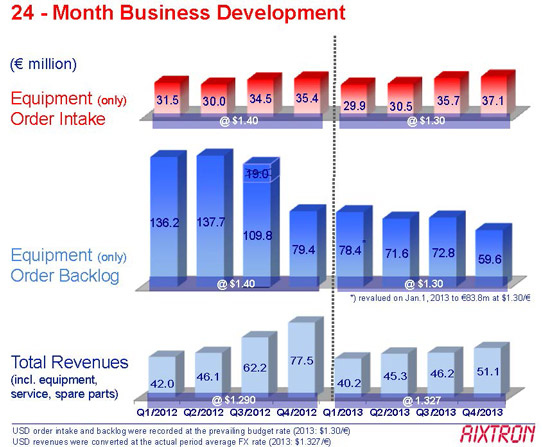

For full-year 2013, deposition equipment maker Aixtron SE of Aachen, Germany has reported a 20% drop in revenue from 2012’s €227.8m to €182.9m. However, although down 34% on €77.5m a year ago, fourth-quarter revenue was €51.1m, up 10.6% on €46.2m Q3/2013.

Quarterly gross margin has risen from 23% in Q3 to 34% in Q4. But, influenced by several unusual items, full-year gross profit has fallen from €0.4m in 2012 to -€7.4m in 2013, resulting in a negative gross margin of -4%, as decreased revenue-related costs were more than offset by lower selling prices for metal-organic chemical vapor deposition (MOCVD) equipment and a -€5.1m impact from inventory destroyed in a fire.

Despite the 20% drop in annual revenue, the full-year EBIT operating result (earnings before interest and taxes) has improved by €36.6m from -€132.3m (an EBIT margin of -58% of revenue) in 2012 to -€95.7m (-52% of revenue) in 2013, as write-downs and restructuring expenses recorded throughout the year were more than offset by insurance proceeds plus cost reductions and efficiency gains realized through the 5-Point-Program initiated in Q1/2013. Full-year operating costs have been cut by more than 20% from €124.9m in 2012 to below the previously targeted €100m in 2013. Excluding unusual items, Q4 EBIT was -€8.3m, a slight improvement on -€9.2m last quarter.

Quarterly free cash flow was -€0.2m in Q4/2013, an improvement from -€6.5m last quarter. For full-year 2013, free cash flow was -€1.1m (a big improvement on -€61.6m in 2012). However, this followed a capital increase in October of €101m. Aixtron’s executive and supervisory boards will propose to the shareholders’ meeting that the 2013 loss (-€1.1m in free cash outflow) should again be carried forward and consequently no dividend payment should be made for 2013.

Aixtron says that, although it recorded increased cash outflow from restructuring-related payments, the significantly improved free cash flow for full-year 2013 underlines its successful liquidity management. As a result of October’s capital increase, the firm has strengthened its financial position. With cash and cash equivalents rising from €205.5m at the end of 2012 and €207.5m at the end of Q3/2013 to €306.3m at the end of 2013, the firm says that it maintains a sound capital base for future business development.

“The structural improvement of the result, in particular within the second half of 2013, has reinforced our view that we have set out on the right path by consolidating and reorienting Aixtron,” comments president & CEO Martin Goetzeler. “As planned, we did not only manage to reduce our 2013 operating costs (excluding unusual items) by more than 20% to less than the targeted €100m through our 5-Point-Program, but we also generated a nearly balanced free cash flow that also contributed to the stabilization of our financial position,” he adds. “Moreover, and in spite of all our cost reduction and process optimization efforts, we have continued our targeted research and development investments in the most important technology fields to further strengthen and diversify Aixtron’s future product portfolio.”

Although capacity utilization rates in Aixtron’s target industries have increased significantly (e.g. at leading Taiwanese and Korean LED chip makers), demand for production equipment remained at a very low level throughout 2013. Consequently, full-year equipment order intake of €133.2m for 2013 was broadly unchanged from €131.4m in 2012, despite quarterly equipment order intake rising 5% from €35.5m a year ago and €35.7m last quarter to €37.1m in Q4. Total equipment order backlog has fallen 25% from €79.4m at the end of 2012 and €72.8m at the end of Q3 to €59.6m at the end of Q4, emphasizing the sustained weakness in demand.

Due to the still very low order visibility, Aixtron’s management says that it is unable to provide any precise revenue or earnings guidance for full-year 2014. However, as a consequence of the already advanced restructuring of the company and the cost reductions realized, it expects further year-on-year improvement in 2014. Based on its consideration of current market demand, management believes that 2014 revenues will be on a par with 2013, with a still negative but significantly improved operating result. Assuming a target gross margin of 40% and operating costs of about €100m, EBIT break-even may now be reached with annual revenue of about €250m.

Aixtron raises €101m from capital increase

Aixtron’s recovery program improves earnings, despite growth remaining subdued

Aixtron cuts losses as revenue rebounds 13% in Q2

Aixtron outlines 5-Point Program to return to sustainable profitability

Aixtron’s revenues and orders continue to struggle in Q1

Aixtron reports loss of €132m for 2012 as sales fall 63%