- News

7 March 2014

Sapphire core prices to resume rise in Q2-Q3/2014; wafer prices to rise slightly in Q2

The sapphire industry recently ended an 18-month period of depressed pricing and achieved $936m in revenue for wafer products, according to the report ‘Sapphire Market 2014’ from Yole Développement.

Recovery was helped by an increase in LED demand due to growing adoption in general lighting and a resilient LCD backlight market. But the saving grace was new consumer electronic (CE) applications: camera lens and fingerprint reader covers, mostly driven by Apple in 2013, notes Yole.

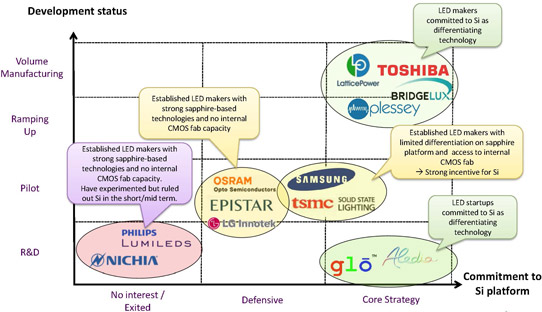

Overall, the growth in wafer demand will be enough to justify a capacity increase toward the end of 2014. For the longer term, Yole has analysed opportunities of alternative LED substrates - i.e. gallium nitride (GaN) and silicon (Si) - but concluded that sapphire will retain more than 90% of the market through 2020.

After almost 2 years of losses, core prices increased by more than 50% in 2013; tier-1 sapphire vendors are finally selling at prices close to breakeven costs. After a short pause, Yole expects the upward trend to resume through Q2 and Q3/2014. However, leading vendors’ interests are not to increase prices above levels that would allow tier-2 competitors to generate a profit as well. Yole therefore expects prices to stabilize by the end of this year.

Due to strong competition, last year wafer finishing companies did not pass the higher material costs on to their customers. Wafer prices remained stable in 2013 but will rise slightly in Q2/2014, forecasts Yole. For patterned sapphire substrates (PSS), which now dominate (with a penetration rate of 85%), prices could increase faster as supply currently falls short of demand in Taiwan. This will continue until leading suppliers increase capacity and emerging players in China ramp up and enter the supply chain later in 2014, forecasts Yole. Overall, sapphire prices should stabilize by the end of 2014 and start decreasing again in late 2015 as the industry keeps improving its cost structure, reckons the market research firm.

Apple could transform industry in 2014

Sapphire has been used for years in various luxury cell phones. In 2013 Yole indicated that adoption in more accessible models could start in 2014. This just happened with the introduction by Gionee of the first ‘non-luxury’ (<$1000) smartphone to feature a sapphire display cover. If adopted by leading cell-phone OEMs for their flagship models, total sapphire demand could increase by up to 2x by the end of 2014 and 20x by the end of the decade, reckons Yole.

On 4 November, Apple and GT Advanced Technologies Inc (GTAT) of Nashua, NH, USA (a provider of polysilicon production technology as well as sapphire and silicon crystal growth systems and materials for the solar, LED and electronics markets) announced a partnership to set up a large sapphire manufacturing plant in Mesa, AZ, USA. Yole says that it has analysed the deal and concludes that, exiting 2014, the plant could reach a capacity equivalent to more than twice the world’s current capacity. Demand for home buttons and camera lens covers is expected to increase in 2014 and 2015 but, even with aggressive forecasts for smart watches (and assuming that Apple uses sapphire for its own model, which Yole doesn’t believe it will), the firm could still tap into the existing supply chain to procure the sapphire it needs. It is therefore difficult to justify this $1bn investment unless new applications requiring a lot of sapphire are coming to market. From its analysis, Yole considers cell-phone display covers to be the most likely outlet for this capacity.

Yole modeled the Mesa operations and believes that the plant will make sapphire slabs that will then be sliced and polished by Apple subcontractors in China. The simulated slab cost of $6.40 per part would enable a $17 cost per finished display cover, with a path for under $13 ASP in the mid-term. The plant could deliver an equivalent of 42 million display covers in 2014 and more than 85 million in 2015, it is reckoned.

Sapphire industry to benefit, but not everybody will win

With display applications, total revenue from polished sapphire products could rise at a compound annual growth rate (CAGR) of 50% through 2018 and exceed $5bn. Sapphire is now a strategic material for Apple that it will use as an element of differentiation versus Samsung and other competitors, says Yole. With the Mesa plant, Apple is creating its own supply chain, sheltered from any risk of shortage or price increase. But a second source is needed. Yole therefore expects other sapphire makers to increase capacity and join the Apple supply chain in the next few months.

There is still a risk associated with the unprecedented ramp up that GTAT and its suppliers have committed to. Even a few months from its targeted full-capacity operation, Apple could still walk away from the project. In addition, sapphire needs to deliver its promises of stronger displays. Bloggers can be creative in their ways to destroy phones and, if initial reports do not show a noticeable improvement in breakage rates, it will create a negative perception of the technology, notes Yole.

The impact of Apple’s commitment to sapphire is positive for the industry, the market research firm reckons. It brings a lot of visibility to sapphire and could spur new applications. But we must guard against the notion that everybody will benefit, says Yole: 2014-2015 will be good for those with efficient cost structures that position themselves in the supply chain. Shortages might occur if other cell-phone OEMs decide to use sapphire as well. Their volume needs will be too small to justify an Apple-like investment, so they will tap into the existing supply chain; even a small percentage of adoption will lead to vast amounts of sapphire per the industry standards.

Now that the deal is sealed, it is in the interest of other sapphire vendors that GTAT and Apple succeed, thinks Yole: the Mesa plant provides unprecedented economies of scale and expertise in high-volume sapphire manufacturing. If Apple was to use less sapphire than anticipated, GTAT might flood the market with unused capacity at very competitive prices. The report thus thoroughly analyzes the impact on the sapphire industry and the supply chain.