- News

3 August 2015

SiC market to treble and GaN to explode - if challenges are overcome

According to the report 'GaN and SiC for power electronics applications' from Yole Développement, in 2014 the silicon carbide (SiC) chip business was worth more than $133m, with power factor correction (PFC) and photovoltaics (PV) still the leading applications (as in previous years).

More than 80% of this market consists of SiC diodes, which in 2020 will remain the main contributor across various applications, including electric vehicles and hybrid electric vehicles (EV/HEV), PV, PFC, wind, uninterruptible power supplies (UPS) and motor drives, reckons Yole.

SiC transistors will grow in parallel with diodes, driven by PV inverters, forecasts the report. However, challenges must be overcome prior to the adoption of pure SiC solutions for EV power train inverters, which is nevertheless expected by 2020.

Including the growth in both diodes and transistors, Yole expects the total SiC market to more than treble $436m by 2020.

Gallium nitride (GaN) potentially has a huge total accessible market (TAM), and its adoption would therefore be significant, says Yole. However, the starting point and the growth rate are directly linked to two important questions:

- How will the emerging applications of low-voltage GaN expand, and how will GaN be adopted by these applications?

- Will 600V devices make their way to market?

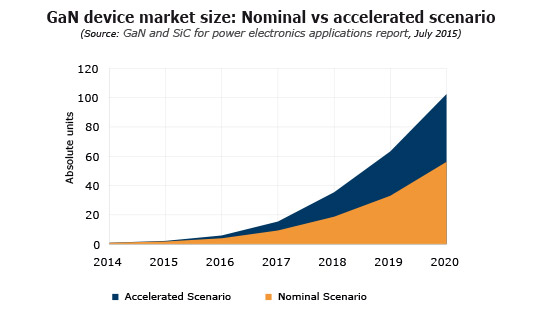

Yole has integrated these variables in developing two scenarios for the GaN device market up to 2020. The analysis is based on the penetration rate of GaN in different applications including DC-DC conversion, Lidar, envelope tracking, wireless power, and PFC. The firm hence estimates that by 2020 the GaN device market will grow to $303m in the nominal scenario, or $560m in the accelerated scenario (where low-voltage GaN and 600V GaN are rapidly adopted). Emerging applications (namely envelope tracking, wireless power and Lidar) will collectively consume one third of GaN transistors, it is forecast. In both scenarios, low-voltage applications below 200V are expected to be the major contributors to the market.

Companies moving in right direction to overcome remaining technical challenges

Designing a totally new product with these semiconductor materials will induce R&D expenses that must be compensated by adding value at the system level, says Yole. This could include improving cost, size, and operating conditions compared with regular silicon solutions. To capture this added value, an integrator must get the full benefit from the increased operating frequency and temperature of wide-bandgap (WBG) devices.

So far, the WBG market has not grown as fast as hoped. The four barriers to device adoption remain: high cost at the device level; reliability; multi-sourcing; and integration.

Many R&D programs have been launched in recent years. Some prototypes have demonstrated that the bill of materials (BOM) cost can be lower at the system level when using WBG devices.

To overcome reliability challenges, Rohm and Cree have announced new SiC device generations or platforms with enhanced, more stable specifications. SiC and GaN devices are also going through reliability tests to reduce the risk involved in adoption.

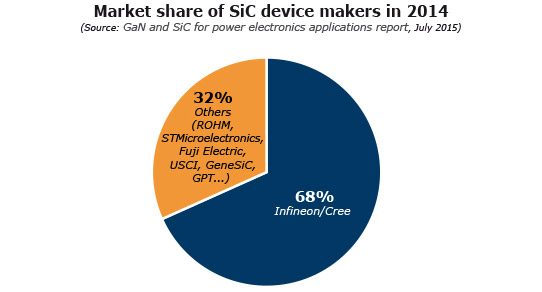

Many companies - including Cree, Rohm, ST Microelectronics, Mitsubishi and GE - have now developed SiC MOSFETs. So, end-users are more able to multi-source these devices. By contrast, there is a limited number of suppliers in the GaN market. In the coming years, new entrants such as ExaGaN and TSMC should provide extra sourcing options. Also, Infineon and Panasonic have announced this year that they will establish a dual-sourcing relationship for normally-off 600V GaN power devices.

Integrating these fast-switching, high-operating-temperature devices remains one of the major challenges. WBG suppliers and end-users need to reconsider many factors, including device packaging, module packaging, gate driver integration and topology design.

Packaging is becoming a particular bottleneck, but the good news is that companies are moving in the right direction, says Yole. GaN device makers EPC and GaN Systems have both adopted advanced packaging, which seems to be more suitable than traditional power device packages. The recent acquisition of APEI by Cree should likewise accelerate the development of SiC module packaging.

Recent financial moves indicate market confidence in WBG devices

There have recently been several pieces of good news for the WBG sector, says Yole. The existing SiC device market leader Cree has decided to spin off its Power and RF division as a separate company, and will issue shares in a new IPO. Yole interprets this as a positive sign of the continuing growth in the SiC power device market.

At the same time, about $100m in investment has been made in various GaN startups. Two of them are in the top four commercial GaN companies. In May, GaN Systems raised $20m in venture funding. In June, Exagan raised €5.7m ($6.5m) in first-round financing to produce high-efficiency GaN-on-silicon power-switching devices on 200mm wafers. Also, Transphorm announced a new $70m funding round led by investment firm KKR. These investments reflect the confidence in the GaN device market and investors' willingness to provide funds to accelerate production capabilities, says Yole.

Will GaN and SiC compete for the same power electronics applications?

After years of discussion about whether it would be GaN or SiC, the answer is now clearer than ever, states Yole.

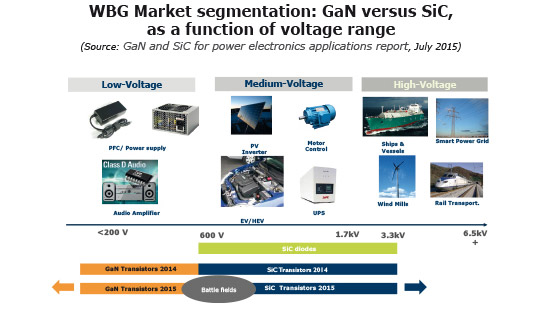

SiC diodes have been on the market for over 14 years, and are becoming a mature technology, leaving no room for GaN diodes.

GaN transistors have made their way into low-voltage applications, which SiC will find difficult to challenge.

Commercial SiC transistors exist in the 600-3300V range. Compared to GaN lateral devices, their advantages at voltages over 1200V are now widely recognized. In early 2015, SiC device leader Cree launched its 900V platform. This is considered by the market as a significant move for SiC, signaling its intention to address 900V and lower voltage applications.

GaN is also trying to enter the 600V market. Applications such as PFC, on-board chargers, and low-voltage/high-voltage DC-DC converters for automotive applications will therefore be the main battlefields for GaN and SiC in the coming years, reckons Yole.

In the end, integrators do not care what the chips they buy are made of, notes the market research firm. They want suitable devices at reasonable prices to make a system desired by the market. The real competition is not between GaN and SiC, but WBG versus incumbent silicon-based technology. Silicon insulated-gate bipolar transistor (IGBT) technology is progressing, becoming better and cheaper. However, in the future, the market will not be as dominated by silicon-based devices as it is today, but more diversified. A variety of devices - including silicon, GaN, SiC and others that are yet to be developed - will find their own niches, concludes Yole.

www.i-micronews.com/compound-semi-report/product/gan-and-sic-for-power-electronics-applications.html