- News

17 February 2015

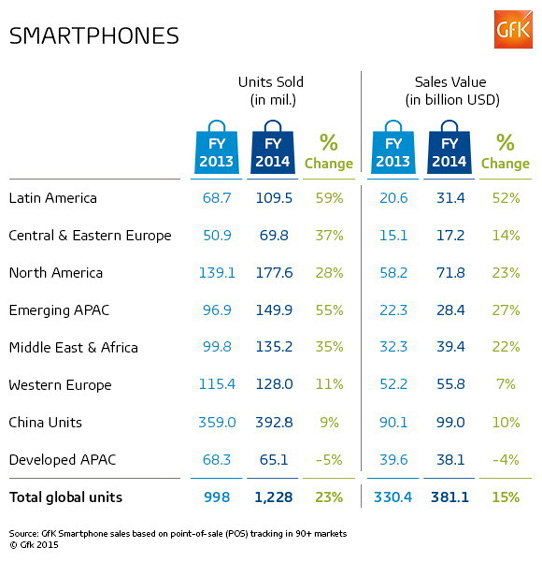

Smartphone sales grow 23% to over 1.2bn units in 2014

Global smartphone revenue grew 20% year-on-year to a record $115bn in fourth-quarter 2014 as unit sales rose 19% to almost 346 million (totalling over 1.2bn in full-year 2014), according to market research firm GfK.

In Q4/2014, all regions saw year-on-year growth, in terms of both units and value, except for developed APAC (Asia-Pacific), where subsidy changes in Korea negatively affected these already very mature markets. The Latin America market saw the highest growth, with revenue growing 37% to about $10bn and unit sales up 43% year-on-year to 36 million units (and up 59% for full-year 2014).

China will remain the biggest market in terms of both unit and value sales for the foreseeable future. However, growth slowed dramatically in second-half 2014. During Q4, smartphone unit sales were flat year-on-year, although the value of units sold rose by 21% to $28bn, the highest ever quarterly figure.

"The increase in the value of units sold in China, despite the recent plateauing of unit sales, is due to consumers' rapid adoption of higher-priced smartphones with larger screen sizes," says Kevin Walsh, director of Trends and Forecasting at GfK. "This is a trend seen in most markets and GfK global data shows that the 5-5.6 inch segment grew by more than 130% year-on-year in Q4/2014 and by nearly 150% in the full year," he adds. "In 2015, we forecast this segment to become the dominant screen-size band, surpassing 4-4.5 inch for the first time."

All other regions - except for North America and Developed APAC - saw a decrease in the average selling price (ASP) in Q4/2014. Looking ahead, all regions will grow in unit terms in 2015, but growth rates will slow significantly from 2014, forecasts GfK.

"The slowdown forecast for 2015 is due to developed markets reaching saturation point," says Walsh. As a result, global smartphone unit growth will be only 14% this year, down from 23% in 2014. "We forecast emerging regions to drive growth in 2015 as smartphones further penetrate lower price points," he adds. GfK forecasts that smartphone price bands above $150 will see a decline in market share. At the next level down ($100-150), sales will remain stable, but it is the cheaper smartphones priced below this point that will gain share.

The most resilient two regions in 2015 - both forecast to grow by 33% in unit terms - are Emerging APAC and Middle East & Africa. Both regions still have significant room for growth as consumers migrate from feature phones and existing smartphones to trade up to a bigger screen, says GfK.