- News

21 September 2015

Slowing demand push down LED light bulb and component prices in August

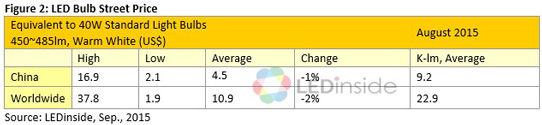

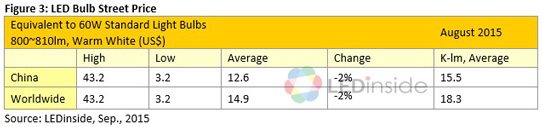

The global average price of 40W-replacement LED light bulbs fell 1.5% in August to US$10.9, while 60W-replacement LED light bulbs fell 2.3% to US$14.9, based on a report by market research firm LEDinside (a division of TrendForce).

According to analyst Allen Yu, the USA was again the regional market that saw the biggest decline in LED light bulb prices after July, as product vendors including Cree and Philips are using package promotion deals and low prices to drive up sales volume and capture market shares.

Furthermore, Chinese LED and chip makers have been gradually expanding their capacities, pushing down component prices during this period of slowing demand. Competition in the LED market on the whole has therefore become more heated.

Yu notes that capacity expansion efforts by many upstream Chinese companies have led to a general supply glut, making price decline inevitable. For example, HC Semitek is raising the metal-organic chemical vapor deposition (MOCVD) capacity of its Souzhou plant, while Changelight's blue and green LEDs have entered mass production at its Xiamen operation. Nationstar is also steadily increasing its chip capacity.

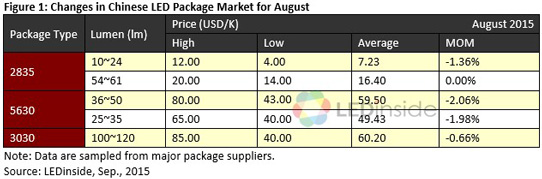

Consequently, in August, prices of 0.2W 2825 LED products fell by 1.36% on average. Prices for 0.5~1W 3030 products fell by 2.15%. In general, Chinese and foreign first-tier package suppliers – Lumileds, Seoul Semiconductor, Osram, Honglitronic and Refond – have all marked down their prices.

After a sharp 14.1% drop on average in July, the prices of 40W-replacement LED light bulbs continued to fall in the US market through August, but with a smaller average decline of 3.7%. Vendors such as Cree and Philips had reduced prices of their products significantly during their promotional campaigns.

Among Cree's products, the price of a pack of six 8.5W 470lm bulbs fell 20% to US$62.26, while a pack of four 6W 450lm bulbs fell more than 30% to US$27. Besides these examples, other vendors including Philips and EcoSmart have also cut prices for their products as part of their sales activities. Many markets outside the USA experienced a gradual price decline in August as well for 40W-replacement products. Prices in Germany and the UK fell 1~2% on average, while China's drop was 1.3%. Japan, however, was an exception to this downtrend as the prices there went up by 0.9% instead.

The USA was also the market where the prices of 60W-replacement LED light bulbs saw the biggest drop.

In July, through their promotional pricing strategies, vendors pushed the average price of these products down 9.5%. Prices fell further in August, with an average monthly decline of 3.9%. Among Philips' products, a pack of four 11W 830lm bulbs fell 20% to US$45.41, and a pack of six 8.5W 800lm bulbs fell 2.57% to US$29.22. A pack of six 13.5W 800lm bulbs from Cree also dropped 20% to US$62.26. In the UK, the price decline of the 60W-replacement LED bulbs grew from 1.1% in July to 3% in August.

However, only a minority of these products saw a significant price decrease. An example of such an extreme case is the price of a Verbatim 10W 820lm bulb, which plummeted nearly 30% to US$18.78 in the UK market. During the same month, prices of 60W-replacement products also fell by 1-3% in other regional markets, including China, Taiwan, Germany and South Korea. Japan was again the exception to the price downtrend, with its 60W-replacement LED bulb market seeing a slight rise of 0.2%.