- News

22 April 2016

Smartphone shipments fall to 292 million in Q1, with iPhone plunging 43.8%

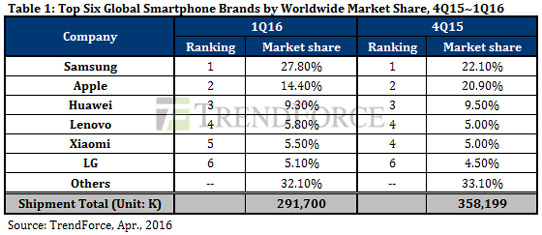

Global smartphone shipments in first-quarter 2016 totaled 292 million units, down 18.6% on last quarter and 1.3% on a year ago, due mainly to market saturation, according to market research firm TrendForce. Leading brands such as Samsung and Apple no longer have the same growth momentum as before, so overall shipments depended on contributions from Chinese brands and rising demand in India and other emerging markets.

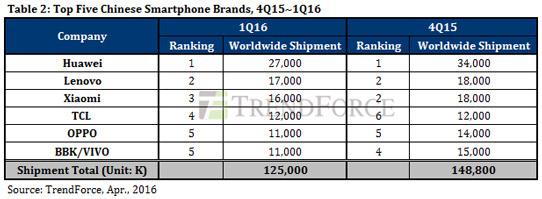

The combined shipments (including exports) from Chinese brands in first-quarter 2016 reached 125 million units, surpassing the combined shipments from Samsung and Apple for the first time. Chinese brands accounted for 42.9% of smartphone shipments, up from 41.5% last quarter. In their home market, Chinese brands have benefitted from increasing subsidies for 4G smartphones from domestic telecom operators. At the same time, they have gained ground in foreign markets. As a result, Chinese smartphone makers did not suffer as steep a shipment decline as their foreign competitors in the off-peak season of Q1, notes smartphone analyst Avril Wu. Their combined quarterly shipments fell by only 16%. On the other hand, competition in overseas markets has intensified as major international brands are struggling to maintain their market share. This will continue to put pressure on Chinese vendors' margins.

Apple unlikely to make turnaround for this year's shipments with iPhone SE; Samsung grew shipments against headwinds

Apple posted its largest ever quarterly decline for iPhone shipments, plummeting 43.8% from 75 million units last quarter to just 42 million units in Q1. Sales of iPhone 6s have been lackluster as the model lacks exciting new features, says TrendForce. Moreover, Apple's management of channel inventories has become more conservative before the launch of its next iPhone. TrendForce has thus lowered its iPhone shipment estimate for 2016 to 213 million units, a drop of almost 10% compared with last year.

"As the budget model, iPhone SE will support Apple's overall shipments in the second quarter before the next major iPhone release," Wu says. "However, iPhone SE is going to face severe price competition from Chinese branded products in its target market, which is the mid-range device segment," she adds. "This year's iPhone SE shipments are projected to come in below 15 million units, and they are unlikely to help turn around the weak annual shipment result for Apple."

Samsung's first-quarter shipments exceeded expectations, rising 2.5% from last quarter to 81 million units. The firm boosted its smartphone sales by launching its flagship models Galaxy S7 and S7 Edge ahead of schedule and stepping up its promotional activities. Additionally, its J series, which consists of entry-level devices with high cost-performance ratios, has been a success in China and worldwide. TrendForce has raised its projection of Samsung's 2016 shipments to 316 million units (about equal to last year). This upward revision also suggests that the vendor is going to retain its market share by keeping margins low. Hence, Samsung's mobile profit may drop slightly in the next few quarters.

Compared with other smartphone makers, LG has put in a bit more effort in developing new designs and features for its products – from G3 (the first smartphone with a 2K screen) to V10 (which came with a secondary display for notifications). G5, the flagship that the South Korean brand revealed at this year's Mobile World Congress, is the first 'modular type' mobile device. This design features detachable component modules, which allow the customization and enhancement of G5's functionality. Besides batteries, G5 users can also swap camera and audio components. Despite LG's innovations, it posted a slight decline in shipments in Q1 due to encountering escalating market competition. The firm remained 6th in the worldwide market share ranking.

Huawei remains top in China and is catching Apple worldwide

Huawei's first-quarter shipments were 27 million units, about 20% down on last quarter. Nonetheless, the Chinese smartphone maker remained the top brand in China and the third largest worldwide. Huawei is currently ahead of its domestic competitors in terms of scale, technology and supply-chain integration. The Kirin processors manufactured by Huawei's semiconductor subsidiary HiSilicon are on par with high-end chips from Qualcomm and MediaTek. Also, Huawei faces less resistance than other Chinese brands in shipping to overseas markets.

"Huawei won't be able to overtake Apple and become the number 2 smartphone brand worldwide any time soon," believes Wu. "Still, the market share gap between Huawei and Apple is expected to narrow with each passing year."

Lenovo's smartphone shipments reached 17 million units in Q1, down just 5.6% on last quarter. The firm will be focusing on foreign markets this year and has assigned 80% of its total shipments for exports. By the end of 2016, its respective market shares in India and Indonesia may surpass 10%. However, the brand's global market share is expected to contract because of insufficient product differentiation. Lenovo's flagship devices also lack attractive features that can capture consumers' interests, says TrendForce.

Xiaomi shipped about 16 million units in Q1 and is now in close competition with Lenovo for 2nd place in China. Xiaomi has been more capable of creating market buzz for its products by making significant hardware upgrades, Wu says. The brand's latest premium smartphone, Mi 5, offers the top-of-line Snapdragon 820 processor, the highest density of LPDDR4 at 4GB, and the largest storage available at 128GB. Xiaomi is also committed to making its smartphones into powerful platforms for the Internet of Things and has built an ecosystem of connected products. TrendForce expects marginal shipment growth from Xiaomi this year, but the Chinese vendor will see increasing profits coming from the sales of peripheral products related to its smartphones.

OPPO and Vivo together will represent almost 20% of Chinese branded smartphone shipments in 2016. Vivo has shown that it is willing to bring out the best hardware with Xplay 5, which features a dual-curve screen and is the first smartphone to carry 6GB of memory. Besides maintaining channel networks in China's second- and third-tier cities, Vivo is also actively building up its overseas presence. Currently, 10% of Vivo's total shipments goes to foreign markets.

OPPO's strategy targets improving the smartphone's overall functionality, such as having an excellent camera and a fast-charging battery. On the other hand, OPPO tends to use mid-range application processors for their mobile devices and rely on system optimization to create better user experience. The firm is among the few Chinese brands to have expanded abroad early on, and the brand has strong sales records in Southeast Asia and India, concludes TrendForce.