- News

20 July 2016

SiC power market growing at CAGR of 19% to 2021 as it spreads to more applications

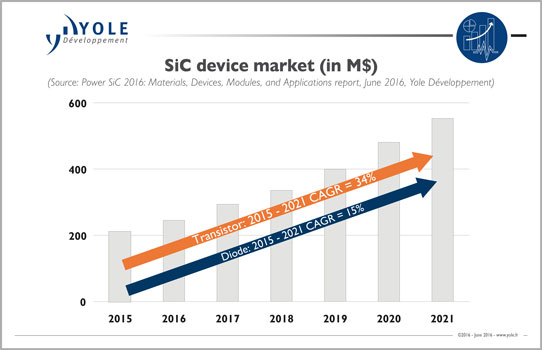

When the first SiC diode was launched in 2001, the industry questioned the future of the SiC power business: Will it grow? Is this a real business? But 15 years later, in 2016, people don't ask these questions anymore, since the SiC power business is concrete and real, with a promising outlook, notes the 'Power SiC 2016: Materials, Devices, Modules & Applications' Market & Technology report released in June by Yole Développement. The SiC power market (including both diodes and transistors) is forecasted to rise at a compound annual growth rate (CAGR) of 19% from more than $200m in 2015 to over $550m in 2021.

SiC diodes still dominate the overall SiC market, with 85% market share, and this leading position will not change for several years, reckons Yole. In parallel, SiC transistors are increasingly present and should reach 27% market share in 2021. SiC solutions are diffusing step by step into multiple application segments: "We are at the opening stage of the SiC industry for power electronics applications," believes Yole.

Unsurprisingly, the power factor correction (PFC) power supply market is still the leading application, with almost 50% market share (by revenue), consuming a large volume of diodes in 2015. However, this market share is expected to decline progressively after 2016.

Photovoltaics (PV) inverters are close behind, as SiC diodes and MOSFETs are now used by various PV inverter manufacturers in their products. It has been confirmed that SiC implementation provides several performance benefits, including increased efficiency, reduced size and weight. In addition, it allows low cost at the system level in a certain power range. Yole says that it has received increasingly positive feedback from the market, and it expects other manufacturers to follow in the footsteps of the early adopters, leading to a rapid expansion of the PV segment in the coming years.

The benefits enabled by SiC, the continuous performance improvement, and the cost erosion of SiC power devices will fuel the implementation of SiC in different applications, reckons Yole. The report hence conveys Yole's understanding of SiC implementation in different segments, and offers a summary of SiC power device market data (split by application), including PFC/power supply, PV, EV/HEV, uninterruptible power supplies (UPS), motor drives, wind, and rail.

SiC device makers must support system makers to facilitate adoption

Designers are well aware of SiC's advantages, but they also know the challenges they face: a new product incorporating SiC devices means R&D investment, higher device cost, differences between silicon devices that they're already familiar with, and a lack of field data. All of these factors present barriers to using SiC, notes Yole.

To accelerate SiC's adoption, it is necessary to continue to educate end-users about the benefits at the system level, and more importantly to support them in using these new devices. Yole sees that device makers have gradually learned from their experiences and are moving in a good direction. For example, facing questioning about reliability, SiC device suppliers are offering more and more reliability data, supported by internal and third-party testing. Understanding that the reliability standards for silicon do not completely suit SiC devices, a consortium to establish new standards has been formed by different SiC power device makers.

Also, the announcement of a new module is frequently associated with the release of a driving solution, assisting the designer in surmounting the difficulties linked to the driver. Similarly, Wolfspeed proposes a new SiC-dedicated online design simulation tool to simplify the designer's task. Moreover, additional integrated solutions such as power stack ('power assembly' or 'power block') are appearing on the market. For example, GE has proposed a power block designed to be a kind of 'plug-and-play' solution, with the objective of avoiding integration difficulties that designers may encounter.

SiC power creating many opportunities for different types of suppliers

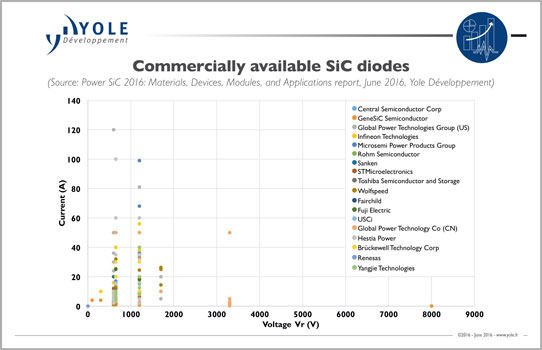

Attracted by the market's potential, more and more players are entering at different levels of the value chain:

- at the module packaging level, Starpower unveiled its SiC module in May;

- at the device level, after investing in Monolith Semiconductors in 2015, Littlefuse released its SiC diode products this May, with the intention to develop a full product range;

- Yole has also identified other newcomers, including Brückewell, YangJie Technology, and Gengol, each with different backgrounds and different business models; and

- on the materials side, SiC growth furnace supplier Aymont has started to supply SiC wafers.

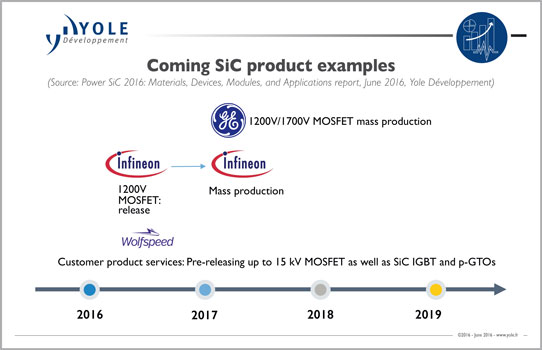

Furthermore, existing players will expand their products, says Yole. For example, Infineon has just released its 1200V SiC MOSFET and plans to go into mass production in 2017. Also, Fuji's full SiC module will be available. As more and more products reach the market, Yole hence expects an acceleration in SiC, with the growing market generating plenty of opportunities for different types of suppliers, such as passive components, materials suppliers, test equipment suppliers, etc.

www.yole.fr/SIC_IndustryReview.aspx