- News

28 March 2016

GaN RF device market to grow at 14% CAGR, rising by 2.5x by end-2022

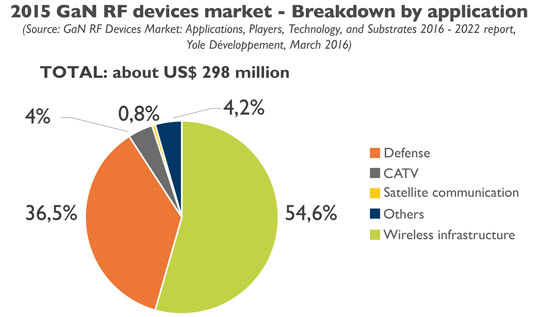

Led by adoption across various market segments, the gallium nitride (GaN) RF device market will double over the next five years, reckons Yole Développement in its new report 'GaN RF Devices Market: Applications, Players, Technology, and Substrates 2016 – 2022', which spans wireless infrastructure, defense & aerospace, satellite communication, wired broadband (CATV and FTTH), and other industrial, scientific & medical (ISM)-band applications.

Indeed, 2015 was a significant year for the GaN RF industry: In particular, a dramatic increase in wireless infrastructure market sales is being driven by the massive adoption of LTE networks in China. By the end of 2015, the total RF GaN market was close to $300m.

Sales will likely not soar as high over the next two years, but growth will continue, driven mainly by increased adoption of GaN technology in the wireless infrastructure and defense markets. However, a significant boost will occur around 2019–2020, led by the implementation of 5G networks. "Market size will be multiplied by 2.5 by the end of 2022, posting a CAGR [compound annual growth rate] of 14% from 2016 – 2022," says technology & market analyst Dr Hong Lin.

The reason for this success is the wireless infrastructure and defense markets, which both offer great opportunities for GaN technology, says Yole. Wireless infrastructure, having surpassed defense, now represents more than half of the total GaN device market. According to Yole, this segment will continue growing fast, at an expected CAGR of 16% over 2016-2022. "Though GaN was originally developed to support governmental military and space projects, mainstream commercial markets should fully embraced this novel technology as well," comments technology & market analyst Zhen Zong.

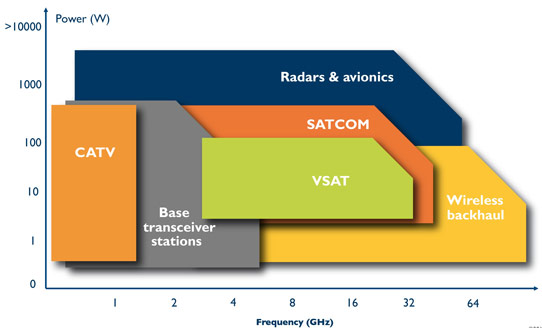

GaN's increased implementation in base stations and wireless backhaul stems from the growing demand for data traffic and higher operating frequencies and bandwidths. In future network designs, new technologies like carrier aggregation and massive MIMO will actually put GaN in a superior position compared with existing LDMOS, says Yole. GaN products have not yet covered the wireless infrastructure market's full spectrum, so more opportunities will arise in the higher-frequency range.

Most GaN device makers offer similar products for base-station applications ranging over 800MHz-3.5GHz (the report covers players such as Sumitomo Electric, Wolfspeed, Qorvo, MACOM, Microsemi, UMS, NXP, Ampleon, RFHIC, Mitsubishi Electric, Northrop Grumman, and Anadigics). The competition will no doubt grow fiercer, reckons Yole, and the cake - even if it's a fast-growing one - will not be divided equally between everyone. In 2016, new entrants like Infineon and possibly another LDMOS player will bring more uncertainty, Yole adds.

In the meantime, defense remains another important market for GaN, and more new products and designs are benefiting from GaN's superior performance and design simplification. Yole predicts steadily growing penetration for GaN into defense market applications such as IED (improvised explosive device) jammers, military communications, radar, and electronic warfare (EW).

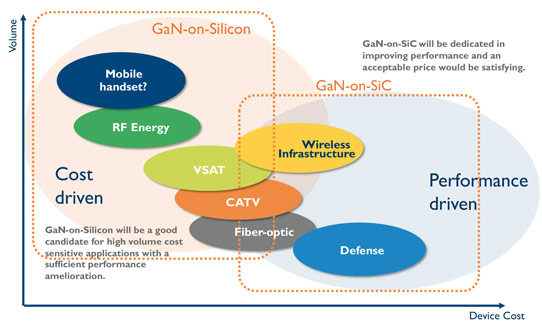

GaN-on-Si opportunity in LTE, SatCom, CATV and RF energy; GaN-on-SiC to remain dominant in GaN RF

Gallim nitride on silicon carbide substrates (GaN-on-SiC) is present in more than 95% of total commercial devices using GaN. GaN-on-SiC's maturity has led it to dominate over GaN-on-silicon, and most GaN RF implementations are currently realized using GaN-on-SiC devices, notes Yole.

GaN-on-SiC is an appealing choice for markets that require higher performance and are less cost-sensitive, and many companies choose GaN-on-SiC for their new designs and products. Meanwhile, silicon LDMOS and gallium arsenide (GaAs) remain the main technologies used for high-volume applications with lower performance requirements.

However, the door has not closed on GaN-on-silicon, reckons Yole. MACOM is pushing its GaN-on-Si products and has just announced its Gen4 GaN product for base stations, with an LDMOS-like cost structure. Over 2016-2020, Yole envisions opportunities for GaN-on-silicon in commercial markets like LTE, SatCom terminals, CATV and RF energy, while GaN-on-SiC will still be the go-to technology for GaN RF. The situation could change drastically, notes Yole, but for now GaN-on-silicon remains a challenger to incumbent GaN-on-SiC technology.