- News

16 October 2018

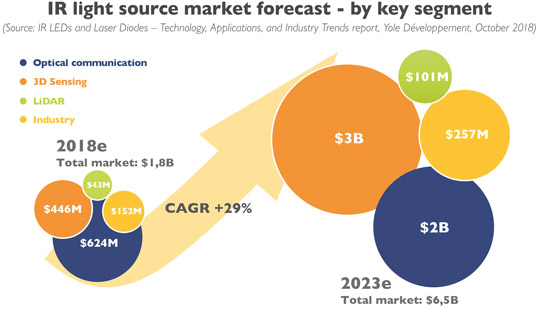

IR light source market to grow at 29% CAGR from $1.8bn in 2018 to $6.5bn in 2023

© Semiconductor Today Magazine / Juno PublishiPicture: Disco’s DAL7440 KABRA laser saw.

The infrared (IR) light source market will rise at a compound annual growth rate (CAGR) of 29% from $1.8bn in 2018 to $6.5bn in 2023, forecasts Yole Développement in ‘IR LEDs & Laser Diodes – Technology, Applications, And Industry Trends report’. The development of new and smart functionalities in smartphone, medical and automotive applications as well as the development of breakthrough devices and functions such as wearables and virtual reality are driving growth in the infrared light-emitting diode (LED) and laser diode (LD) industry, the report notes.

IR light source technologies

Initially developed for optical communication applications, IR LEDs and laser diodes are now integrated into high-value functions for datacom/telecom, industrial, automotive and consumer applications. These technologies are part of a revolution, with each one finding its own path:

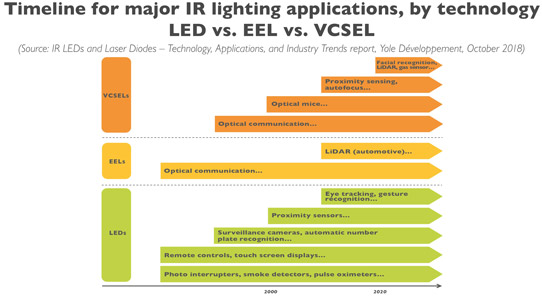

- Initially focused on low-end applications (photo-interrupters, remote controls, etc), IR LEDs are now increasingly implemented into smartphones for proximity sensing; automotive for gesture recognition; and VR/AR (virtual reality/augmented reality) headsets for eye tracking.

- For edge-emitting lasers (EELs), the market has historically been driven by optical communication applications. This is likely to continue, given the always-increasing amount of data exchanged with optical fiber networks. However, in the mid-term the technology may also find strong growth relays in new applications, such as. LiDAR. Yole had the opportunity to discuss with Dr Joerg Strauss, head of the Emitter Laser & Sensor Segment at Osram Opto Semiconductors to share their vision of the industry and get a deep understanding of the development of EEL-based solutions: “Within Osram, that EEL laser will continue to be beneficial compared to VCSELs [vertical-cavity surface-emitting lasers] in LiDAR [light detection and ranging] applications,” Strauss believes. “Primary reason is the required laser power for LiDAR which is hard to achieve with a reasonable light emission area by VCSEL technology,” he adds.

- Today, vertical cavity surface-emitting lasers might be the fastest-growing technology. Having originally found its sweet spot in short-distance data communication, Apple’s 2017 release of the iPhone X (which has a 3D sensing function based on VCSEL technology) has completely changed the business landscape.

Each of these infrared SSL sources have different semiconductor structures (i.e. epitaxy, front-end, back-end), emit at different wavelengths/power outputs, and provide different light-emission profiles/shapes, creating a large variety of possible specifications as well as applications.

Different industry structures and maturity levels for LEDs, EELs and VCSELs

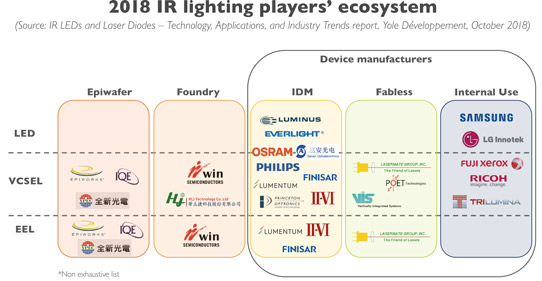

Fueled by visible lighting applications, the LED industry is quite mature. Almost all players are vertically integrated, from epitaxy to packaging. More than 40 IR LED suppliers have been established, mostly in Asia. The manufacturing process is well controlled and there are few remaining challenges, except for high-power and long/multi-wavelength IR LED devices.

The landscape is different for edge-emitting lasers and vertical-cavity surface-emitting lasers, where most of the identified players are in the USA and Europe. The manufacturing process is much more complex and there is still a need for R&D and engineering to increase device performance and production yields. There is hence a variety of players with different positioning along the supply chain, includng epi houses, foundries, IDMs and fabless players.

illus_ir_led_laser_irlighting_ecosystem_yole_oct2018[1].jpg

Since EELs and VCSELs will drive the bulk of future IR lighting revenue, there is still a large business opportunity for specialized players (epi houses and foundries primarily, but also designers). This is related to the manufacturing process (which still must be optimized) and also to the challenges of integrating light sources into packages and/or systems. Indeed, VCSELs and EELs can be combined with complex optics: for example, the dot projector used in facial recognition; or integrated into packages for optical communications and its future evolution, silicon photonics.

IR light source applications

“More than 40 different applications have been identified as integrating IR SSL [solid-state lighting] sources,” says technology & market analyst Pierrick Boulay. “Among these, some are expected to make the IR LED and laser diode markets boom in the next five years,” he adds.

Optical communication (one of the oldest IR light-source applications) is still expected to be one of the major drivers in the coming years. Indeed, the amount of data exchanged on the internet is exploding, and will continue to do so with the emergence of the Internet of Things (IoT), cloud-based services, autonomous cars, and more.

Driven by additive manufacturing, industrial applications are also expected to generate much revenue in the coming years. Traditional IR light sources that emit light in all directions and consume large amounts of energy are starting to be replaced by vertical-cavity surface-emitting lasers (VCSELs) that can be individually controlled, resulting in lower energy consumption.

Finally, 3D sensing is expected to be the killer application for IR light sources. The integration of VCSELs in Apple’s iPhone X for facial recognition has generated much interest in 3D sensing. “In 2017 Apple released the iPhone X, with a 3D sensing function based on this technology,” notes Yole’s Pierrick Boulay. “It integrates three different VCSEL dies for the proximity sensor and the Face ID module, and made the VCSEL market explode in 2017, propelling overall revenue to about $330m,” he adds. After Apple, some key Android-based smartphone manufacturers are following a similar strategy and starting to release new products.

“3D sensing is not limited to smartphones. It also has potential for automotive LiDAR [light detection and ranging], which is necessary for the development of ADAS [advanced driver assistance systems],” says Pars Mukish, business unit manager Solid-State Lighting & Display at Yole. “Not surprisingly, many start-ups in this field have entered the market in order to develop this technology and join the coming revolution.”

With increasing interest from the automotive and consumer industries in photonic technologies, IR lighting has a bright future ahead, concludes Yole.

www.i-micronews.com/report/product/ir-leds-and-laser-diodes-technology