- News

3 January 2019

GaN market growing at CAGR of 55% to 2023, driven by power supply segement, or 93% if adopted for wireless charging in consumer electronics

Over a long period, industrial companies followed the development of gallium nitride (GaN)-based solutions (mainly by R&D institutes and laboratories) at a distance. But since then, the context has changed. In its updated annual report ‘Power GaN: Epitaxy, Devices, Applications and Technology Trends’, market research firm Yole Développement has identified many power electronics and compound semiconductor companies (including leading players such as Infineon Technologies and STMicroelectronics) that are engaged in significant development projects. Some have already introduced GaN products to their portfolio, but this is not the case for the majority. So what is the status of GaN technology?

From the theoretical point of view, GaN offers fantastic technical advantages over traditional silicon MOSFETs: the technology is very appealing, and more players are entering. Moreover, the lowering of prices could make GaN devices good competitors for incumbent Si-based power switching transistors.

“Nevertheless, the technical panorama is not clear yet; every manufacturer presents its solution on die design and packaging integration,” says Elena Barbarini PhD, head of the Semiconductors Devices department at Yole company System Plus Consulting. “This brings strong competition, which will accelerate technical innovations in terms of integration and better performances.”

Even though the existing GaN power market remains tiny compared with the $32.8bn silicon power market, GaN devices are penetrating different applications.

The biggest segment in the power GaN market is still power supply applications, i.e. fast charging for cell phones. This year, Navitas Semiconductor Inc and Exagan introduced 45W fast-charging power adaptors with an integrated GaN solution. In addition, light detection and ranging (LiDAR) applications are high-end solutions that take full benefit of high-frequency switching in GaN power devices.

Also, what is the status of GaN solutions in the EV/HEV (electric vehicle/hybrid electric vehicle) market, which is step by step being dominated by silicon carbide (SiC) technology replacing silicon IGBTs in the main inverters? The SiC market will rise to US$450m in 2023, according to Yole’s ‘Power SiC’ report.

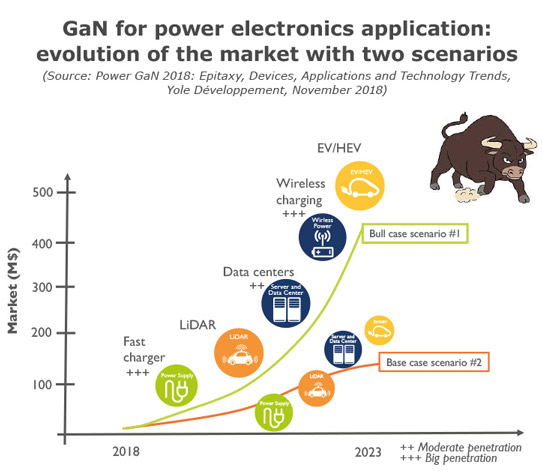

“The accumulation of the market growth in various applicative markets - especially the power supply market segment, which is the most important in that case - confirms our first scenario,” comments technology & market analyst Ana Villamor PhD. Under this ‘Base Case’ scenario, the GaN market is expected to rise at a compound annual growth rate (CAGR) of 55% between 2017 and 2023.

However, Yole’s Power & Wireless team went further in their investigations, reckoning that there could be a killer application that causes the GaN power device market to explode. In fact, several industrial players confirm that smartphone maker Apple might consider GaN technology for its wireless charging solution. “Potential adoption of GaN by Apple or another smartphone giant would completely change the market’s dynamics and finally provide a breath of life to the GaN power device industry,” says technology & market analyst Ezgi Dogmus PhD, part of the Yole’s Power & Wireless team. “We imagine that, after a company like Apple adopts GaN, numerous other companies would follow on the commercial electronics market.”

What could be the added-value of GaN technology? Various players, such as Efficient Power Conversion Corp (EPC) and Transphorm Inc, have already obtained automotive qualification in preparation for the potential ramp-up of GaN. In addition, BMW i Ventures’s investment in GaN Systems Inc clearly demonstrates the automotive industry’s interest in GaN solutions for EV/HEV technology, Yole reckons.

Yole’s second ‘Bull Case’ scenario is much more aggressive, conditioned by the adoption of GaN wireless charging solution by leading consumer manufacturers. In this context, the GaN power market is rising at a CAGR of 93% from 2017 to $423m in 2023.

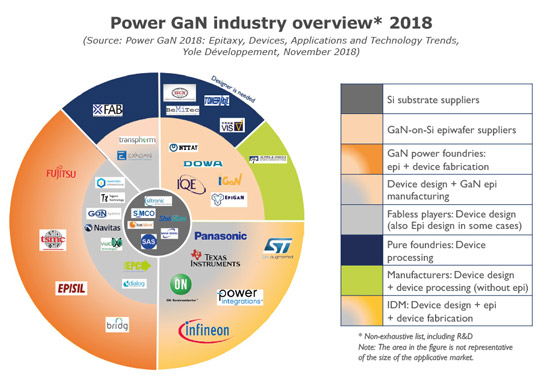

GaN supply chain

With eight years having passed since release of the first commercial power GaN devices, the power industry is becoming increasingly familiar with the names of start-ups that are actively promoting GaN technology. Not surprisingly, the list of pure GaN start-up players is getting longer: Efficient Power Supply (EPC), GaN System, Transphorm, Navitas and more are coming, according to Yole. Most of these start-ups have chosen the foundry model, mostly using TSMC, Episil or X-Fab as their preferred partner. Meanwhile, other foundries may offer this service if the market takes off. The foundry model affords fabless or fab-lite start-ups the possibility of ramping up quickly if the market suddenly takes off.

Along with these start-ups, companies with very different profiles (including industrial giants like Infineon, ON Semiconductor, STMicroelectronics, Panasonic, and Texas Instruments) are competing in the same playground. In particular, several developments in 2018 caught the attention, notes Yole:

- Infineon announced it would start volume production of CoolGaN 400V and 600V E-mode HEMT products by the end of 2018;

- STMicroelectronics and CEA Leti announced their cooperation in developing GaN-on-Si technologies (for both diodes and transistors) on Leti’s 200mm R&D line, and expect to have validated engineering samples in 2019. In parallel, STMicroelectronics will create a fully qualified manufacturing line (including GaN-on-Si hetero-epitaxy) for initial production running in its front-end wafer fab in Tours, France, by 2020.

These integrated device manufacturers (IDMs) will leverage their vertically integrated structure and bring to market cost-competitive products, says Yole.

A cost-effective solution?

If properly designed, the integration of GaN solutions into a final electronics product can increase system efficiency, and passive components will be smaller because the system can work at higher frequencies.

However, cost is a key consideration when introducing a new technology to the market, and it is currently not one of GaN’s strong points. GaN’s principal competitor is the silicon MOSFET, which has been on the market for many years and offers very competitive cost with high average efficiencies, excellent quality, and superb reliability. Currently, only one company, EPC, claims to be at the same price level as silicon with its low-voltage wafer-level package products. However, when standard packaging is added and the voltage is increased, a GaN product would cost more than the silicon alternative – and higher cost is often cited as a main barrier to adoption.

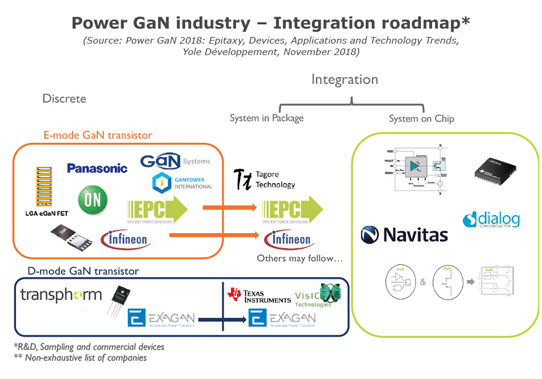

Many players have started building integrated systems in order to be cost-competitive at the system level. This is happening not only with depletion-mode (D-mode) solutions but also with enhancement-mode (E-mode) integrated solutions, which seem appealing for the end user as an easy-to-use product. Yole also finds system-in-package solutions that include silicon (i.e. Texas Instruments’ and Exagan’s products) as well as integrated solutions where the driver, ESD protection and other functions are monolithically integrated (i.e. Navitas’ power IC products).

www.i-micronews.com/category-listing/product/power-gan-2018-epitaxy-devices