- News

28 June 2019

VCSEL market growing at 31% CAGR to $3.7bn in 2024, driven by new smartphone and automotive functionalities

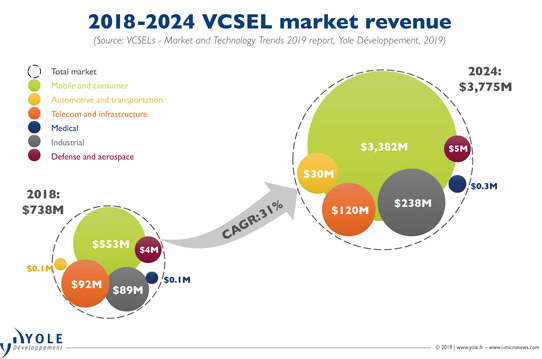

The global vertical-cavity surface-emitting laser (VCSEL) market is rising at a compound annual growth rate (CAGR) of 31% from $0.738bn in 2018 to $3.775bn in 2024, mostly from the consumer segment (growing from $0.553bn to $3.382bn).

“Today, up to three VCSEL dies can be integrated in a smartphone: 3D recognition with the flood illuminator, the dot projector, and the proximity sensor; all are based on VCSEL laser components,” notes Sylvain Hallereau, project manager at Yole company System Plus Consulting. “Already integrated in flagship smartphones, these functions will quickly find a home in all smartphones, causing a sharp increase in VCSEL demand.”

Behind the smartphone applications, the automotive sector with emerging 3D sensing functionalities will also playing a key role, growing at a CAGR of 185% from just $0.1m in 2018 to $30m in 2024, reckons Yole Développement.

This year, the Yole group of companies has released two reports focused on VCSEL technology and applications: ‘VCSELs – Market and Technology Trends’ and ‘VCSEL in Smartphone – Comparison’, from Yole and System Plus Consulting, respectively. The firms have now combined their market and technical expertise to give their vision of the VCSEL industry, technology status, players’ positioning and strategies, highlighting the direct link between each VCSEL type and its applications. Yole and System Plus Consulting collaborated to get a better, more accurate understanding of market evolution and technical issues. In particular, since the previous edition of the report, the Yole group has taken into account the drastic decrease in VCSEL average selling price (ASP).

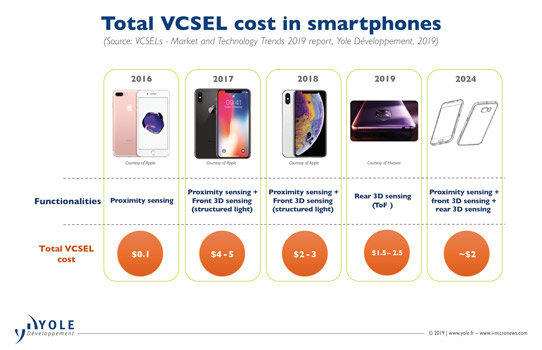

“In 2017, the total VCSEL cost per smartphone was estimated at $4–5. In 2018, this dropped to $2–3, evidence of a strong price decrease,” states business unit manager Pars Mukish. “There are several explanations for this: higher volumes leading to lower cost; more VCSEL manufacturers qualified by smartphone manufacturers, leading to lower margins; and higher manufacturing yields leading to increased ‘good’ VCSELs per wafer,” he adds. “In the future, a smartphone should embed VCSELs for proximity sensing and front and rear 3D sensing, with a total VCSEL cost around $2.”

In November 2017, Apple released the iPhone X with the new feature FaceID, which detects and recognizes the smartphone’s owner and unlocks the phone, thanks to three VCSELs working together. With this implementation of VCSELs for front 3D imaging, Apple set the proverbial ‘cat among the pigeons’ in the smartphone world, and consequently in the VCSEL industry, says Yole. Following the iPhone X’s release, several smartphone makers announced that their next flagship would embed a similar feature. Front 3D imaging was implemented as a first step, and more recently smartphone makers have released new products with a rear 3D sensing module, using the time-of-flight (ToF) principle. Mobile and consumer VCSEL applications are exhibiting impressive growth, at a CAGR of 35% between 2018 and 2024.

Other applications are also expected to implement VCSELs in the mid to long term in different market segments: mobile & consumer, automotive & transportation, and industrial. In light detection & ranging (LiDAR), VCSELs are expected to compete with edge-emitting lasers (EELs), especially for mid- and short-range LiDAR.

“Use of VCSELs for long-range detection is still challenging due to the VCSEL’s limited output optical power compared to EELs,” explains technology & market analyst Pierrick Boulay. “Also, cost is still prohibitive. But, due to their ability to easily be built in arrays, VCSELs are a good opportunity for reducing LiDAR cost and reaching the targets set by OEMs.”

In the long-term, the VCSEL market for LiDAR could generate revenue of about $800m by 2032.

Following on from Apple, rival smartphone makers Xiaomi and Oppo released their flagship phones with a 3D sensing feature, and even more recently the two market leaders Huawei and Samsung began implementing VCSELs. On the technology side, structured light (used for facial recognition for the first time on high-end smartphones) implies the use of two different VCSELs: one flood illuminator and one dot projector. Using these two light sources hence adds a tangible cost to the 3D sensing module.

Meanwhile, a face recognition module using the ToF principle was implemented by LG in early 2019. This leads to using only one VCSEL (a flood illuminator) and therefore reduced cost of the 3D sensing module compared with modules using the structured light principle.

Conducted by System Plus Consulting, the report ‘VCSEL in Smartphone – Comparison’ provides insights into the structures, technology and design choices related to these components, which are at the center of innovative functions for smartphones. Analysts have compared four dot projectors, four flood illuminators, and two ToF systems, extracted the VCSEL dies, and performed a full physical analysis. The System Plus Consulting report gives a technical and economic comparison of 10 VCSEL dies integrated by the major smartphone makers: Apple, Xiaomi, Huawei, Oppo and Lenovo in their flagship smartphones, and by Intel in its RealSense product suite.

www.i-micronews.com/products/vcsels-market-and-technology-trends-2019