- News

7 October 2019

Micro-LED technologies make significant progress over last 18 months

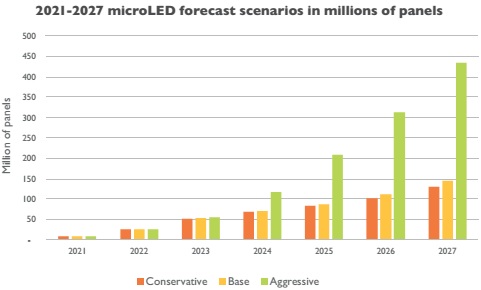

With micro-LEDs drawing an increasing amount of attention, startups have raised more than $800m to date, including at least $100m in 2019, and Apple has spent $1.5-2bn on the technology over the last five years, reckons market analyst firm Yole Développement in its report ‘MicroLED Displays’. Panel makers such as Samsung Display, LG Display, AUO or Innolux have also significantly increased their efforts.

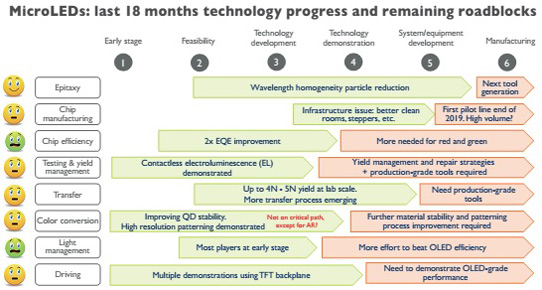

“Without doubt, micro-LEDs are today progressing on all fronts,” says principal display market & technologies analyst Eric Virey PhD. Patent filings are growing exponentially and technology is progressing. The external quantum efficiency of blue and green micro-LED chips has more than doubled over the past 24 months. Some transfer and assembly processes are reaching performance close to what is required to enable some micro-LED consumer applications. Progress is also visible in the proliferation of prototypes presented over the last 18 months by nearly 20 companies.

“The demos cover a broad range of display types, sizes and technologies,” notes technology & market analyst Zine Bouhamri PhD, part of the Display team at Yole.

“Native RGB or color-converted displays on TFT [thin-film transistor] backplanes are offered by many companies, with some examples including Playnitride, CSOT, Samsung, LG, glō, AUO, eLux and Kyocera. Lumiode has developed native RGB or color-converted displays on monolithicaly integrated LTPS [low temperature polysilicon],” he adds.

Micro-displays on CMOS backplanes have also been demonstrated by companies including Plessey, glō, Lumens, JB Display, Sharp and Ostendo. Finally, discrete micro-driver ICs have been developed by X-Display. The multiple prototypes based on TFT backplanes give credence to the idea that micro-LED displays could leverage existing panel makers’ capacity, simplifying and streamlining the supply chain.

“Equipment makers have taken notice and are starting to develop micro-LED-specific tools for assembly, bonding, inspection, testing and repair,” notes Eric Virey of Yole.

LED makers are also showing interest, with San’an planning to invest $1.8bn to set up a mini- and micro-LED manufacturing base. Osram, Seoul Semiconductor, Nichia and Lumileds are also increasing their activity and Playnitride is completing its first micro-LED pilot line.

However, significant roadblocks still exist for key applications. For many of them, economics are pushing die size requirements below 10μm. This compounds efficiency, transfer and manufacturability challenges and, despite significant improvement, small-die efficiency remains low. In most cases, display efficiency based on this technology still cannot match that of organic light-emitting diode (OLED) technology. Significant effort is therefore needed to further improve the internal quantum efficiency, light extraction and beam shaping of green and red micro-LED chips.

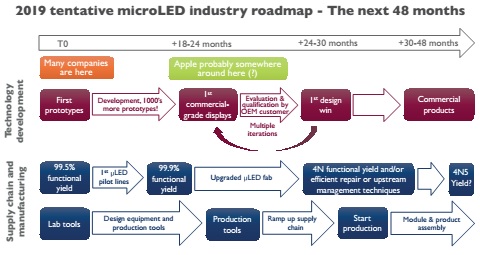

For micro-LED companies, the first few prototypes provide useful experience, but maturing toward consumer-grade displays could require thousands more. Startups are entering the ‘valley of death’: many might fail to raise enough money to successfully go through this more capital- and resource-intensive phase. Support from and partnership with large display makers or OEMs, either as strategic investors or development partners, is therefore critical, concludes Yole.

Bouhamri is presenting key results of Yole’s micro-LED analysis in ‘Impressive Technologies for MicroLED Displays’ on 29 November (3:20pm) at the International Display Workshop (IDW ’19) in Sapporo, Japan (27-29 November).