| Home | About Us | Contribute | Bookstore | Advertising | Subscribe for Free NOW! |

| News Archive | Features | Events | Recruitment | Directory |

CMP PROCESSING

Learn more about R&D chemical mechanical polishing by requesting our FREE informational CD.

| FREE subscription |

| Subscribe for free to receive each issue of Semiconductor Today magazine and weekly news brief. |

News

23 November 2007

More LED power and efficiency needed to profit from general lighting market

In recent years LED component volumes have been driven mainly by mobile phone sales, showing a compound annual growth rate of more than 45%, yet revenue growth has grown at only 8% over the last two years due to the strong pressure on component prices, according to the new report ‘LED Manufacturing Technologies 08’ from market research firm Yole Developpement of Lyon, France in collaboration with the Paris-based European Photonics Industry Consortium (EPIC).

“It is now clear that the LED market needs to expand into new and profitable sectors with higher margins,” says Philippe Roussel, Yole senior analyst for compound semiconductor activity. “We believe that this growth will come from three additional application areas: automotive lighting, architectural lighting, and general illumination, in addition to the LCD backlighting market.”

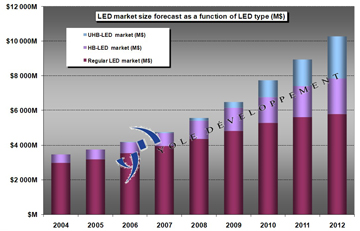

To capture profits in these application sectors, significant improvements are needed in LED performance, especially in dollars per lumen ($/lm) and in lumens per Watt (lm/W) at full power . New approaches manufacturing technologies are required at all stages (materials, design, front-end, back-end and packaging) to profit from the potential of ultra-high-brightness LEDs (UHB-LEDs), Yole says (see Figure).

Recent announcements from LED manufacturers show impressive efficiency (150lm/W has been proved in the laboratory), but only for low-current (<20mA) low-power operation , says EPIC’s secretary general, Tom Pearsall.

The difficulty in obtaining high power and high efficiency simultaneously underscores the immediate need for dramatic improvements in manufacturing technologies, Yole adds. Existing high-power LEDs generate about 75% heat versus only 25% light, so several parameters (such as internal quantum efficiency, electrical losses, extraction efficiency, and phosphor conversion and optics quality) must be improved significantly. Currently, no more than 70lm/W has been demonstrated with high-power LEDs (>1W), so LEDs still lag behind the performance of fluorescent lamps for general lighting applications. The report describes 10 key manufacturing technologies (either in use or under investigation) that can considerably improve LED optical output power: new substrate materials; laser lift-off; temporary bonding; transparent top contacts; binning; surface texturing; phosphor composition and deposition

Also, although LEDs have a natural advantage in automotive, outdoor and backlighting, a new business model is needed to penetrate the general lighting sector where fluorescent lighting remains a strong competitor, Yole believes. The incandescent lighting business currently generates revenues because 30% of the installed base is replaced every year and the manufacturing infrastructure has been amortized for many years. The industry needs to solve the challenge of building a growing market of lighting products with a quasi-infinite lifetime while developing mass-production methods for the next-generation of UHB-LEDs, the report concludes.

Credit: Yole Developpement

See related items:

LED market returns to double-digit growth in 2007

Opto-enabled product and component market to grow at 7.7% annually to 2017

Analysts forecast seven-year wait before LEDs penetrate home lighting market

Search: LEDs

Visit: www.yole.fr

Visit: www.epic-assoc.com