| Home | About Us | Contribute | Bookstore | Advertising | Subscribe for Free NOW! |

| News Archive | Features | Events | Recruitment | Directory |

| FREE subscription |

| Subscribe for free to receive each issue of Semiconductor Today magazine and weekly news brief. |

News

28 April 2008

Mobile shipments of 289m in Q1 exceed expectations

Mobile device shipments rose a higher-than-expected 13.7% year-on-year to 289m units in Q1/2008 as operators and distributors continued to top up their inventories after a particularly strong Q4/2007, according to Jake Saunders, VP at analyst firm ABI Research. However, Q2/2008 is likely to be softer than in previous years, he cautions.

Shipment volumes in the developed markets have softened slightly due to the credit crisis, but emerging markets such as Asia-Pacific, South America, and the Middle East/Africa are delivering growth rate percentages in the mid-20s. Mobile devices have proved to be a ‘lifestyle necessity’ rather than a mere luxury accessory.

Despite all the global concern about price inflation in food, rent, clothing, oil, and utility bills, device manufacturers are not benefiting. The average selling price (ASP) has shown comprehensive price erosion for all manufacturers.

Despite all the global concern about price inflation in food, rent, clothing, oil, and utility bills, device manufacturers are not benefiting. The average selling price (ASP) has shown comprehensive price erosion for all manufacturers.

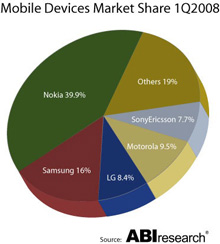

Nokia grew its market share to 39.9%, while Samsung and LG were also net winners with 16% and 8.4%, respectively. Motorola continued to lose market share (falling 2.6% to 9.5%). More surprising was that Sony Ericsson also lost market share (down to 7.7%). It may be the case that its Walkman and CyberShot lineups are in need of a substantial refresh, says the market research firm.

Additionally, WCDMA continues to build momentum, with shipment volumes up 44% year-on-year – but no one should count out GSM, says ABI Research, as GSM-enabled handsets grew 17% in the quarter.

The market is still very much dominated by the ‘big five’ manufacturers, but an innovative tier of manufacturers (RIM, HTC, Apple) has been stirring up interest in smartphones and will soon be joined by a new class of mobile device. MIDs (mobile internet devices) made their debut last year, but vendors such as Lenovo, Aigo, and Asus are expected to drive growth rapidly.

“Mobile device shipment volumes show no sign of abating in growth, despite the uncertain economy,” says research director Kevin Burden. “ABI Research expects 2008 to top out at 1.28 billion devices shipped – a 12% increase year-on-year – but these volumes could be subject to the overall global economic climate.”

See related items:

Handset shipments up 14% year-on-year in Q1

Rich-media specialists increase share of handset profits

Mitsubishi Electric terminating mobile handset business

Handset shipments up in ‘07, but ‘08 forecast cut

Q3 cell-phone shipments of 285m led by Nokia in emerging entry-level GSM markets and Samsung in 3G

Handset sales to grow 4% through to 2012

Search: Handset shipments

Visit: www.abiresearch.com