| Home | About Us | Contribute | Bookstore | Advertising | Subscribe for Free NOW! |

| News Archive | Features | Events | Recruitment | Directory |

WAFER PROCESSING

Achieve accurate and repeatable processing results with Logitech's semiconductor equipment.

| FREE subscription |

| Subscribe for free to receive each issue of Semiconductor Today magazine and weekly news brief. |

News

9 June 2008

Thin-film solar market to reach 9GW in 2012

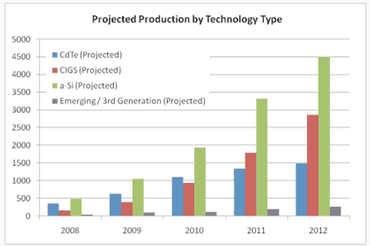

Thin-film solar production will grow from 1GW this year to more than 9GW in 2012, forecasts the Prometheus Institute for Sustainable Development, according to preliminary figures presented at a recent Greentech Media conference. “We project increased penetration of all technologies – cadmium telluride (CdTe), copper indium gallium diselenide (CIGS) and amorphous silicon (a-Si) – above even our aggressive forecasts in 2007,” says the institute’s president Travis Bradford.

Chart credit: Prometheus Institute

CdTe films, led by First Solar, comprise the largest portion of the thin-film market. Bradford expects the firm’s costs to fall from less than $1.25 per watt to less than $1 per watt by 2009. However, those costs could be subject to the price of glass, which in turn depends on energy prices, he cautions. Also, the cost of telluride (a mining byproduct of zinc) has increased. “There are some difficulties. But First Solar will continue to do well.”

The big story of next year is likely to be CIGS, reckons Bradford. Even though no companies have yet produced CIGS films in significant volumes, the technologies have potential, he says. “Many of these [technologies] are ready to go. In some cases, it takes as much of a third of the capital less than First Solar to build a plant,” he adds. “We know how many companies are putting in multi megawatts of CIGS in 2009… Just like polysilicon was the big story of 2007 and First Solar is the big story of 2008, we believe in 2009 the big story will really be CIGS.”

CIGS PV makers Global Solar Energy Inc (GSE) of Tucson, AZ, Nanosolar of San Jose, CA, Miasolé of Santa Clara, CA, and HelioVolt Corp of Austin, TX have all announced plans to expand production in the last few months.

Meanwhile, Prometheus expects amorphous-silicon films – such as those made by Applied Materials and Oerlikon – to stumble slightly in 2008 and 2009, as technologies get debugged and verified, before taking off in 2010. By 2012, amorphous silicon should comprise the largest segment of the thin-film market, with 4.5GW of production, with CIGS second at more than 2.6GW.

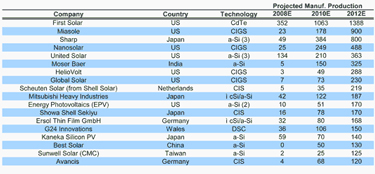

The Prometheus Institute also expects the top thin-film producers in 2012 (by manufacturing capacity in GW) to be First Solar (CdTe, 1.39GW), then Miasolé (CIGS, 0.9GW), Sharp (a-Si, 0.8GW), Nanosolar (CIGS, 0.49GW), United Solar (a-Si, 0.36GW), Moser Baer (a-Si, 0.32GW), HelioVolt (CIGS, 0.28GW), and GSE (CIGS, 0.23GW).

Top 15 producers in 2012 (spread over all technology types)

Chart credit: Prometheus Institute

“There are so many technologies, even if we’re wrong in one bucket, in one technology, there are a lot of different ways to hit 4GW in 2010 and our projections in 2012,” Bradford concludes.

See related items:

Solar VC investment reaches record $280m in Q1

Thin-film to grow from 10% to 19% of PV market by 2012

Search: Thin-film solar First Solar CdTe GSE Nanosolar HelioVolt CIGS Applied Materials Oerlikon a-Si

Visit: www.prometheus.org

Visit: www.greentechmedia.com