| Home | About Us | Contribute | Bookstore | Advertising | Subscribe for Free NOW! |

| News Archive | Features | Events | Recruitment | Directory |

News

29 October 2010

GaN power device market to reach $350m in 2015

Yole Développement is forecasting a $350m market in 2015 for gallium nitride (GaN) power devices [Power GaN: Market & Technology Analysis – GaN Technologies for Power Electronics Applications: Industry and Market Status & Forecasts, 2010]. Presently the France-based market research company sees a total accessible market (TAM) of $16.6bn for power IC, discrete and module components.

Nitride semiconductors already dominate the market in short-wavelength (green, blue, violet, ultraviolet) light-emitting devices, and has made inroads into the RF power amplification market (~2GHz, e.g. mobile phone network).

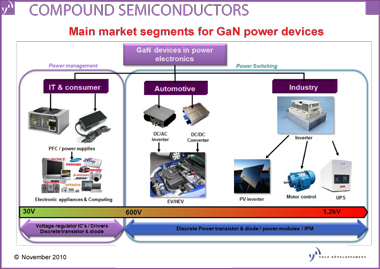

GaN devices for lower-frequency power switching are maturing in terms of transistor, diode and even IC parts in the 0–600V range. Based on its assessment of the state-of-the-art for GaN production, Yole believes that the most promising applications for nitride semiconductors could be (Figure 1) IT and consumer, automotive, better inverters for photovoltaic (PV) DC–AC conversion, uninterrupted power supply (UPS), and motor control. These applications take advantage of features such as higher breakdown electric field, better electron mobility, and higher melting point, leading to higher breakdown voltages, switching frequencies and overall system efficiency offered by GaN over silicon-based devices.

“About 67 % of the power electronics market is looking at 0–900V voltage range, mostly made of cost-driven consumer and IT applications,” says the report’s author Dr Philippe Roussel, project manager at Yole Développement.

These markets will require high volume and low cost. The use of either bulk GaN or GaN-on-silicon carbide (SiC) substrates is seen as being too expensive for this. Particularly attractive for this market are GaN-on-silicon 6-inch diameter wafers that both lower costs (by using a silicon base) and create economies of scale (with larger wafers). Yole is assuming that this will be the dominant option chosen for power GaN devices. The substrate market supporting power GaN is expected to reach $100m in 2015. There is hence expected to be erosion in the price of GaN-on-Si substrates.

GaN-on-Si high-electron-mobility transistors (HEMT) could be 50% cheaper than the same sort of device built using silicon carbide (SiC) technology. Yet today’s state-of-the-art remains twice and even three-times more expensive than the similar silicon device.

However, there are system-level arguments for choosing the more expensive component. For example, GaN devices operate better than silicon at higher temperatures, allowing a reduction or even elimination of cooling systems. Also, GaN has a higher switching speed at high power handling, allowing a reduction in RF filtering costs with the use of smaller capacitors and inductors. The smaller-sized housing due to the smaller GaN components will also allow further cost reductions.

This year saw the first product announcements in the sector from International Rectifier (IR) and Efficient Power Conversion Corp (EPC). The devices cover breakdown voltages ranging up to 200V (V_b). However, the roadmaps of IR and EPC are promising 600V and even 900V in the short term. These ratings would bring industrial and automotive applications onto the agenda.

Other contenders due to enter the arena include MicroGaN, Furukawa, GaN Systems, Panasonic, Sanken, and Toshiba.

Since it takes time to qualify devices, particular for target applications that need to consider reliability and safety factors such as automotive, Yole is forecasting an ‘inflexion point’ for GaN market ramp-up occurring early in 2012, leading to a market size in excess of $50m in 2013 and ~$350m by 2015. The kinds of devices in 2015 are expected to be evenly split between ICs, discretes and modules.

Yole says that its report provides a complete analysis of the GaN device and substrate industry in the power electronics field, along with key market metrics. ‘It provides company involvement as well as technology state-of-the-art. In addition, an extensive review of the possible substrates for GaN is provided, offering the most complete view of the power GaN industry available to date.’

See related items:

GaN power management chip market to grow to $183m by 2013

New SiC and GaN power devices pave the way to a $160m market by 2013

![]() Search: GaN power device market

Search: GaN power device market

Visit: www.yole.fr

Visit: http://epc-co.com/epc/

Visit: www.irf.com/indexnsw.html

For more: Latest issue of Semiconductor Today

The author Mike Cooke is a freelance technology journalist who has worked in the semiconductor and advanced technology sectors since 1997.