- News

9 July 2018

SiC power semiconductor market growing at 29% CAGR to $1.4bn in 2023, aided by adoption in automotive applications

© Semiconductor Today Magazine / Juno PublishiPicture: Disco’s DAL7440 KABRA laser saw.

The silicon carbide (SiC) power semiconductor market is increasing at a compound annual growth rate (CAGR) of 29% from 2017 to $1.4bn in 2023, according to the report ‘Power SiC 2018: Materials, Devices and Applications’ by the Power & Wireless team at market research and strategy consulting company Yole Développement.

The SiC market is still being driven by diodes used in power factor correction (PFC) and photovoltaic (PV) applications. However, Yole expects that in five years the main SiC device market driver will be transistors, with a 50% CAGR over 2017-2023.

Adoption is partially due to the improvement in transistor performance and reliability compared with the first generation of products, giving confidence to customers regarding implementation.

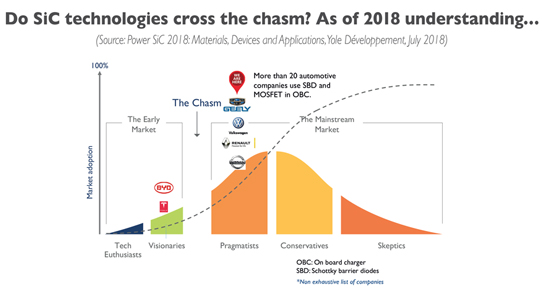

Yole says that atopic that has been discussed in all its exchanges with industrial players is SiC adoption for automotive applications over the next 5-10 years. “Its implementation rate differs depending on where SiC is being used,” comments Dr Hong Lin, Technology and Market Analyst, Compound Semiconductors at Yole. “That could be in the main inverter, in the on-board charger (OBC) or in the DC/DC converter,” he adds. “More than 20 automotive companies are already using SiC Schottky barrier diodes (SBDs) or SiC metal-oxide semiconductor field-effect transistors (MOSFETs) for the OBC, which will lead to a 44% CAGR through to 2023.”

Yole anticipates SiC adoption in the main inverter by some pioneers, at a 108% CAGR during 2017-2023, since nearly all carmakers have projects to implement SiC in the main inverter over coming years. Chinese automotive players in particular are strongly considering the adoption of SiC.

An example of early adoption is the recent SiC module developed by STMicroelectronics for Tesla and its Model 3 car. The SiC-based inverter, analyzed by Yole’s sister company System Plus Consulting, consists of 24 1-in-1 power modules. Each contains two SiC MOSFETs with an innovative die attach solution and connected directly on the terminals with copper clips and thermally dissipated by copper baseplates. The thermal dissipation of the modules is enabled by a specially designed pin-fin heatsink.

“The SiC MOSFET is manufactured with the latest STMicroelectronics technology design,” notes Dr Elena Barbarini, head of Department Devices at System Plus Consulting. “This technical choice allows a reduction of conduction losses and switching losses,” she adds. STMicroelectronics is strongly involved in the development of SiC-based modules for the automotive industry. During its recent Capital Markets Day, the leading player detailed its activities in this field. STMicroelectronics is also commited to the development of innovative packaging solutions.

PV has also caught the attention of Yole’s analysts during recent months. China claimed almost the half of the world’s installations in the last year. This segment therefore could have helped grow the SiC device market. However, due to new governmental regulations, Yole foresees a slowdown in the PV market in the short term and has hence lowered its expectation of SiC penetration for the segment.

In general, system manufacturers are interested in implementing cost-effective systems that are reliable, regardless of whether the power devices are silicon or SiC based. “Today, even if it’s certified that SiC performs better than silicon, system manufacturers still get questions about long-term reliability and the total cost of the SiC inverter,” comments Ana Villamor, technology & market analyst, Power Electronics & Compound Semiconductors at Yole.

Silicon carbide adoption accelerating, but is the supply chain ready?

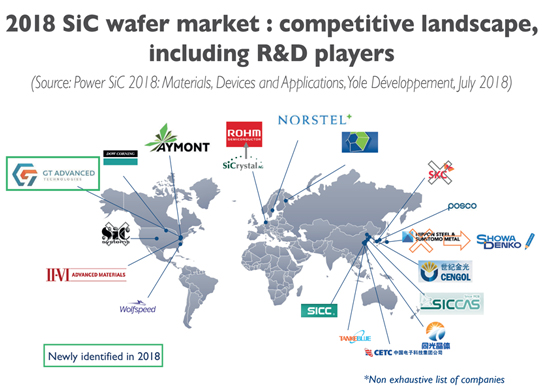

The market is growing in 2018. The question now is how big it will be in five years. Another question is whether the supply chain is ready to embrace the market acceleration? One of the bottlenecks as of 2018 is SiC wafer supply.

The shortage has existed since late 2016. Yole says that last year it heard complaints. Some expected the situation to be resolved in second-half 2017, but as of mid-2018 the issue remains, due to two main reasons: (1) the transition from 4” to 6” wafers is much faster than suppliers expected; (2) the increase in wafer demand has been faster than expected.

Some say that the shortage is temporary and typical when shifting to larger wafer sizes. Others consider the situation to be critical. It is a good problem for wafer suppliers, as constrained supply allows them to maintain high wafer prices. But they are also investing heavily to satisfy demand from numerous clients. Yole estimates that, in the coming years, several hundred million dollars will be invested, as leading SiC wafer suppliers Cree-Wolfspeed, II-VI Inc and Dow are all planning to expand capacity.

At the epiwafer level, the market has struggled to take off for several years, but the situation is evolving quickly. For example, Yole has seen Showa Denko expand its capacity consecutively in 2015, 2016 and 2018 as the technology becomes more mature and the outsourcing ratio increases.

Cree pivots, while STMicroelectronics steps up with Tesla

At its investor day in February, Cree announced a turnaround in its strategy following the abortive sale of its Wolfspeed business to Infineon. It decided to instead focus on Wolfspeed which, despite being Cree’s smallest business, in 2017 was the market leader in both the SiC wafer and SiC power device markets. This strategy pivot will allow Cree to invest more into its SiC activities (expanding wafer, epiwafer and device capacity) and prepare for market growth. On the other side of the abortive acquisition, Infineon has also developed its SiC power business. The firm signed a long-term SiC wafer supply agreement with Cree and began to actively promote its CoolSiC MOSFETs at different power electronic tradeshows and conferences in 2018.

A foundry model is clearly forming that enables fabless and fab-lite companies to launch SiC products and make the technology more accessible. However, there was also a short supply of foundry services in 2017. The new 6” wafer foundry Clas-SiC Wafer Fab Ltd was founded in 2017 comprising the entire SiC team from Raytheon, which has ceased its SiC activities. Taiwanese foundry Episil is also now active.

Yole and System Plus Consulting teams will attend SEMICON Europa 2018 in Munich, Germany (13–16 November), where Dr Milan Rosina, senior technology & market analyst, Power Electronics & Batteries at Yole, will give a presentation on wide-bandgap semiconductors at 2:30pm on 15 November. SiC and GaN devices have demonstrated their large potential for power electronic applications. During the presentation ‘GaN and SiC power device: market overview’ during the Power Electronics Session, Rosina proposes an overview of the market, technology and the industrial supply chain.

SiC power market growing at CAGR of 19% to 2021 as it spreads to more applications

www.i-micronews.com/category-listing/