- News

5 November 2018

Veeco’s Q3 revenue down more than expected due to China market softness

© Semiconductor Today Magazine / Juno PublishiPicture: Disco’s DAL7440 KABRA laser saw.

For third-quarter 2018, epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA has reported revenue of $126.8m, down 19.6% on $157.8m last quarter and 1.9% on $129.3m a year ago. It is also below the $130-140m guidance range due to market softness in China across all of the firm’s businesses, as well as a US foundry [GlobalFoundries] unexpectedly putting its 7nm FinFET program on hold indefinitely.

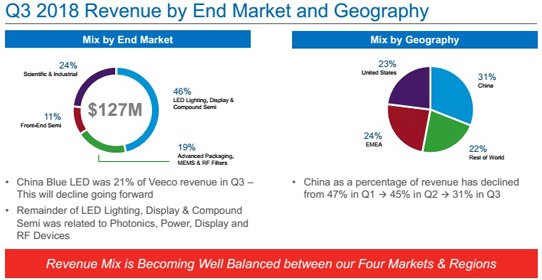

Geographically, compared with last quarter, China has fallen from 45% to 31% of total revenue, while Europe, Middle East & Africa (EMEA) has grown from 16% to 24%, the USA from 21% to 23%, and rest of the world from 18% to 22%.

Of total revenue, the LED Lighting, Display & Compound Semiconductor segment fell from $88m to $59m (from 55% of total revenue to 46%, including blue LED MOCVD systems for China falling from 31% to 21%). Most of this segment’s revenue was therefore in Compound Semiconductors, including metal-organic chemical vapor deposition (MOCVD) systems for specialty LEDs, automotive, photonics and power electronics applications as well as Precision Surface Processing (PSP) systems for RF device manufacturing.

The Advanced Packaging, MEMS & RF Filter segment - including lithography and PSP systems sold to IDMs and OSATs for Advanced Packaging in automotive, memory and other areas - was level on last quarter at $25m (rising from 16% to 19% of total revenue).

The Front-End Semiconductor segment (formerly part of the Scientific & Industrial segment, before the May 2017 acquisition of lithography, laser-processing and inspection system maker Ultratech Inc of San Jose, CA, USA) fell back from $18m to $13m (from 12% to 11% of total revenue), which included sales of ion beam etch systems for STT-MRAM manufacturing as well as 3D inspection systems.

Scientific & Industrial revenue (including shipments to data storage and optical coding customers) recovered from $27m to $30m (rising from 17% to 24% of total revenue).

Despite being down from 41.2% a year ago, non-GAAP gross margin has rebounded from 35.8% last quarter to 38.2%, exceeding the 36-38% guidance range due to a favorable product mix and lower spending. Operating expenditure (OpEx) has improved further, from $48.9m a year ago and $45.7m last quarter to $40.4m (better than the expected $43-45m), due mainly to selling, general & administrative (SG&A) expenses being cut further, from $25.7m a year ago and $21.9m last quarter to just $17.6m.

“Gross margin was better than guidance and led to non-GAAP operating income, net income and EPS all coming in at the high end of our guided ranges,” says CEO Dr William J. Miller.

Operating income was $8m, down from $10.8m last quarter but up from $4.3m a year ago.

Likewise, net income was $5.3m ($0.11 per diluted share), down from $7.2m ($0.15 per diluted share) last quarter but up from $2.4m ($0.05 per diluted share) a year ago, and above the midpoint of the $1-6m ($0.03-0.13 per diluted share) guidance range.

Operating cash flow was positive, at $18m (compared with -$46m last quarter). During the quarter Veeco purchased $10m of its common stock (1.8% of its outstanding shares) at an average price of $11.58 per share.

During the quarter, cash and short-term investments rose from $261m to $266.3m, due mainly to the reduction in accounts receivable from $134m to $91m, and improving days sales outstanding (DSO) from 76 to 64 days. Inventory remained high ($150m) as Veeco continued to ramp EUV systems-related manufacturing and also to invest in new products for MOCVD. Consequently days of inventory (DOI) rose from 130 to 173 days. Long-term debt was $284m, representing the carrying value of $345m in convertible notes.

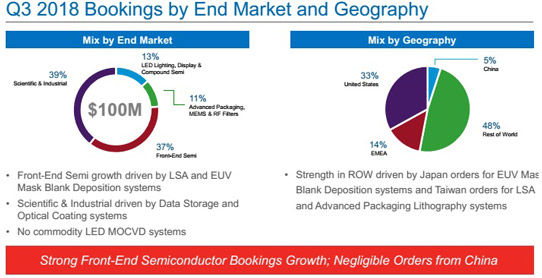

Order bookings were $100m, down 24% on $132m last quarter and 38% on $162m a year ago, reflecting softness in China across all of Veeco’s business.

LED Lighting, Display & Compound Semiconductor orders continued to be weak, as expected (comprising just 13% of total bookings), with no orders for blue LED MOCVD systems.

Advanced Packaging, MEMS & RF Filter orders comprised 11% of total bookings, including multiple lithography tools with a large Taiwanese outsourced assembly. & test (OSAT) firm that is adding capacity to provide wafer-level advanced packaging applications for their logic customers.

Industrial & Scientific orders comprised 39% of total bookings, remaining strong in data storage as well as in optical coatings systems.

Front-End Semiconductor orders grew strongly to 37% of total bookings, including two extreme ultraviolet (EUV) mask blank deposition systems for Japan and a laser spike anneal (LSA) system for leading-edge applications at a market leader in Taiwan.

Driven by the latter, orders from the rest of the world (including Japan and Taiwan) rose to 48% of bookings, the USA comprised 33% and EMEA 14%, while China fell to just 5%.

Order backlog hence fell further during Q3/2018, from $305m to $276m. Typically, more than two-thirds of backlog turns into revenue in the subsequent two quarters. However, less than half of the Q3 ending backlog is expected to turn into revenue in Q4/2018 or Q1/2019, primarily due to the EUV systems (which typically ship with a lead time of 10-12 months).

For fourth-quarter 2018, Veeco expects revenue to fall to $85-105m, partly due to revenue from blue LED MOCVD system sales to China being negligible (compared with 21% in Q3 – and, going forward, Veeco expects the proportion of overall revenue from China to decline significantly). Compared with the previous outlook, Q4 is weaker due to push-outs of non-MOCVD products for China-based customers as well as the US foundry’s unexpected discontinuation of its 7nm program.

Q4 gross margin should be 36-38%. Product mix is shifting away from low-margin blue LED MOCVD systems for China, but this is being offset by the overall decline in business volume, preventing Veeco from achieving its previously stated goal of 40% gross margin by Q4. “We continue to target 40% gross margin or higher as volume picks up,” says chief operating officer & chief financial officer Sam Maheshwari.

OpEx should be $41-43m, the midpoint of which is an improvement after adjusting Q3’s OpEx for a one-time credit of $2.2m.

Veeco expects an operating loss of $10-3m and a net loss of $11-4m ($0.25-0.09 per diluted share).

“It has become clear some of our prior plans have been impacted for various reasons,” notes CEO Bill Miller.

“The first was our forecast to grow full-year 2018 revenue over 2017. Given our current visibility, full-year 2018 revenue will be slightly lower than the $556m pro-forma 2017 revenue of the combined Veeco and Ultratech. The revenue shortfall was driven by a US foundry’s decision to put its 7nm FinFET program on hold. We are also seeing broader China softness across all of our businesses,” he adds.

“The second was our plan to exit 2018 with 40% gross margin. Our cost-reduction efforts and improved product mix have helped gross margin. However, lower Q4 revenue and the resulting under-absorption has more than offset the benefits.”

“Third was our plan to release a tool for the VCSEL market in the second half of this year. We are engaged with customers under a new VCSEL platform and have demonstrated many key requirements for VCSEL manufacturing, but commercial availability will be delayed at least three months as we optimize our technology.”

Based on its backlog and current visibility, Veeco sees Q1/2019 sales tracking slightly above Q4/2018. It also expects OpEx to continue declining towards the $40m targeted by end-Q2/2019.

“We remain encouraged by our growth prospects in compound semiconductor, advanced packaging and front-end semiconductor,” Miller says. “We are working on many promising initiatives in Front-End Semiconductor and Compound Semi which offset the declining commodity LED business, but this transition will take time. Therefore, we have begun to take proactive measures to reduce expenses in such a way that we preserve our innovation capability and position Veeco for growth when our markets regain traction.”

“We announced $15m in annualized OpEx synergies when we acquired Ultratech. A few actions are still outstanding and we expect to complete them by early Q1/2019,” notes Maheshwari. “We recently initiated additional expense reduction efforts to align our cost structure to the current business conditions. These new actions are projected to save an additional $20m annually to bring our quarterly non-GAAP operating expenses to $40m by Q2/2019. These expense reductions are being implemented primarily in SG&A [selling, general & administrative] with a minimal impact to our R&D and new product development efforts [in laser anneal, MOCVD and lithography].”

- Veeco has filed an 8-K form with the US Securities and Exchange Commission (SEC) reporting that it has recently discovered an attack on its computer systems by a “highly sophisticated actor”. The firm has notified law enforcement of the attack and has retained forensic experts to assist with the investigation.

Veeco’s revenue grows 14% in Q1 to $158.6m, driven by MOCVD system shipments to China

Veeco’s revenue rises 9% in Q4/2017, driven by rebound in GaN MOCVD sales to China

Veeco’s Q3 revenue growth driven by continued recovery in MOCVD market

Veeco completes acquisition of Ultratech for $862m