- News

11 November 2019

Veeco’s revenue rebounds in Q3 as 300mm GaN MOCVD cluster system accepted for pilot production

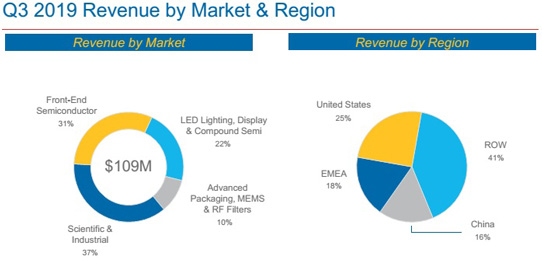

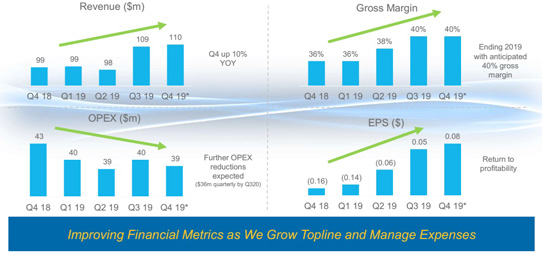

For third-quarter 2019, epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA has reported revenue of $109m, down 14% on $126.8m a year ago but up 11.5% on $97.8m last quarter and above the midpoint of the $95-115m guidance range.

The LED Lighting, Display & Compound Semiconductor segment – which includes photonics, 5G RF, power devices and advanced display applications – contributed $24m (22% of overall revenue), more than doubling from just $10m last quarter, including service and upgrades for LED customers and shipment of Veeco’s first 300mm fully automated single-wafer gallium nitride (GaN) metal-organic chemical vapor deposition (MOCVD) cluster system to a “leading-edge semiconductor fab” for a pilot-production environment (after completing development during the quarter). “We recently obtained acceptance from our customer on this tool,” notes CEO Bill Miller.

The Front-End Semiconductor segment (formerly part of the Scientific & Industrial segment, before the May 2017 acquisition of lithography, laser-processing and inspection system maker Ultratech Inc of San Jose, CA, USA) contributed $34m (31% of total revenue), up 36% on $25m last quarter, driven by shipment of Veeco’s second production extreme ultraviolet (EUV) mask blank system as well as sales of multiple laser spike annealing (LSA) systems. Also, shipments to data storage customers remained solid as they continued to invest in technology and capacity.

The Advanced Packaging, MEMS & RF Filter segment – including lithography and Precision Surface Processing (PSP) systems sold to integrated device manufacturers (IDMs) and outsourced assembly & test firms (OSATs) for Advanced Packaging in automotive, memory and other areas – contributed $11m (10% of overall revenue), falling 31% from $16m last quarter, reflecting continued market softness.

The Scientific & Industrial segment fell back by 15% from $47m last quarter to $40m (37% of total revenue), including ion beam system shipments to data storage customers as well as sales of ion beam sputtering systems to high-end optical coating customers.

By region, the rest of the world (RoW, including Japan, Taiwan, Korea and Southeast Asia) was 41% of overall revenue (driven by the EUV mask blank system sale, LSA product sales and data storage products). The USA contributed 25% of overall revenue (including sales to the data storage market) and Europe, the Middle-East & Africa (EMEA) was 18% (driven by sales to Scientific & Industrial customers). China was 16% of overall revenue (driven by LSA product shipments to foundries).

On a non-GAAP basis, gross margin was 40.3%, up from 37.8% last quarter and 38.2% a year ago, and above the guidance of 37-39%, driven by improved product mix, higher volume and well managed expenses. Operating expenditure (OpEx) was $40m, above the expected $39m and $38.5m last quarter but cut from $40.4m a year ago.

“The company returned to profitability on a non-GAAP basis,” says Miller. Net income was $2.6m ($0.05 per diluted share), down from $5.3m ($0.11 per diluted share) a year ago but recovering from a net loss of $3m ($0.06 per diluted share) last quarter, and above the midpoint of the guidance range between a loss of $5m (–$0.10 per diluted share) and a profit of $4m (+$0.10 per diluted share).

Compared with cash inflow from operations of $14m last quarter, cash outflow from operations was –$15m. This was due to biannual interest payment on the firm’s debt and an increase of about $10m in contract assets on the balance sheet (a tool was shipped to a Japanese customer, recorded as per US SEC revenue-recognition rules, but – following the Japanese business practice – to be invoiced only after the tool has been received, installed and then accepted). Accounts receivable have hence risen from $59m to $73m. Accounts payable has risen from $22m to $35m. Inventory has been reduced from $140m to $135m. “We have made progress reducing overall inventory, however a portion of the inventory is slow moving, which is related to the LED business and certain other products,” notes chief operating officer & chief financial officer Sam Maheshwari. “We believe the slow moving inventory is no more than $25m, and we are pursuing steps to sell this.” Capital expenditure (CapEx) has more than halved from $4.3m last quarter was $1.7m.

Overall, cash and short-term investments hence fell during the quarter by $15m from $247m to $232m (of which $42m is held offshore). Long-term debt has risen slightly from $294m to $297m, representing the carrying value of $345m in convertible notes.

Order bookings were $115m, up on $100m a year ago and rebounding by 47% on $78.2m last quarter, driven by strength in both data storage and EUV mask blank markets.

Quarter-end backlog rose from $274m last quarter to $279m, driven by the ‘very strong’ Front-End Semi and Scientific & Industrial (data storage) segments, as Advanced Packaging is weak (driven largely by the smartphone unit-related softness) and the Lighting, Display & Compound Semi segment is also “somewhat on the weak side” (while Veeco tries to penetrate opportunities in power semiconductors as well as in VCSELs and certain other arsenide-phosphide applications including edge-emitting lasers and photonics-related applications).

For fourth-quarter 2019, Veeco expects revenue of $100-120m and gross margin of 39-41%. OpEx should be cut back to about $39m. Net earnings are expected to range between a loss of $2m ($0.03 per share) and a profit of $8m ($0.18 per share).

“Based on our current visibility we see Q1/2020 trending similar to Q4/2019 [regarding revenue and gross margin],” says Maheshwari.

Miller says that the transformation of Veeco will be completed in two phases: returning the company to profitability and driving growth.

“Phase 1 – returning the company to profitability – is well underway and includes our MOCVD shift from the commodity-led markets to photonics and emerging applications, making general infrastructure reductions, and rationalizing our product lines by re-prioritizing R&D expenditures. On our last earnings call, we alluded to slow moving inventory. We also mentioned reducing expenses to improve profitability. We made progress in both areas,” Miller says.

Veeco continues to take action to reduce infrastructure costs as well as rationalize ongoing investments in certain product lines. “We have been working on a number of products and product development efforts. So there is a little bit of facilities- and administrative-oriented signing and optimization that we are going to be working through,” says Maheshwari. “But a larger portion of the reduction is going to come from the R&D line. And that is really driven by optimizing and reducing consultants, contractors and project material related spending as a number of our products are getting towards the late stages in terms of their development cycles.” The target is to eliminate about $16m from the current run rate on an annualized basis, or about $4m per quarter. So, at current revenue levels, OpEx is expected to decline towards the target of $36m per quarter by Q3/2020.

“Phase 2 – driving growth – is in the early stages,” says Miller. “We’re taking steps to grow our existing Front-End Semi advanced packaging and data storage markets. In addition, we are investing in new applications such as EUV mass blank production and compound semi applications with our MOCVD products,” he adds.

Last quarter Veeco announced the shipment of a beta version of its improved arsenide-phosphide MOCVD system, optimized for photonics applications including VCSELs, edge-emitting lasers, mini- and micro-LEDs and red/orange/yellow LEDs. “We are on target to receive customer acceptance in the next few quarters,” notes Miller. “We have been working closely with other customers as well to place another evaluation tool for VCSELs. When this market begins to grow, we hope to be well positioned and gain market share,” he adds.

“When we complete our transformation we will be a leaner and real focused company on the path to growth,” Miller concludes.

Veeco’s Q1 revenue levels out at $99m after drop off of commodity LED MOCVD system sales to China

Veeco’s revenue falls 22% in Q4/2018 due to commoditization of China LED MOCVD market

Veeco’s Q3 revenue down more than expected due to China market softness