- News

27 July 2017

Aixtron’s first-half revenue doubles year-on-year

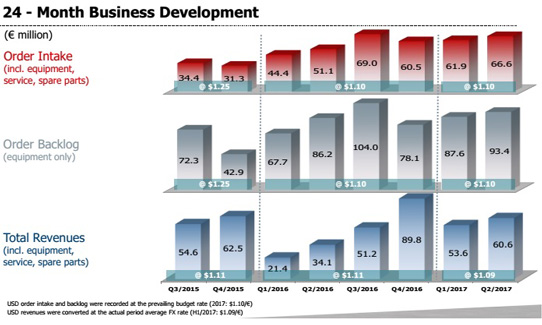

For first-half 2017, deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported revenue of €114.1m, more than doubling from first-half 2016’s €55.5m.

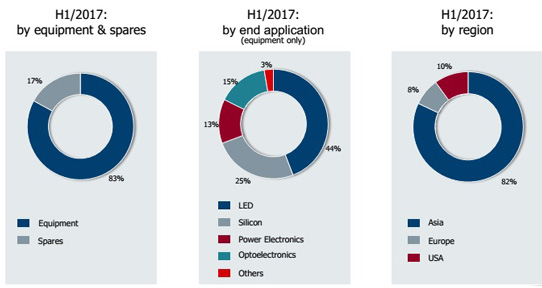

Specifically, equipment sales of €94.4m comprised 83% of total revenue (up from 66%, or €36.6m, in first-half 2016). Sales of spare parts and services comprised the remaining €19.7m or 17% of total revenue.

On a regional basis, 82% of revenue came from Asia (continuing to rebound, after dipping to just 55% in first-half 2016), 8% came from Europe, and 10% came from the USA.

For second-quarter 2017, revenue was €60.6m, up 13% on €53.6m last quarter and up 78% on €34.1m a year ago. Equipment sales of €50.9m comprised 84% of total revenue (up from 81% or €43.5m in Q1 and 72% or just €24.7m a year ago).

First-half 2017 revenue growth was driven mainly by improved demand for metal-organic chemical vapor deposition (MOCVD) systems for manufacturing vertical-cavity surface-emitting lasers (VCSELs), red-orange-yellow (ROY) and specialty LEDs as well as power electronics, and chemical vapor deposition (CVD) systems for manufacturing flash memory.

Gross margin has improved from 18% in first-half 2016 to 25% in first-half 2017, or 27% after adjusting for restructuring costs of €2.3m (with Q2’s 26% down slightly from Q1’s 27%, impacted as expected by low-margin shipments from inventory of the remaining AIX R6 MOCVD systems for GaN LEDs).

Operating expenses rose from €35.9m in first-half 2016 to €40.2m in first-half 2017 (while being cut from €20.6m in Q1 to €19.6m in Q2).

Earnings before interest, tax, depreciation and amortization (EBITDA) have improved from ‑€20m in first-half 2016 to -€10.2 in second-half 2017, or -€4m after adjusting for €6.2m of restructuring costs (improving from -€2.7m in Q1 to -€1.3m in Q2).

The net result improved from -€26.6m in first-half 2016 to €24.9m in second-half 2017, or -€10.4m after adjusting for €14.5m of restructuring costs.

Operating cash flow has improved from -€39.3m in first-half 2016 to €43.3m in first-half 2017, while capital expenditure (CapEx) for property, plant & equipment has been halved from €5.9m to just €3m. Free cash flow has hence improved by €81.3m from -€41m to €40.3m (€33.3m in Q1 and €7m in Q2), due mainly to the collection of receivables as well as advanced payments received from customers.

Cash and cash equivalents at the end of June were €197.1m, up from €193.6m at the end of March but up by €37m from €160.1m at the end of December.

Total order intake (including spares and service) has risen by 34% from first-half 2016’s €95.5m to €128.5m in first-half 2017 (with Q2’s €66.6m up 8% on Q1’s €61.9m and up 30% on €51.1m a year ago, driven mainly by increased demand from LED and optoelectronic as well as memory applications).

Equipment order backlog at the end of June was €93.4m, up 7% on €87.6m at the end of March. Most of the backlog is due for shipment in 2017.

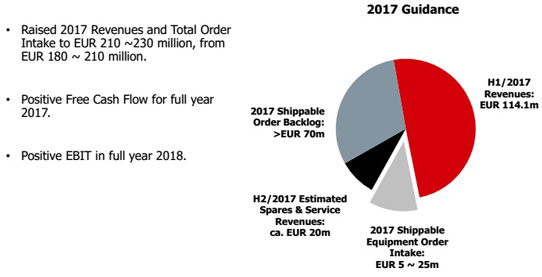

“In H1/2017, the positive development in order intake has continued and will result in improved revenues,” notes CEO Kim Schindelhauer. Aixtron has therefore raised its full-year 2017 guidance for both order intake and revenue from €180-210m to €210-230m (consisting of H1/2017’s revenue of €114.1m supplemented by 2017-shippable order backlog of at least €70m joined by a forecasted €5-25m of further 2017-shippable equipment order intake, plus a forecasted €20m of spares & service revenue).

In addition, in first-half 2017 Aixtron stepped forward in focusing on its core business:

1. in Q1/2017 Aixtron froze product development activities for III-V on silicon (TFOS) materials for next-generation logic chips (resulting in a one-time write down of €6.6m) and in Q2/2017 the firm froze thin-film encapsulation (TFE) activities (involving write downs of €6.4m).

2. as it continues to transform the company to align R&D expenses with revenue (targeting a return to profitability in 2018), on 25 May Aixtron agreed to sell the assets of its ALD & CVD memory product line (based mainly at US subsidiary Aixtron Inc in Sunnyvale, CA) to Eugene Technologies Inc, a US subsidiary of South Korea-based Eugene Technology Co Ltd that makes single-wafer ALD, CVD and plasma deposition and surface treatment systems.

3. To support the ongoing establishment of a joint venture to spin-off its organic light-emitting diode (OLED) deposition technology, Aixtron has founded the subsidiary APEVA SE (with all related staff transferring to the new JV by 1 October).

Dr Felix Grawert will join Aixtron as member of the executive board by 14 August, which means that in first-half 2017 Aixtron completed the majority of tasks concerning the firm’s realignment.

Aixtron says that it continues to transform the firm to align R&D expenses with revenues in order to return to profitability in 2018. As the execution of this strategy may have a substantial influence on profit, management is not guiding on EBITDA, EBIT and net result for full-year 2017. Nevertheless, Aixtron expects to achieve positive free cash flow in 2017 and a positive EBIT for 2018.

Aixtron to sell ALD/CVD memory product line to US subsidiary of South Korea’s Eugene Technology

Aixtron’s Q1 revenue and order intake rise strongly year-on-year

Aixtron’s returns profit in Q4, helping full-year 2016 revenue recover to 2015 level

Aixtron's supervisory board chairman to become interim CEO

Aixtron to delist American depositary shares from NASDAQ and deregister with SEC

China's Grand Chip abandons acquisition of Aixtron

Aixtron returns to positive free cash flow in Q3, boosted by sales of AIX R6 system inventory

Aixtron's increased orders in Q2 herald recovery in second-half 2016

Aixtron continues reorganization in 2015

Aixtron launches AIX R6 next-generation MOCVD system