- News

13 August 2019

Veeco’s Q2 revenue still suppressed by soft LED market while MOCVD platform developed for As/P-based photonics

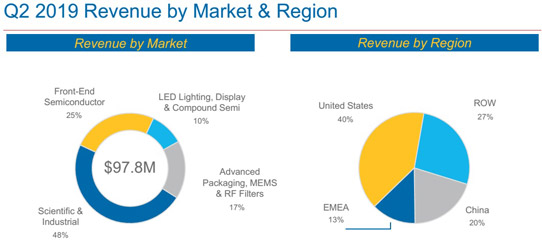

For second-quarter 2019, epitaxial deposition and process equipment maker Veeco Instruments Inc of Plainview, NY, USA has reported revenue of $97.8m, down 1.6% on $99.4m last quarter and 38% on $157.8m a year ago. This is also slightly below the midpoint of the $90–110m guidance, due to the recent trading restrictions with Huawei (which impacted revenue by about $2m). “The semiconductor capital equipment industry is experiencing headwinds from multiple end markets,” notes CEO William J. Miller Ph.D.

The LED Lighting, Display and Compound Semiconductor segment – including metal-organic chemical vapor deposition (MOCVD) systems – comprised just 10% of total revenue (down from 14% last quarter and 55% a year ago). This reflects softness in the global LED market and Veeco being in the early stages of penetrating the photonics market.

The Front-End Semiconductor segment (formerly part of the Scientific & Industrial segment, before the May 2017 acquisition of lithography, laser-processing and inspection system maker Ultratech Inc of San Jose, CA, USA) reached its highest revenue level in several years, comprising 25% of total revenue (up from 23% last quarter and just 12% a year ago). Growth was driven by shipments of Veeco’s first extreme ultraviolet (EUV) mask blank system for volume production as well as sales of multiple laser spike anneal (LSA) systems.

The Advanced Packaging, MEMS & RF Filter segment – including lithography and Precision Surface Processing (PSP) systems sold to integrated device manufacturers (IDMs) and outsourced assembly & test firms (OSATs) for Advanced Packaging in automotive, memory and other areas – comprised 17% of total revenue (falling back from 23% last quarter, but up from 16% a year ago). Revenue growth was driven by multiple advanced packaging (AP) lithography systems for high-bandwidth memory and CPU application. “Automotive sales growth has slowed, the memory market is in a cyclical downturn with high inventory levels and the smartphones supply chain is in a state of overcapacity as smartphone unit volume growth has slowed,” says Miller. “As a result of these headwinds, wafer fab equipment spending is expected to be down in 2019, and estimates vary regarding the timing of recovery.”

The Scientific & Industrial segment comprised 48% of total revenue (rebounding from 40% last quarter, and up on just 17% a year ago), driven by ion beam system shipments to data storage and optical customers. “As demand for cloud storage increases, we continue to see strength in our data storage products,” says Miller.

By region, the USA contributed 40% of revenue (up from 33% last quarter), driven by the data storage market. The rest of the world (including Japan, Taiwan and Korea) contributed 27%, driven by EUV mask blank systems sales. China contributed 20% of revenue (up from just 10%), driven by services revenue and LSA product shipment. Europe, the Middle-East & Africa (EMEA) contributed 13% of revenue.

Due to the improved product mix as well as cost-reduction efforts, gross margin has rebounded from 35.5% last quarter to 37.8%, up from 35.8% a year ago.

Operating expenses (OpEx) have been cut further, from $45.7m a year ago and $40m last quarter to $38.5m (below the expected $40m) due to reduced R&D spending.

Compared with net income of $7.2m ($0.15 per diluted share) a year ago, net loss was $3m ($0.06 per diluted share), but this was cut from $6.4m ($0.14 per diluted share) last quarter.

Cash flow from operations was +$14m (compared with outflow of -$22m last quarter), driven by decreases in accounts receivable (from $75m to $59m) and inventory (from $148m to $140m) as well as an increase in customer deposit, offset by a reduction in accounts payable (from $36m to $22m). “We made good progress reducing inventory by converting evaluation tools in this quarter, however inventory is still high because we are experiencing slow-moving inventory in the LED business due to the ongoing softness there,” says executive VP, chief operating officer & chief financial officer Sam Maheshwari.

So, despite capital expenditure (CapEx) almost doubling from $2.2m last quarter to $4.3m, cash and short-term investments hence rose during the quarter by $10m from $237m to $247m (of which $43m is held offshore). Long-term debt was $294m (up slightly from $290m last quarter), representing the carrying value of $345m in convertible notes.

“We have been enhancing our TurboDisc MOCVD platform for the photonics [arsenide/phosphide] market,” says Miller. “We shipped our first beta MOCVD system optimized for photonics applications… Initial feedback suggests our new product has advantages over our competition in key customer requirements, such as particle defectivity, growth rates, uniformity and run-to-run consistency. This is an important step in our penetration into the arsenide/phosphide MOCVD market with customers focused on VCSELs [vertical-cavity surface-emitting lasers], edge-emitting lasers and ROY [red, orange, yellow] specialty LEDs,” he adds. “We continue to work with other customers to place additional systems… Future growth drivers for this market will be machine vision and industrial applications, world-facing sensors and automotive LIDAR. We are working with customers to help them build capacity when the market returns.” Another beta tool should be shipped in second-half 2019.

“We continue to see strength in our technology-driven purchases but capacity-related orders were soft,” says Miller. Order bookings hence fell from $107.2m to $78.2m. “This was expected given the soft macro-environment,” he adds. Order backlog correspondingly declined from $295m to $274m.

For third-quarter 2019, Veeco expects revenue of $95-115m. Gross margin should be 37-39%, aided by cost reduction. OpEx is expected to be about $39m. “We expect OpEx to remain at these levels for the remainder of this year and expect to reduce it in 2020,” says Maheshwari. Operating income should range between a loss of $3m and a profit of $6m. Net income should range between a loss of $5m (-$0.10 per diluted share) and a profit of $4m (+$0.10 per diluted share).

“Based on our current visibility, we are reiterating second-half top-line growth of roughly 10% over the first half,” says Maheshwari. “We continue to target gross margin of 40% by the end of this year due to the favorable product mix and cost reductions. And we expect positive EPS in Q4,” he adds.

“We’ve seen good bookings in July already. So some of the business that we were planning to close in June, it just got pushed over to the first two weeks in July,” says Maheshwari. “We are looking at improving our bookings in Q3 over Q2,” he adds.

“Veeco is impacted by the industry slowdown. But we benefit from technology inflection spending,” says Miller. “While we see softness in the short term, long-term trends driving this semi industry are intact,” he adds. “We are making progress with exciting new products and remained focused on winning our customers business,” he says, citing growth initiatives supporting EUV adoption, front-end semiconductor manufacturing with laser annealing, MOCVD for the photonics market, and advanced packaging. “We have completed most of the development activity on our MOCVD system designed for photonics applications, our next-generation advanced packaging lithography system, and our laser annealing system for the sub-7nm market.”

“We remain optimistic about our long-term growth prospects,” says Miller. “We are still working toward our goal of returning to profitability, and we’ll be reducing infrastructure in the coming quarters to further improve the cost structure of the company.”

Veeco’s Q1 revenue levels out at $99m after drop off of commodity LED MOCVD system sales to China

Veeco’s revenue falls 22% in Q4/2018 due to commoditization of China LED MOCVD market

Veeco’s Q3 revenue down more than expected due to China market softness