News: Markets

4 August 2020

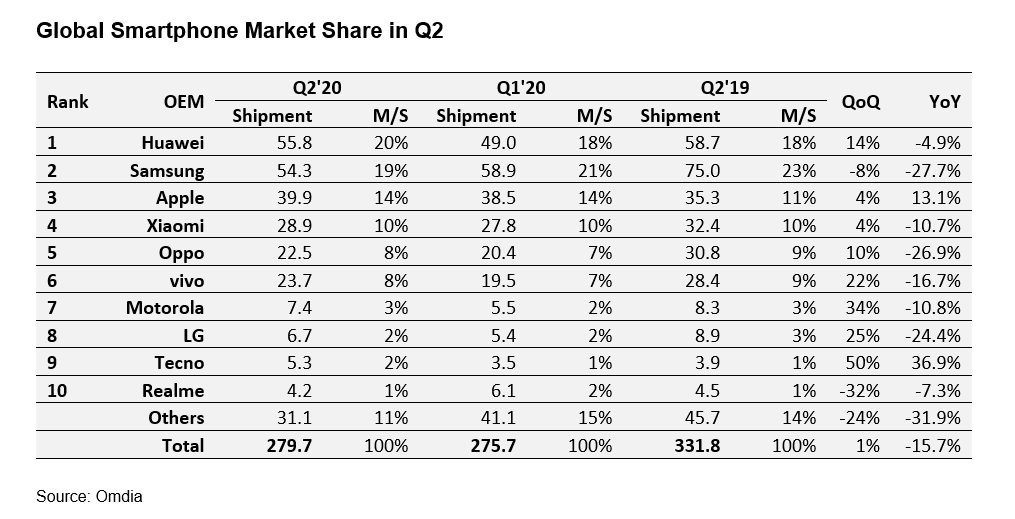

Smartphone shipments fall 15.7% year-on-year to 279.7 million in Q2

Even as some countries and regions have begun to loosen restrictions, other countries are still dealing with the initial wave of the ongoing global COVID-19 pandemic. For smartphone OEMs, this means that second-quarter 2020 was another quarter with extraordinary circumstances and quickly changing realities on the ground. The result is a 15.7% decline year-on-year in unit shipments from 331.8 million in Q2/2019 to 279.7 million in Q2/2020, according to a report by Omdia.

For most OEMs, Q2 was another quarter of negative growth. However, of the major OEMs, Apple was most successful in navigating the marketplace, expanding shipments by 13.1% on the back of its iPhone 11 and iPhone SE products.

Huawei beats Samsung to top spot for first time

Shipping 55.8 million units in Q2/2020, Huawei surpassed Samsung, which shipped 54.3 million units, for the first time. Because of the recovery in China, Huawei’s shipments are down only 4.9% on the 58.7 million units it shipped in Q2/2019. Despite facing sanctions from the US government that are now entering their second year, Huawei has been able to mitigate impacts on its international business enough to compete with Samsung and finally claim the global top spot.

Samsung, on the other hand, saw unit shipments fall by 27.7% year-on-year, from 75 million in Q2/2019 to 54.3 million units in Q2/2020. Many of its most important markets were significantly impacted by COVID-19, especially emerging markets, which accounted for more than 70% of Samsung’s overall shipment in 2019. China is not a large-scale market for Samsung, so the firm cannot benefit from the recovery there. In Western Europe, reopening and loosening of restrictions started near the end of the quarter, meaning that much of the first and second quarters were impacted for many of Samsung’s key markets.

Apple’s product mix helps in Q2

Only Apple, iTel, Tecno and Infinix had unit shipments up year-on-year in Q2. Apple shipped 39.9 million units, up 13.1% from 35.3 million units. The iPhone SE, a model with mid-range pricing, and the iPhone 11 helped Apple to expand its unit shipments.

“With the launch of the iPhone SE in April, Apple has released a long-desired product, with an attractive price,” says Jusy Hong, director of smartphone research at Omdia. “The launch added a new iPhone model into Apple’s product mix just as lockdown restrictions had reached important markets, such as the USA. A $399 starting price point makes the iPhone SE an attractive new device, especially in the face of continued economic uncertainty in many markets. For existing iPhone users who needed to upgrade their smartphones in the second quarter, the new SE represented an affordable option that does not require a large down-payment or high monthly repayment rates.”

Regional focus aids Transsion Holdings

The other brands with year-on-year growth in shipments (iTel at 35.3%, Tecno at 36.9% and Infinix at 17.3%) are all part of Transsion Holdings, which collectively shipped 12 million units in Q2/2020, up from 9.1 million units in Q2/2019.

All three brands focus on the Middle East and Africa as their main target markets. Because of Huawei’s weakening presence in the market, and the return of production in China at the end of the first quarter of 2020, these three brands were less affected by the pandemic than other brands.

Market environment challenging for most OEMs

In first-quarter 2020, Realme was one of the few OEMs whose growth was spurred by resilience in the Indian market. Now, however, Realme has joined all other OEMs in facing declining shipments in Q2. Realme’s shipments fell 7.3% year-on-year, from 4.5 million units to 4.2 million units.

Tensions between the Indian and Chinese governments have impacted the smartphone market in India, even though many Chinese OEMs have invested significantly over the last 18 months to increase their production and customer service operations in the country. For OEMs like Realme, vivo and Xiaomi, which focus on this market, the pandemic and governmental issues contributed to a difficult Q2/2020.

Vivo saw shipments decline 16.7%, from 28.4 million units in Q2/2019 to 23.7 million units in Q2/2020. OPPO saw an even larger decline, of 26.9%, from 30.8 million to 22.5 million units. Xiaomi’s shipments, on the other hand, declined 10.7% from 32.4 million to 28.9 million units.

The rest of the top 10 global OEMs all saw shipments decline. LG’s shipments fell by 24.4%, from 8.9 million to 6.7 million units, as the firm continues to struggle against mid-range competition from Chinese OEMs in many markets.

Motorola had another quarter of 10.8% year-on-year shipment decline, from 8.3 million units in Q2/2019 to 7.4 million units in Q2/2020. The pandemic has impacted the launch of the new RAZR, the firm’s first foldable device, and is making it difficult for Motorola to break through a difficult market with its latest devices. The COVID-19 crisis is occurring just as the firm was set to return to unit and market share expansion.

Ongoing challenges

Although many countries have lifted some restrictions on movement and business activities, and others are working towards a return to normal, other countries still continue to be in the midst of the initial outbreak. There are also signs of potential new outbreaks in countries where the virus has been brought under control. In this continued environment of uncertainty, the smartphone market will continue to be impacted in the third and fourth quarters of 2020, reckons Omdia. While smartphone OEMs have found their footing in terms of releasing new devices and continuing on the path of their product roadmaps, user purchasing behavior will continue to depend on the strides made in fighting the outbreak and containment of the subsequent threat of new outbreaks, the firm concludes.