News: LEDs

15 July 2020

Mini/micro-LED market to reach US$4.2bn in 2024

By 2024, the global mini/micro-LED market will reach US$4.2bn in revenue, forecasts TrendForce’s latest ‘LED Industry Demand and Supply Data Base’.

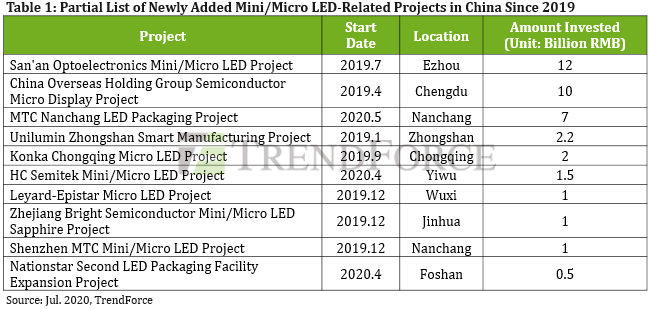

The positive outlook of the mini/micro-LED industry has attracted many investors. Since 2019, total investment in mini/micro-LED-related projects in China has reached RMB39.1bn (US$5.59bn), with more than 14 newly added projects. This massive influx of capital is expected to accelerate the overall pace of mini/micro-LED commercialization.

Given the recent delays in mini-LED commercialization this year, some manufacturers are likely to push back their original plans of ramping up mass production of mini-LED TVs and monitors in mid-2020, notes analyst Allen Yu. On the other hand, since micro-LEDs are still in the R&D stage for most manufacturers, the technology has a long way to go before it is ready for commercial use. Nevertheless, investors are still relatively hopeful about the future of mini/micro-LEDs. For instance, LED chip and packaging suppliers, such as San’an Optoelectronics, Epistar, HC Semitek, Nationstar and Refond, as well as video wall and panel manufacturers such as Leyard, Unilumin, TCL CSOT and BOE, have all launched mini/micro-LED-related projects in an effort to drive the industry forward.

In July 2019, San’an commenced its mini/micro-LED wafer and chip development and production project in Ezhou, Hubei, which aims mostly to develop new mini/micro-LED displays and is projected to involve RMB12bn worth of investment capital. In December 2019, Leyard and Epistar jointly invested RMB1bn to set up a mini/micro-LED production center in Wuxi, Jiangsu. Also, in May, MTC established its headquarters and its LED packaging facilities in the Qingshanhu District of Nanchang, Jiangxi. MTC is expected to build 5000 production lines for LED packaging operations (including mini/micro-LED packaging), with an investment totaling RMB7bn.

TrendForce believes that participation of the above companies in mini/micro-LED R&D will inject a corresponding influx of capital in all aspects of mini/micro-LED technology development, including new equipment, materials and manufacturing technologies, with these investment efforts also resulting in the maturation of the related supply chain.