News: Markets

12 June 2020

Optical transceivers market to more than double to $17.7bn by 2025, driven by investment in data centers

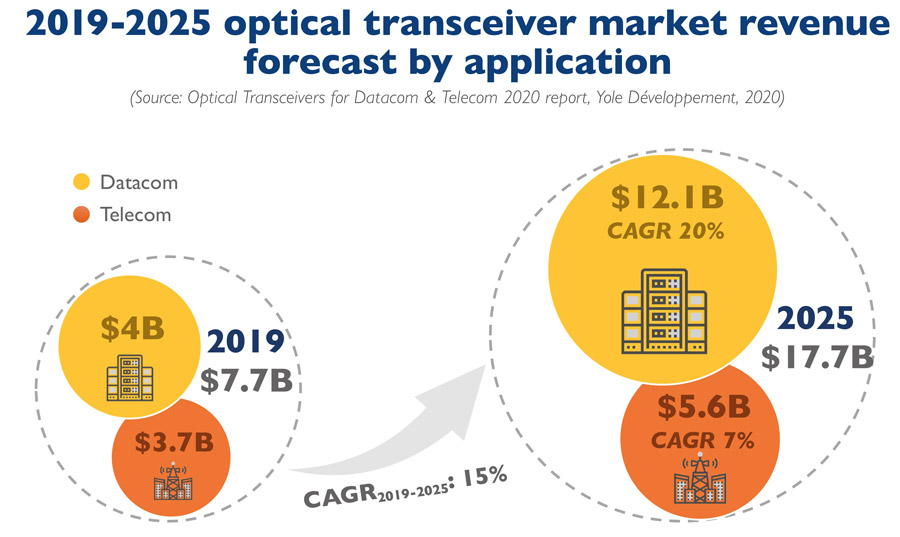

Optical transceiver revenue is increasing at a compound annual growth rate (CAGR) of 15% from $7.7bn in 2019 to more than double, to about $17.7bn, in 2025, reckons Yole Développement in its report ‘Optical Transceivers for Datacom & Telecom 2020’

“This growth will be driven by high-volume adoption of expensive high data rates including 400G and 800G modules by big cloud service operators,” says Martin Vallo PhD, technology & market analyst Solid-State Lighting technologies, in Yole’s Photonics, Sensing & Display division. “Therefore, such players invest more and more in new data centers and, on top of that, telecom operators have also increased their investments into the 5G networks that use wireless optical transceivers,” he adds.

High demand from data-center and telecom operators has been confirmed as follows:

- Datacom transceiver module revenue growth at about 20% CAGR will be driven by the adoption of expensive higher-data-rate optical modules, migrating from core/spine networks down to inter-rack connections.

- Telecom transceiver module revenue growth at a 5% CAGR will be driven by coherent technologies for data-center interconnect (DCI) optical transport solutions and 5G optical transceivers deployment in Asia.

The sharp difference in revenue growth is caused by lower sales expectation in 2020 due to the COVID-19 pandemic. In addition, total revenue is expected to rise only moderately in 2020 due to the effect of the pandemic. Indeed, COVID-19 is naturally affecting telecommunications globally and hence sales of optical transceiver modules. However, demand from data-center operators for optical modules is very strong in China, pushed by the local government. Its strategy is focused mainly on 5G deployment and the development of cloud data centers.

“The state of the art of fiber-optic communication technologies has advanced dramatically over the past 25 years,” notes Pars Mukish, business unit manager, Solid-State Lighting (SSL) & Display at Yole. “The highest capacity of commercial fiber-optic links available in the 1990s was only 2.5-10Gb/s, while today they can carry up to 800Gb/s. The last decade of developments has enabled higher-efficiency digital communication systems and solved problems with degraded signals.”

Network traffic growth has been increasing at an enormous pace over the decades and across all the network architectures from the long-haul, mobile access to intra-data-center networks. This growth has been driven by streaming ultra-high-definition (UHD) videos (which need ever higher data throughput) and now newly emerging digital applications and services requiring fast access to the digital networks. It appears that the success and demand for existing applications is continuously driving the scale and capacity of the underlying network infrastructure (including optical transceivers) to points where further applications are enabled, renewing the cycle.

Optical transceivers are widely used in server network cards, switches, routers and wireless base-station equipment in a variety of network architectures and applications. Distances covered start from less than 50m for server and storage interconnections in data centers and enterprise networks to more than 800km in telecom networks.

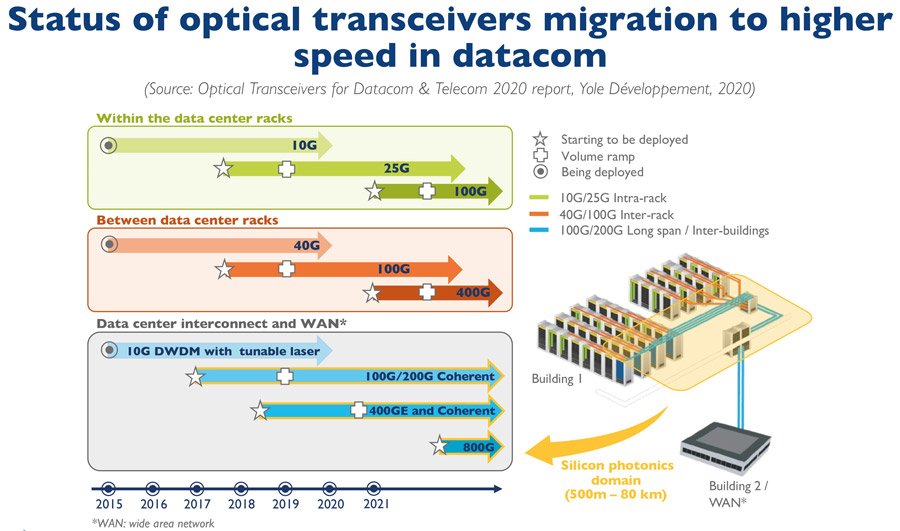

The evolution of multiple technologies has enabled transmission speed of 400G and beyond in long-haul and metro networks. Today’s trend of migration to 400G speeds stem from cloud operators’ demand to interconnect data centers. Furthermore, the exponential increase in digital communication network capacity and the growing number of optical ports is impacting optical module technology hugely. The new form factors are increasingly universal and designed to reduce their size and thus power consumption. Inside modules, the optics and integrated circuits are getting closer together.

Silicon photonics hence may represent a key enabling technology for the further development of optical interconnect solutions needed to address growing traffic. This technology will play an important role in 500m–80km distance applications, reckons Yole. The industry is working on the heterogeneous integration of indium phosphide (InP) lasers directly onto silicon chips. The advantage is scalable integration and the elimination of cost and complexity of the optical package. Reduced efficiency and lower optical power at high temperature are typical challenges for these lasers.

“Besides increasing speed by integrating amplifiers, the higher data throughput is also achieved by integrating state-of-the-art digital signal processing chips, providing different multi-level modulation techniques such as PAM4 or QAM,” notes Eric Mounier PhD, Fellow Analyst at Yole. “Another technique to increase data rates is parallelization or multiplexing, which enables increasing capacity using parallel fibers or different wavelengths onto a single fiber,” he adds.

Progress in the integration of optical component technologies has led to dramatic reductions in the complexity and cost of optical transceivers. The massive growth in bandwidth has yielded a 10-100-fold decrease in cost per transmitted bit, Yole concludes.