News: Markets

19 May 2020

GaN RF market growing at 12% CAGR to over $2bn in 2025, driven by 5G infrastructure and defense applications

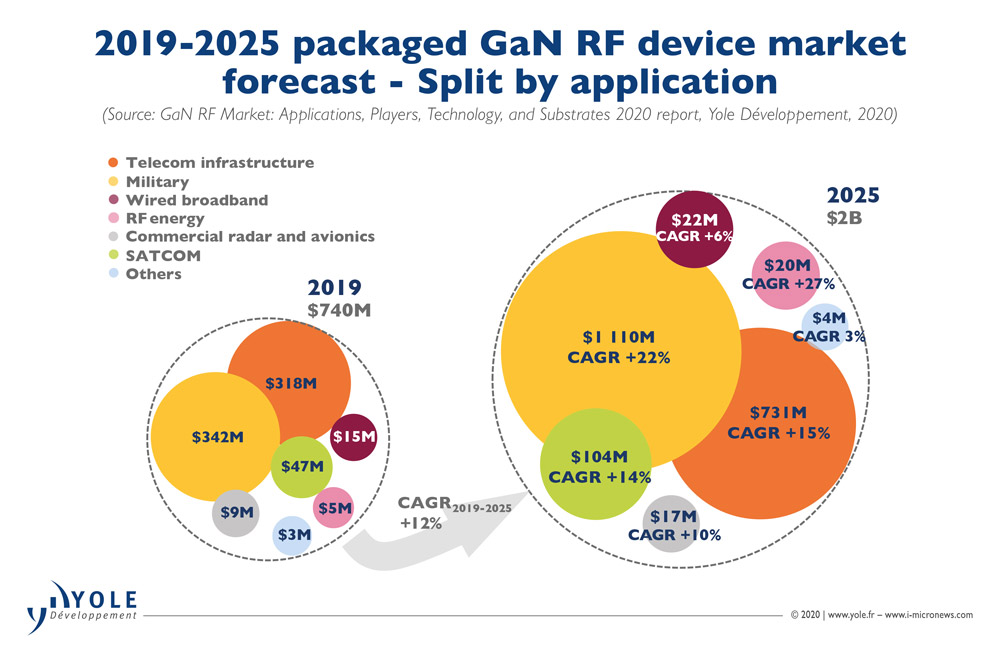

The total gallium nitride (GaN) radio frequency (RF) market is rising at a compound annual growth rate (CAGR) of 12% from $740m to more than $2bn by 2025, forecasts market research and strategy consulting company Yole Développement in its annual report ‘GaN RF market: applications, players, technology, and substrates 2020’.

“In the past few years, RF applications have received a boost from the implementation of GaN technology,” says technology & market analyst Ezgi Dogmus PhD. “The main GaN RF market drivers remain telecom and defense applications.”

In telecom infrastructure, the aftermath of US sanctions related to Huawei slowed the GaN-based remote radio head (RRH) market in 2019 and pushed original equipment manufacturers (OEMs) to restructure their supply chain for the coming years. Nevertheless, GaN deployment will remain the same for the long term. In active antenna systems (AAS), the increase in bandwidth will favor increasing GaN implementation. Also, small cells and backhaul connections will see impressive deployment of GaN in the coming years, reckons the report.

In military applications, with investments from governments to improve their national security by replacing travelling-wave tube (TWT)-based systems, defense will remain one of the GaN RF market’s main drivers, predicts the report.

“Radar is the main driver in military applications, mainly due to the increase of transmit/receive (T/R) modules in new GaN-based AESA [active electronically scanned array] systems and stringent requirements for lightweight devices for airborne systems,” says technology & market analyst Ahmed Ben Slimane PhD. “The total GaN RF military market will surpass $1.1bn in 2025, at a 22% CAGR,” he adds.

For handsets, GaN’s high performance and small form factor could attract OEMs. The adoption of GaN power amplifiers (PAs) will depend on the evolution over the next five years of GaN’s technology maturity, supply chain, and cost, as well as OEM strategies.

However, Yole says it is not possible today to give a comprehensive picture of the RF GaN industry without taking into account the US–China trade conflict and COVID-19 outbreak, since both events are having a significant impact on the landscape of the semiconductor industry.

China is the largest market for antenna systems and will remain so for the next several years. Due to US sanctions related to China-based Huawei, the OEM’s supply chain has been restructured. As a consequence, Yole identifies a positive impact on Asian integrated device manufacturers (IDMs) and foundries, as well as European players. For example, the European foundry UMS doubled its GaN RF business in 2019, due mainly to the base transceiver station (BTS) market. The US–China trade war also makes it more urgent for Huawei and ZTE to have domestic suppliers.

“According to the industry feedback, despite the virus outbreak, leading Chinese telecom operators’ 5G construction goals remain unchanged and development continues,” notes Dogmus. The virus outbreak is therefore likely to have minor consequences for GaN deployment in 2020. “We could also expect a market adjustment starting from second-half 2020 in China as well as the rest of the world,” he concludes.

The GaN-based military market will likely follow the same trend, predicts Yole. The firm expects only minor changes in the long term, as the defense market is ‘on demand’. However, in the short term, some disruptions to the supply chain may slow the global military market.