News: Microelectronics

27 November 2020

Turning point in RF GaN patenting over last 2 years

The radio frequency (RF) gallium nitride (GaN) market is seeing impressive growth, driven mainly by telecom and military applications. Yole Développement forecasts that the GaN RF market will rise at a compound annual growth rate (CAGR) of 12% from $740m in 2019 to more than $2bn in 2025.

According to market analysts, both the COVID-19 pandemic and the US-China trade conflict have started to change the landscape of the semiconductor industry. However, the virus outbreak is likely to have minor consequences for GaN deployment. Leading Chinese telecom operators’ 5G construction goals remain unchanged and development continues. Furthermore, the US-China conflict is likely to have a positive impact on Asian integrated device manufacturers (IDMs) and foundries, as well as European players.

In this context, patent analysis and technology intelligence firm Knowmade (a partner of Yole Développement) has released a new RF GaN patent landscape report, covering the whole value chain from epitaxial structures to RF devices, circuits, packages, modules and systems. The company selected and analyzed more than 6300 patents, representing more than 3000 patent families (inventions) filed by more than 500 different organizations. “This 2020 edition comprises 2x more patent families and more than 100 new players compared to the 2019 edition,” says Knowmade’s CEO & co-founder Nicolas Baron.

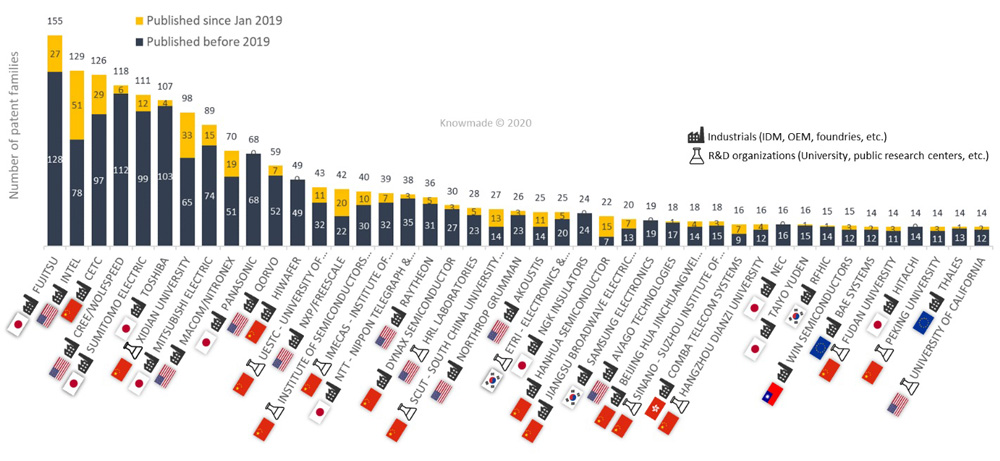

Figure 1: Ranking of patent applicants according to the number of their RF GaN-related patent families.

The first RF GaN patent applications were filed in the 1990s. The level of activity took off in 2004 and accelerated significantly from 2015. Today, IP dynamics are driven by two major factors: (1) China, and (2) the shift of IP further down the value chain, says the report.

Chinese patenting activity has been accelerating since 2015. Over the last two years, there has been a remarkable increase in patents coming from China, with many Chinese newcomers entering the RF GaN IP landscape. In 2019-2020, the Chinese organizations represented more than 40% of the patent applicants (American = 23%, Japanese = 10%, European = 3%). “The rise in RF GaN patents from Chinese companies follows a more general trend as the country transitions from a manufacturing to an innovation-driven economy,” says Baron. “This trend also reflects the situation in the RF industry, with a Chinese market that is showing exploding demand for commercial wireless telecom applications and Chinese companies already developing next-generation telecom networks. Moreover, following the US-China trade war, numerous China-based companies are trying to develop GaN RF for 5G infrastructures internally”, he adds.

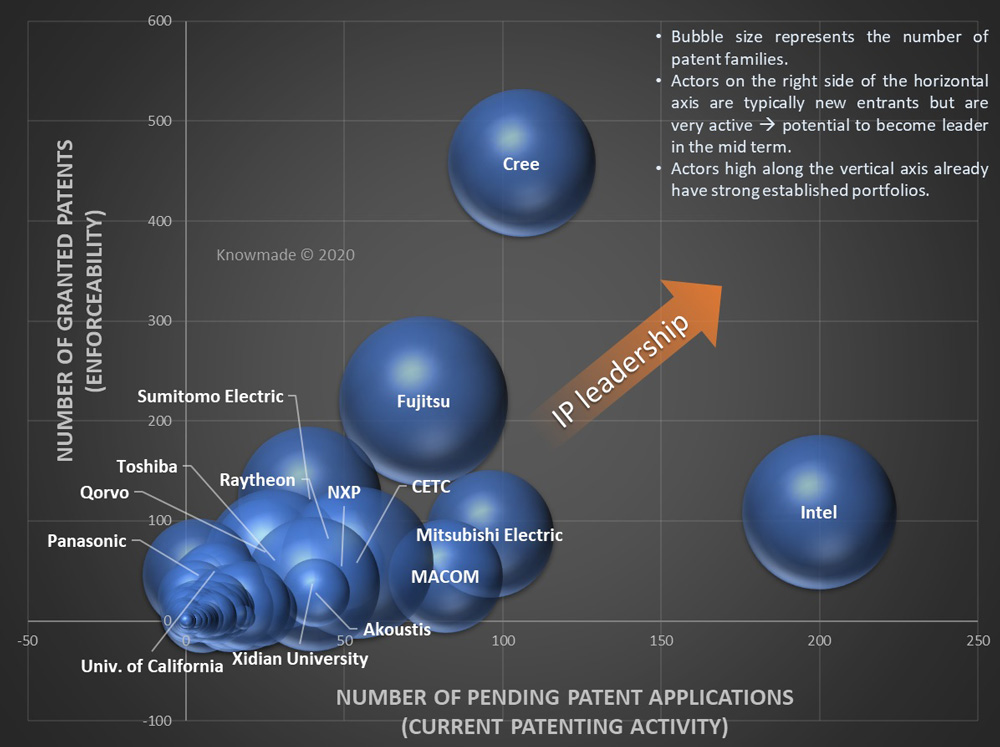

The RF GaN patent landscape is currently dominated by American and Japanese companies such as Cree, Fujitsu, Sumitomo Electric, Mitsubishi Electric, Intel, MACOM, Toshiba, Qorvo and Raytheon. The IP competition has been strongest in the USA, as demonstrated by a much greater number of granted patents (1200+) compared with China (640+), Japan (440+) and Europe (250+). However, patenting activity is now focused on China.

Cree has the strongest IP position thanks to numerous fundamental patents, especially for gallium nitride on silicon carbide (GaN-on-SiC) technology. Over the past five years, inventive activity at Cree, Sumitomo Electric and Toshiba stalled, says Knowmade. These IP leaders have developed broad patent portfolios covering a wide range of RF GaN technology nodes. “The reduced IP activity could be a sign of confidence in their already robust RF GaN patent portfolio,” comments Baron.

Intel and MACOM have greatly increased their IP activity since 2017, especially for GaN-on-silicon technology. Intel is currently the most active patent applicant in the RF GaN field, with a record level of activity in patenting new inventions over the last couple of years that could, in the future, position it ahead of Sumitomo Electric, Fujitsu or Cree in terms of IP leadership, reckons Knowmade.

Figure 2: IP leadership of RF GaN patent applicants.

In China, CETC and Xidian University have the most prolific inventive activity. Other players such as HiWafer, Dynax, Hanhua and China’s top public research entities UEST, IMECAS, SCUT and Institute of Semiconductors have built sizeable RF GaN IP portfolios, and numerous new players are entering the IP landscape (Boxin, Reactor Microelectronics, TUS - Semiconductor, Hatchip, Nexgo, Bosemi, HC Semitek, A-INFO, RDW, Chippacking, China Mobile, Gaxtrem, etc).

“The China IP rise should be taken seriously as it changes the landscape in which international companies operate,” says Baron. While China currently emphasizes quantity over quality, many RF GaN patents from top Chinese organizations are up to international quality standards (CETC, Xidian University, HiWafer, Dynax, etc). Furthermore, some Chinese companies that have global ambitions (e.g. Dynax, Hanhua, Zhuhai Crystal Resonance, ZTE, Huawei, CCT, Nexgo) are filing or acquiring patents in key countries. Also, foreign companies (such as Mitsubishi Electric, NXP) are now increasingly applying for patent protection in China. For domestic or foreign businesses operating in China, this increases the risk of patent infringement, which also becomes hard to manage.

European RF players Thales, BAE Systems, Infineon, Ampleon, Ericsson etc are only playing a small part in current RF GaN IP dynamics. In Taiwan, the foundries WIN Semiconductors, TSMC and GlobalWafers entered the RF GaN IP landscape first in the mid-2010s, followed by others such as Vanguard International Semiconductor (VIS) and Wavetek in 2018. South Korean entities are not very active in terms of patent filings. Korea’s Electronics and Telecommunications Research Institute (ETRI) has continued to file few new patents every year over the past decade. In 2016, RFHIC acquired GaN-on-diamond-related patents from Element Six.

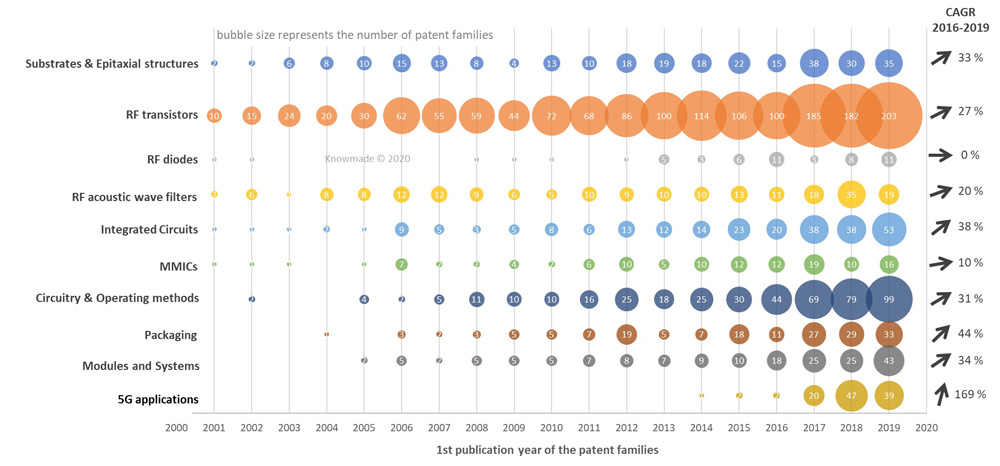

More recently, we have seen the entry of Wavice, U-Tel and Wavepia. Over the last few years, the level of creativity to address all the technology and manufacturing roadblocks for GaN RF devices has been impressive. “More recently, IP developments are accelerating on topics further down the value chain to address manufacturing and technology issues related to monolithic integration, packaging, RF circuits and modules/systems. This trend is expected to accelerate as more mature RF products implement GaN technology,” says Baron. Current patenting activity suggests that manufacturing and technology issues still need to be resolved in the monolithic integration of different RF semiconductor devices; thermal management at the epi-stack, semiconductor device and package levels; linearity at the device and circuit levels; and protection, matching and distortion compensation at the circuit level.

In this 2020 edition of its RF GaN patent landscape report, Knowmade’s analysts detail the RF GaN IP landscape and recent patents of note related to GaN-on-SiC, GaN-on-silicon, GaN-on-diamond and GaN-on-sapphire. They analyze and describe the IP activity related to RF transistors (HEMT, HBT, E-mode, etc), RF diodes (varactor, RTD, IMPATT, etc), and RF acoustic wave devices (SAW, TC-SAW, FBAR, BAW-SMR). Furthermore, the report includes a section dedicated to GaN-based MMIC-related patents. Overall, IP analysts highlight patents dealing with manufacturing and technology issues still of interest to IP players (heat dissipation, monolithic integration, linearity, impedance matching etc), and/or targeting µW/mmWave frequency ranges or 5G telecom applications.

Figure 3: Time evolution of RF GaN-related patent publications for the main segments.

GaN-related patenting activity is prolific; an increasing number of players are entering the sector and the GaN IP landscape is evolving. On the one hand, some GaN startups and pure-play companies remain on the lookout for promising business opportunities and are developing transverse GaN IP portfolios to address not only RF applications but also power electronics. On the other hand, RF companies from outside the GaN industry, and OEMs, are seeking to take leading positions in RF GaN by developing patents claiming the use of GaN technology in RF modules/systems. There are now enough companies with transverse portfolios, and enough enforceable patents worldwide that address most technology issues through the whole value chain, to say that the freedom to operate of active entities is shrinking, and to predict that complex licensing and legal battles will likely arise once GaN RF devices enter high-volume commercial markets. Now the questions are: will Chinese IP shape the future of the GaN RF industry? And, which IP owners will be the GaN RF leaders in the 5G, post-COVID world?