News: Optoelectronics

23 November 2020

Lumentum’s quarterly revenue grows 22.9%, yielding record margins and EPS

For fiscal first-quarter 2021 (ended 26 September 2020), Lumentum Holdings Inc of San Jose, CA, USA (which designs and makes photonics products for optical networks and lasers for industrial and consumer markets) has reported revenue of $452.4m, up 22.9% on $368.1m last quarter and 0.6% on $449.9m a year ago, and near the top of the guidance range of $430-455m.

This is despite sales to China-based Huawei Technologies declining further, to less than 10% of total revenue, given the further restrictions on licenses for exporting to Huawei announced by the US Department of Commerce in August.

Commercial Lasers segment revenue was $23.9m (just 5.3% of total revenue), down 36.8% (more than the expected 25%) on $37.8m last quarter and down 29.3% on $33.8m a year ago. “Given our customer mix, this decline was related to manufacturing weakness outside of China,” notes president & CEO Alan Lowe. “It will be several quarters before we get back to the revenue levels we saw in fiscal 2020.”

Optical Communication segment revenue was $428.5m (94.7% of total revenue), up 29.7% on $330.3m last quarter (due to 3D sensing seasonality and growth in telecoms and datacoms) and up 3% on $416.1m a year ago (as a result of growth in telecoms and particularly in the datacoms chip business). Specifically:

- Industrial & Consumer revenue was $167.2m, almost level with $168m a year ago but more than doubling from $73.9m last quarter, and significantly higher than guidance, due particularly to vertical-cavity surface-emitting lasers (VCSELs) for 3D sensing applications.

“Revenue mix was different than we had contemplated in our guidance due to the changes throughout the quarter,” notes Lowe. “Our assumptions for 3D sensing proved conservative and demand for our 3D sensing products accelerated,” he adds. Strength in 3D sensing sales more than offset lower-than-anticipated Commercial Laser and Telecom sales.

- Telecom & Datacom revenue was $261.3m, up 2% on $256.4m last quarter and 5% on $248.1m a year ago (or up 4% and 14% respectively, excluding low-margin product lines that have been discontinued, such as the lithium niobate (LiNbO3)-based optical component wafer fab in San Donato, Italy divested in December 2019).

Telecom transmission was the largest contributor to this growth. Sales were strong for indium phosphide (InP)-based coherent transmission modules and components, including ACO (analog coherent optics) and DCO (digital coherent optics) modules and 600G and 800G modulators. Sales of reconfigurable optical add/drop multiplexer (ROADMs) grew from last quarter, but were still down year-on-year. In particular, contentionless MxN ROADMs grew by over 30% quarter-on-quarter to a new high, highlighting the increasing shift to this technology in new customer systems. Nevertheless, there were some push outs in telecom customer orders. There were also reductions in customer forecasts due to COVID-19 impacting the timing of new deployments in addition to customer inventory management. These contributed to lower telecom revenue than assumed in the guidance.

“During the first quarter, we made a lot of progress on new products,” says Lowe. “On the transmission side, we began sampling our 400G DCO transmission modules. On the transport side, we continued to proliferate a contentionless MxN and high-port-count ROADM technologies [previously led by customers in China] with C-, L- and extended C-band versions to enable customers’ next-generation systems globally,” he adds. “On certain key new telecom products, however, demand exceeded our ability to supply and we are working hard to expand output.”

In Datacoms, prior-quarter trends continued, with chip sales growing 6% sequentially (capacity-constrained, as demand is outstripping the increases in production). “We did see some delays in the demand for our datacom chips for 5G deployment [front-haul related], mostly in China. But that is easily taken up by strong demand in hyperscale cloud data centers,” says Lowe. “We have seen a shift in near-term customer forecast so that lower projected 5G demand is offset by continued strength in demand for our market-leading chips for data centers. We have adjusted our wafer start plans accordingly.”

On a non-GAAP basis, gross margin has risen further, from 45.8% a year ago and 47.2% last quarter to a record 52%, driven by an improvement in product mix and acquisition synergies (following on from the acquisition of San Jose-based optical communications component and module maker Oclaro Inc in December 2018). “This record gross margin performance demonstrates the improvements we’ve made in our financial model,” says chief financial officer Wajid Ali.

Optical Communication segment gross margin was 52.5%, rising further from 46.6% last quarter (due to a better product mix with higher chip-related revenue) and 46.1% a year ago (due to a more favorable product mix, improved telecom and datacom margins, and acquisition synergies).

Commercial Laser segment gross margin fell from 52.9% last quarter to 43.5% (due to the significant reduction in manufacturing volumes), although this is still up slightly on 42% a year ago.

Operating expenses remained about $82.7m (18.3% of revenue, down from 22.4% last quarter), a little lower than normal run rates due to the COVID-19 pandemic reducing travel, trade show and other expenses. Specifically, selling, general & administrative (SG&A) expense remained about $36.8m and R&D expense $45.9m.

Driven by gross margin improvements (since operating expenses were level), operating income was a record $152.5m (operating margin of 33.7% of revenue), up from $91.4m (24.8% margin) last quarter and $122.7m (27.3% margin) a year ago.

“For the first time, we achieved gross margin in excess of 50% and operating margin above 30%. This performance demonstrates the strength and resilience of our business and financial model,” says Lowe.

Likewise, net income was a record $139.2m ($1.78 per diluted share), up from $91.7m ($1.18 per diluted share) last quarter and $111.4m ($1.44 per diluted share) a year ago.

“We started fiscal 2021 on a strong note, achieving record non-GAAP gross margin, operating margin and earnings per share in the first quarter,” notes Lowe.

During the quarter, total cash and short-term investments rose by $56.9m, from $1553.8m to $1610.7m.

Lumentum has $1.5bn in convertible notes and no term debt. Of the convertible notes, $450m is due in 2024 and $1.05bn is due in 2026. The total associated cash interest expense is about $6m per year. “We are well positioned financially, with a strong margin model, high levels of cash and low interest expense as well as long-maturity financing,” says Ali. “Strong growth in our accounts receivable during fiscal Q1 should lead to even stronger cash generation in fiscal Q2,” he adds.

“We expect the strong momentum to continue into the second quarter,” says Lowe. “Long-term market trends are very favorable, as the world is increasingly shifting to digital and virtual approaches to work, education and life, which drives increasing demand for our differentiated products and technologies.”

For fiscal second-quarter 2021 (to end-December 2020), Lumentum expects revenue to grow to $465-485m, despite Huawei declining further (and to less than 5% of total revenue beyond fiscal Q2).

Sequential growth is forecasted in both telecoms and datacoms. The strongest growth will come from telecom transport, driven by growth in next-generation ROADMs (with non-Huawei business in the rest of the world outside China expected to grow dramatically over the next 18 months while Lumentum continues to add production capacity). “We’re also seeing strength in the higher-speed coherent components like our 600G and 800G modulators and tunable lasers,” notes Lowe. “Growth is being driven from a product standpoint across high-end ROADMs and the newest coherent components,” confirms Chris Coldren, senior VP of strategy & corporate development.

The Industrial & Consumer and Commercial Lasers segments are both expected to be flat to up modestly quarter-on-quarter. “We’ve seen strong demand through August and September, and it carried through October. So it’s more of a front-end-loaded quarter,” says Lowe. “We expect some of the demand that would typically be consumed in the December quarter to roll into the March quarter,” he adds.

Despite a rise in operating expenses (due primarily to an increase in R&D as Lumentum invests in new products and technology), operating margin should be 32-34% and diluted net income per share $1.72-1.90. “We’re expecting our cash flow to be significantly better in fiscal Q2 versus fiscal Q1,” says Ali.

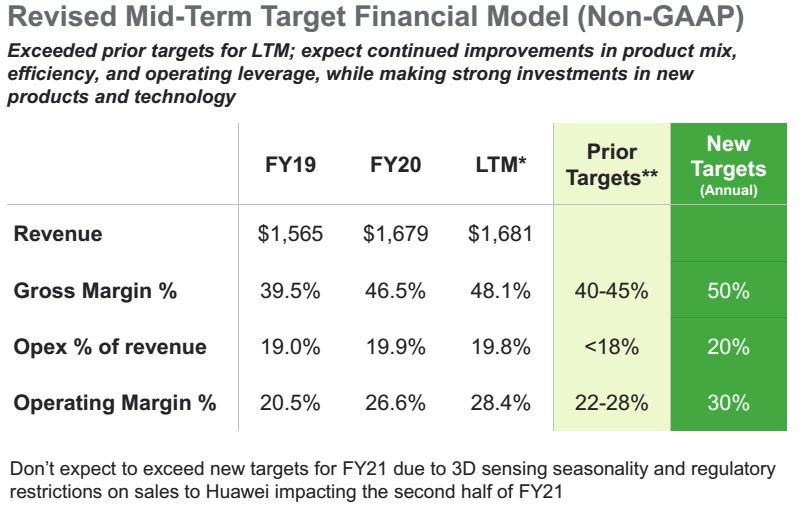

“When we announced the acquisition of Oclaro, we put forth a target financial model with a gross margin range of 40-45% and an operating margin range of 22-28% [with OpEx <18% of revenue],” notes Ali. “For the trailing 12 months from the end of the first quarter of fiscal 2020 to the end of the first quarter of fiscal 2021, we exceeded this target model.”

“We will continue to grow margins over time due to further improvements in product mix, efficiency and operating leverage. As such, we are now increasing this annual target in our mid-term financial model [to gross margin of 50% and operating margin of 30%, with OpEx of 20% of revenue],” he adds. “We don’t expect to exceed these new targets for the current fiscal year due to 3D sensing seasonality as well as regulatory restrictions on sales to Huawei impacting the second half of the fiscal year,” Ali cautions.

“Our backlog for datacom chips remains very robust and demand continues to outstrip our wafer fab capacity. In the short-term, we’re going to be constrained on those data-center chips… We are going to continue to get some incremental improvement through yields and productivity,” says Lowe. “We are continuing to aggressively expand our wafer fab capacity based on long-term demand trends and expectations. We’re expecting to double the wafer capacity over the next 18-24 months… Probably middle of next calendar year, we’ll see a step up of installed capacity to be able to take advantage in the second half of the year,” he adds “Some of the newer chips are bigger and so they consume more real estate on a wafer. It may not be a doubling of units but it would be a doubling of wafers, as the newer 200G chips are actually larger and there are fewer chips per wafer.”

“On the new product front, we are working closely with our lead customers on their needs for future 800G-and-above datacom transceivers. To this end, we have recently demonstrated high-performance 200G PAM4 [4-level pulse amplitude modulation] externally modulated lasers (EMLs) for such applications,” continues Lowe.

In the Industrial & Consumer segment: “Our unmatched experience in shipping hundreds of millions of VCSEL arrays per year continues to put us in a leadership position in the market,” believes Lowe. “Since we became an independent public company five years ago, we have shipped approximately $1.5bn of 3D sensing revenue. We have a larger addressable opportunity over this product cycle. This is due to the significant increase in 3D sensing content for consumer device we are now shipping,” he adds.

“We are optimistic about 3D sensing demand in the coming quarters and years. In addition to increasing content, we believe there’s potential for a strong consumer upgrade cycle driven by new features, including 5G, augmented and virtual reality (AR/VR) and computational photography. Further, we believe there’s potential for market share shifts at our customer’s level, which could be beneficial to us,” says Lowe. “On Android, we continue to make very good progress on new opportunities. However, we are taking a conservative approach to Android revenue in our near-term projections to the COVID-19 and geopolitical factors.”

“Even further ahead, we have multi-year product and technology roadmaps aligned with our consumer electronics customers. These include unique technologies to increase the integration of other components, enable under-screen 3D cameras, produce higher-density and larger arrays to enable higher-performance 3D imaging, as well as to create new lasers to increase our opportunity within other consumer mobile devices,” he adds.

“We are also focused on planting seeds for growth in markets beyond consumer electronics. We have unmatched and invaluable experience in 3D sensing lasers for consumer electronics applications and broad industry-leading photonic capabilities used across other markets. We believe this gives us a competitive advantage as we pursue emerging long-term opportunities outside of consumer electronics.”

“In the past quarter, our VCSEL arrays have completed the important AEC automotive qualification through a module partner, and we expect initial deployments of these products to be in automobile in-cabin applications. We are also now sampling high-power VCSEL arrays into LiDAR for last-mile vehicle applications. According to our customers, these last-mile applications could be one of the largest LiDAR opportunities in the next several years. In addition, we are also sampling or are in qualification with major tier-1 auto suppliers for broader automobile opportunities that we’ll deploy and develop over time,” Lowe continues.

“We are making progress in the security and access control markets. We are already shipping in volume for facial recognition on payment kiosks. We are engaged with providers of security and access control systems who are looking to add 3D sensing to enable touchless or contactless high-security access control. These applications are also accelerating due to public health & safety concerns,” Lowe concludes.

Lumentum acquires TriLumina assets

Lumentum’s revenue falls a less-than-expected 9% in June quarter

Lumentum’s quarterly revenue falls 12% as COVID-19 exacerbates supply constraints

Lumentum divests lithium niobate-based product lines in Italy to China’s AFR