News: Markets

30 November 2020

Power module market growing at 9.1% CAGR over 2019–2025

The market for power modules (one of the key elements in power converters and inverters) is rising at a compound annual growth rate (CAGR) of 9.1% over 2019-2025, to $7.6bn, according to the annual power electronics report ‘Status of the Power Module Packaging Industry’ by Yole Développement.

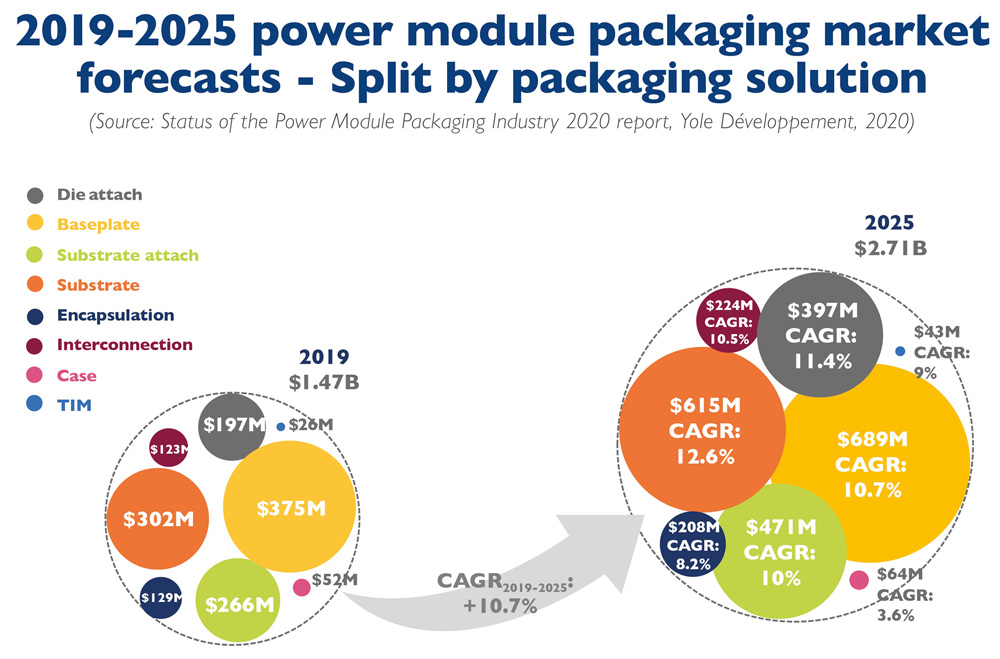

In the past, packaging needs were driven by industrial applications, but today they are increasingly driven by electric and hybrid electric vehicles (EV/HEVs). “EVs are driving the growth of power module packaging, as going to mass production of EV/HEV changes the rules of game,” says Shalu Agarwal, technology & market analyst at Yole. “Technology alone is not enough; low cost is increasingly important.” In fact, by 2025 EV/HEVs will become the biggest power module market, at almost $3.4bn. This promising outlook is hence also beneficial for the power module packaging material market, which will grow at a CAGR of 10.7% from $1.47bn in 2019 to $2.71bn in 2025.

In 2019, packaging materials comprised about 31% of power module costs. The largest packaging materials market segment was for baseplates, followed by substrates. The next biggest segment was substrate-attach, followed by die-attach materials. Major technical choices in these segments can therefore rapidly impact the overall power module packaging market. For example, the market share for silver nitride as a substrate is increasing, driven especially by EV/HEVs. This technology is pricier than more conventional aluminium oxide substrates, and the CAGR for the substrate market is hence 12.6% – higher than for other market segments – between 2019 and 2025.

The huge business opportunity in the power device market is attracting interest from various players in the power electronics and automotive supply chains. With a strong focus on power modules, changes in business models and a constant re-shaping of the supply chain are expected, especially in the very dynamic power module packaging market.

Automotive tier-1 part suppliers and car-making original equipment manufacturer (OEMs) are becoming increasingly involved in the design and manufacturing of power modules. As power module packaging of semiconductor devices is a relatively new concept for system and car makers, it takes time to develop a power module with high performance and low manufacturing costs, notes Yole.

Some tier-1s and OEMs thus prefer to focus directly on newer silicon carbide (SiC) MOSFET technology, instead of facing competition from power module makers with strong experience in already well-established silicon insulated-gate bipolar transistor (IGBT) automotive power modules. This focus on SiC power module development has been strengthened by the adoption of SiC modules in traction inverters in Tesla Model 3 and BYD Han vehicles.

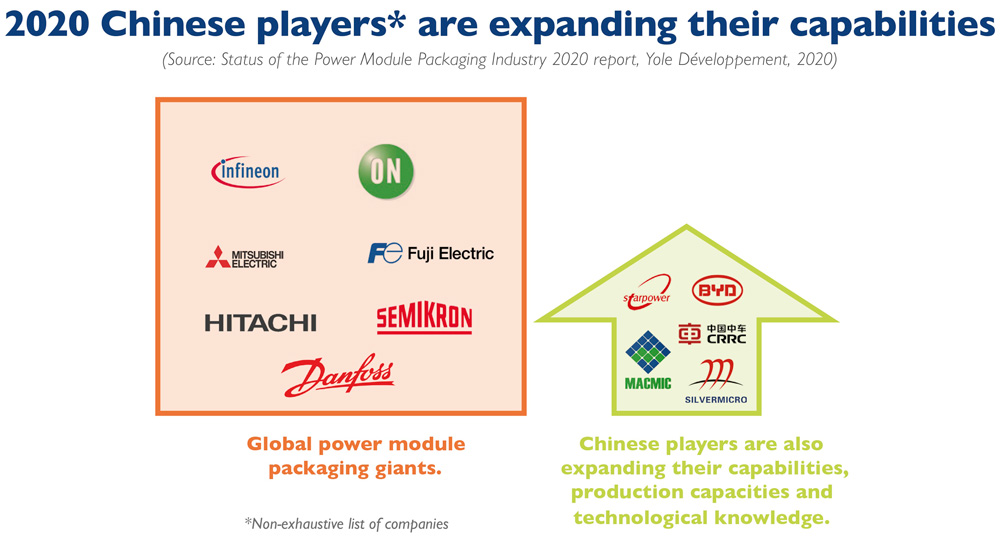

Chinese companies want to have as local a supply chain as possible. Subsidies are given by the government to support this. Many Chinese companies develop power module packaging solutions, mainly still using power dies supplied by European, Japanese and US companies. Most Chinese packaging companies focus on power modules for industrial applications, which are based on more conventional packaging solutions and have thus less exacting requirements on packaging know-how. Here Chinese companies, which often have difficulty competing on a technological basis, can offer cost-competitive products.

However, Chinese players are moving very fast. With the help of leading material suppliers and equipment makers they are evaluating and testing different innovative solutions, such as sintered SiC dies, targeted primarily at EV/HEV applications.

Power module packaging technology is about more than just wire bonding, soldering and encapsulation. The packaging technologies – especially for applications with strong demand for power density, performance and reliability – are very complex and require specific know-how. In particular, continuous improvements in module materials and packaging design is needed, especially to fully benefit from the technology advantages of silicon carbide and gallium nitride. Many newcomers in power module packaging have underestimated the packaging complexity and are struggling to bring their packaging concepts to commercial production. Initially they targeted performance and reliability.

Nowadays, many players must refocus their development efforts on manufacturing processes and material choices in order to achieve ‘good enough’ performance and reliability while achieving acceptable manufacturing yield and throughput, enabling them to reduce manufacturing costs. External partners with the required knowhow are therefore more than welcome to speed up the development and bring products to market earlier, Yole says.

www.i-micronews.com/products/status-of-the-power-module-packaging-industry-2020