News: Markets

9 October 2020

VCSEL market to grow at 18.3% CAGR from $1bn in 2020 to $2.7bn in 2025

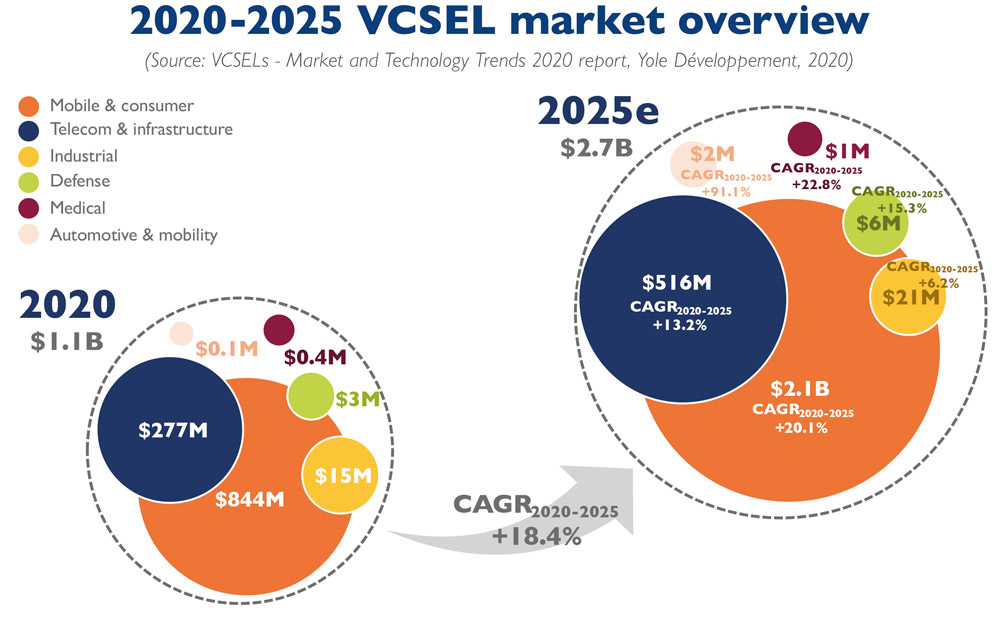

The vertical-cavity surface-emitting laser (VCSEL) market will rise at a compound annual growth rate (CAGR) of 18.3% from more than $1bn in 2020 to $2.7bn in 2025, forecasts the report ‘VCSELs - Market and Technology Trends 2020’ from Yole Développement.

In particular, telecom and infrastructure applications (mainly datacom) are expected to generate revenue of $277m in 2020 and should reach $516m in 2025 at a CAGR of 13.2%. “Other applications are not significant yet but could emerge in the mid- to long-term, such as automotive applications like LiDAR [light detection & ranging] or driver monitoring systems,” reckons Pierrick Boulay, Solid State Lighting and Lighting Systems, in Yole’s Photonics, Sensing & Display division.

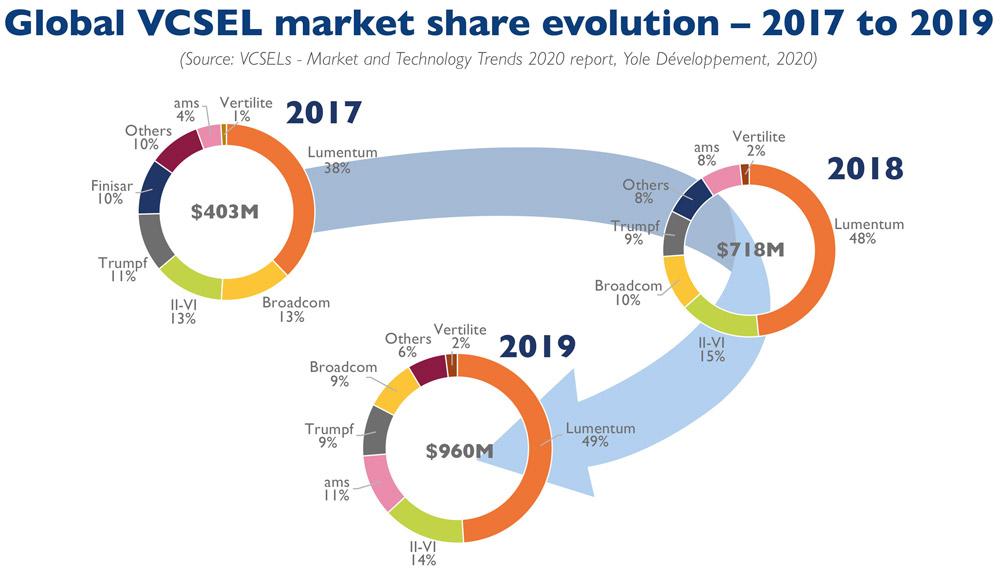

Up to 2017, the VCSEL market was driven by datacom applications, says Yole. Since then, datacoms has been replaced step by step as the market driver by 3D sensing (rising to 75% of VCSEL revenue in 2020), especially since the strategic technical choice made by Apple and the implementation of the Face ID module in its iPhones.

“The LiDAR uses a VCSEL coming from Lumentum,” notes project manager Sylvain Hallereau in Yole company System Plus Consulting’s ‘Apple iPad Pro LiDAR Module’ report. “Therefore, Lumentum is in tight collaboration with Apple and generated more than $100m only with Apple’s smartphones,” he adds. “In its LiDAR, the laser is designed to have multiple electrodes connected separately to the emitter array. A new design with mesa contact is used to enhance wafer probe testing.”

Following the release of the iPhone X, several manufacturers have decided to follow the same path and implement 3D sensing modules in the front side of their smartphones for face recognition. It was subsequently expected that other Chinese smartphone makers would also implement such modules on the front side. This was the case the following year, but the trend rapidly declined.

“3D sensing modules moved from the front side to the world-facing side, mainly for photography applications,” notes Boulay. “This can be explained by several factors, including the cost of 3D sensing modules, the intellectual property around structured light solutions, and the competition with under-display fingerprint solutions that were more accessible to mid-price smartphones,” he adds.

This transition from the front side to the world-facing side certainly has an important consequence for the VCSEL market. It was expected that front 3D modules would use structured light solutions with two VCSELs. In contrast, world-facing 3D modules use time-of-flight (ToF) solutions with only one VCSEL. In this dynamic context, mobile and consumer applications are expected to generate revenue of $0.8bn in 2020, then grow at at a CAGR of 20.1% to $2.1bn in 2025.

Since the adoption of VCSEL solutions for 3D sensing modules in smartphones, Apple has been consuming the majority of VCSELs produced by Lumentum. In 2017, 41 million units were implemented in iPhones and in 2020 more than 325 million of VCSEL are expected to be used in iPhones. “This number represents more than two-thirds of the total VCSEL consumption for mobile 3D sensing,” notes Boulay. “Lumentum, as the main supplier of Apple’s VCSELs, is clearly leading the mobile and consumer market, with 68% of the market in 2020.” Behind Lumentum, ams and Trumpf have market shares of 15% and 7%, respectively.

The supply chain has also been severely impacted by political decisions and the trade war between the USA and China, notes the report. In May 2019, the US banned exports to China’s Huawei Technologies. Lumentum stopped supplying Huawei, which must find a new provider of VCSELs. This ban severely damaged Huawei’s supply chain. Huawei therefore had no choice but to build its own supply chain, giving rise to Chinese supplier Vertilite. Other Chinese VCSEL suppliers are expected to emerge as other smartphone makers like Oppo, Xiaomi and Vivo could follow this trend and develop a local ecosystem to secure their supply chain, the report concludes.

3D imaging and sensing market growing at 20% CAGR to $15bn in 2025

www.i-micronews.com/products/vcsels-market-and-technology-trends-2020