News: Markets

15 October 2020

UVC LED market growing at 61% CAGR to $2.5bn in 2025

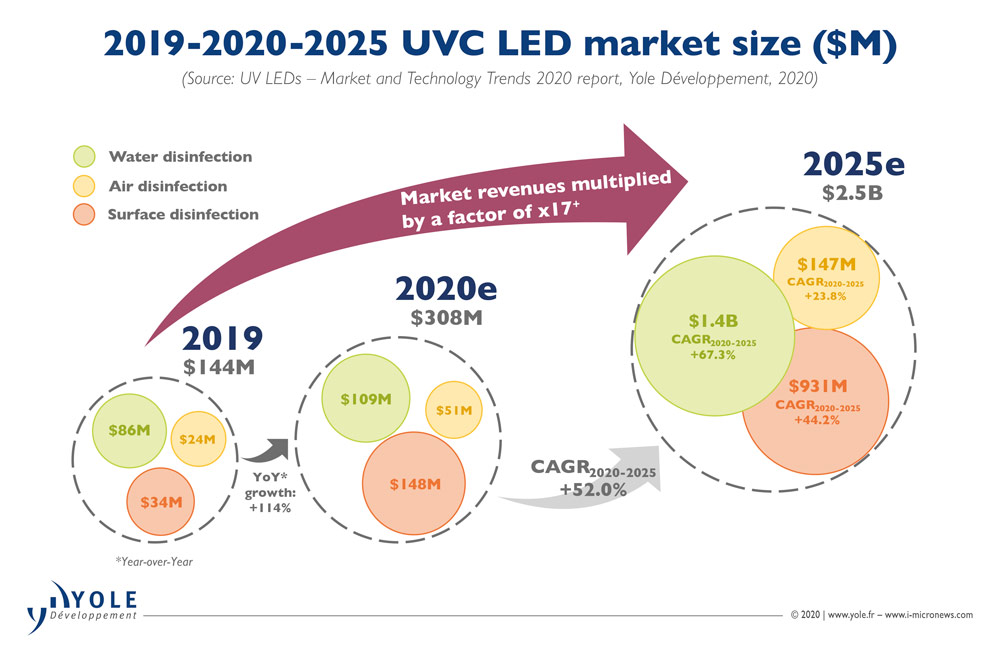

The UVC light-emitting diode (LED) market could rise at a compound annual growth rate (CAGR) of 61% over 2019-2025 to reach $2.5bn, forecasts Yole Développement in the report ‘UV LEDs – Market and Technology Trends 2020’.

“After more than 10 years of waiting, in 2020 the UV LED market could ramp up and reach the billion-dollar mark very rapidly,” reckons Pars Mukish, business unit manager, Solid-State Lighting & Display at Yole Développement. “There is good in everything bad, and the recent COVID-19 pandemic has created some perfect use-cases for the technology to spread across a rapidly changing disinfection/purification market,” he adds.

“Indeed, according to the optic and photonic innovation platform, in the current context of health crisis due to the SARS-CoV-2 virus, the need to prevent contagion through disinfection has become a major issue,” notes Joël Thomé, CEO of photonic innovation services firm PISEO, which has issued the report ‘UV-C LEDs at the Time of COVID-19’. “Like other coronaviruses, this new virus can be destroyed by UVC radiation. With the emergence of UVC LEDs, the question of the relevance of using this technology to stop the current epidemic arises.”

From being about $20m in 2008, the UV LEDs market reached the first milestone of $100m in 2015, driven mostly by UVA LEDs being increasingly used in UV curing applications. But further growth was then restricted by the industry’s overcapacity and strong price pressure following the massive entry of visible LED players starting from 2012. In this context, the attention of the industry was then focused on UVC LEDs that could act as a game-changer for disinfection/purification applications. But UVC LED technology is intrinsically different to UVA LED technology. Also, whereas the external quantum efficiency (EQE) of UVA LEDs has rapidly exceeded 50%, the EQE of UVC LEDs is still below 10% in most commercial devices. Consequently, the technology was not considered mature by integrators and only early adopters started implementing it.

“But that was before the COVID-19 pandemic,” notes Pierrick Boulay, market & technology analyst, Solid-State Lighting and Lighting Systems Photonics, in Yole’s Sensing & Display division. “SARS-COV-2, the virus that causes COVID-19, has one of the highest reproduction/transmissibility rates compared to all viruses that have emerged in our modern society”.

To reduce the spread of the disease, many recommendations have been made by the World Health Organization (WHO) and governments/authorities. But those best practices are mostly preventing infection from direct contacts. For infection based on either close contacts or indirect ones through contaminated objects or surfaces, disinfection technologies are required to further reduce spread of the virus. In this field, UV lighting, which can deactivate bacteria and viruses through physical methods, has gained unprecedented attention.

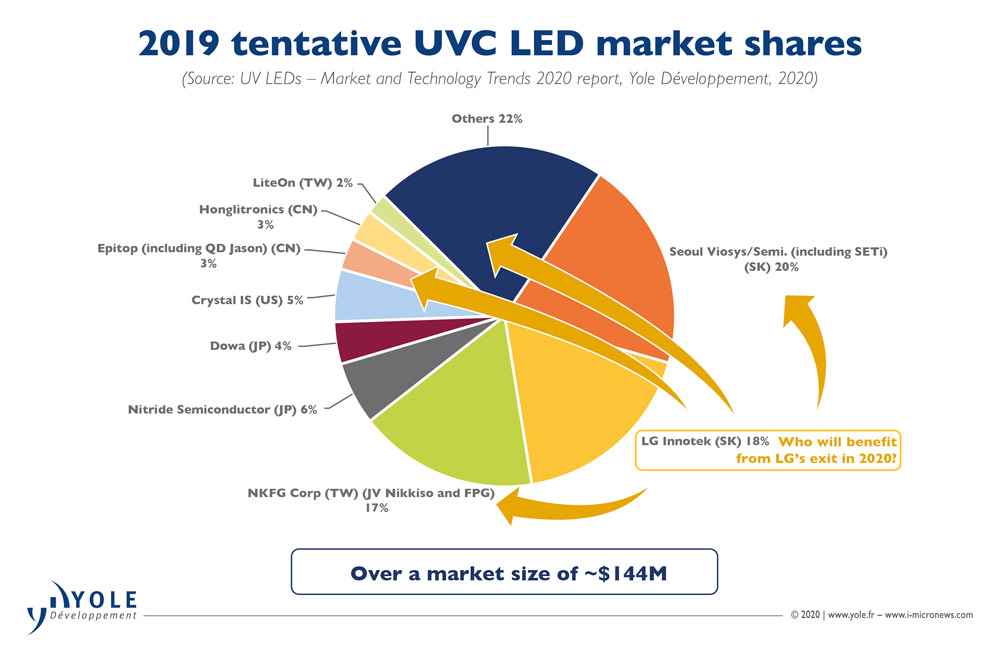

The COVID-19 pandemic has created momentum for the UVC LED industry. From $144m in 2019, the UVC LED market is expected to more than double in 2020 to $308m. It could have been even bigger if production capacity could keep up with demand. With market growth now being triggered, Yole expects it to exceed $2.5bn in 2025, driven first by surface applications and then application to water.

“With the COVID-19 epidemic, many UVC products, mainly for surface disinfection, are appearing on the market,” notes Thomé. “The current regulations and standards cover the safety aspects related to the use of these devices, but do not cover the disinfection aspect.”

For now, manufacturers of disinfection systems generally rely on scientific publications and have their products tested by microbiology laboratories as a guarantee of the quality of their product in terms of disinfection. However, even a laboratory test is not a guarantee for the user, as the test conditions may be different from the conditions of use (type of surface, etc). Eventually, faced with the photo-biological risk, countries have decided to ban the sale and use of UVC disinfection products outside the medical environment.

Yole’s UV LED report also includes a dedicated part focused on the UV lamp. In the current dynamic context, some traditional UV lamp manufacturers have already made a move to benefit from this momentum by increasing their production capacity and/or developing new products. One concrete example is market leader Signify (formerly Philips Lighting), which plans to multiply its production capacity eightfold very rapidly. Another trend is related to the development of far-UVC lamps that emit at wavelengths around 222nm in order to avoid the harmful effects of traditional UVC wavelengths.

“The traditional UV lamp industry has also a role to play as UVC LEDs are still less efficient and more expensive than traditional UV lamps,” says Mukish. “UVC lamps also have the advantage of fixed specifications, structural design, and circuits. These features allow manufacturers to easily produce systems according to specific requirements of the application, accelerating development time of products,” he adds. “Finally, there is still some lack of knowledge about UVC LEDs’ disinfecting effectiveness, which will benefit incumbent technology”.

Ultimately, Yole expects growth in the UV lamp industry to come back to UV LEDs when the technology is on a par with traditional UV lamps. Such a transition might then also further increase value at the system level, the firm concludes.

www.piseo.fr/en/press-news/techno-reports-posts/uv-c-leds-at-the-time-of-covid-19

www.i-micronews.com/products/uv-leds-market-and-technology-trends-2020