News: Markets

16 April 2021

Micro-LEDs to challenge OLED displays?

With the launch of micro- and mini-LED displays by various OEMs and display vendors, self-emissive LED-based displays have attracted tremendous attention from both investors and end-users, according to market research firm IDTechEx in its report ‘Micro-LED Displays 2021-2031: Technology, Commercialization, Opportunity, Market and Players’.

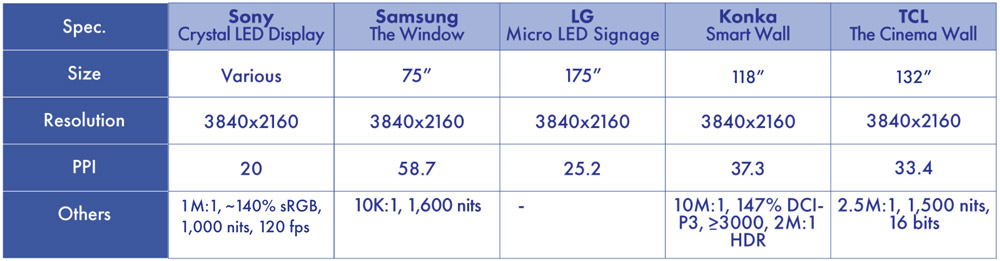

Picture: A selection of micro- and mini-LED displays, compiled by IDTechEx.

Believed by many to represent the next-generation display technology, micro-LEDs have been pursued by players in the LED, display, OEM, materials sectors etc. It is also widely believed by many that micro-LED displays are the replacement for organic light-emitting diode (OLED) displays, especially in TV applications.

In the liquid-crystal display (LCD) regime, LCD manufacturing is shifting to mainland China due to cost, the production efficiency new lines, and industry supply-chain support. Other regions have begun to shift away from the LCD business. For instance, Samsung has announced it is exiting the LCD business and will focus on its QD LCD and OLED technology. LG Display has halted its domestic production of LCD panels. Panasonic and JDI are getting out of the LCD business. Meanwhile, AUO, Innolux and a few other Taiwanese companies are slowing down investment in LCD or OLED technology.

In the OLED area, OLED panel production is dominated by Korean companies in terms of effective production capacity, technology maturity, upstream materials and equipment, downstream application, and supply chain completeness. For instance, SDC and LG Display have supported upstream material and equipment companies, building good ecosystems. For downstream applications, Samsung’s small/mid-sized OLED panels are supplied first to Samsung smartphones, while LG Display’s large-sized OLED panels are offered first for LG TVs. Their brands can also provide sufficient demand and feedback. Samsung and LG hence dominate small/mid- and large-sized OLED panels, respectively.

Another technology in the competitive market is quantum dot (QD) technology, mainly using its photoluminescent feature. By applying QD films in the LCD structure, the color gamut can be significantly improved. QD-based displays are catching up, says IDTechEx.

Micro-LED displays are composed of self-emissive inorganic LEDs, acting as subpixels. These LEDs are usually in the micron range, with neither package nor substrate, and therefore are transferred using a method different from traditional pick & place techniques. Micro-LED displays have value propositions including wide color gamut, high luminance, low power consumption, excellent stability and long lifetime, wide view angle, high dynamic range, high contrast, fast refresh rate, transparency, seamless connection, and sensor integration capability, notes the report.

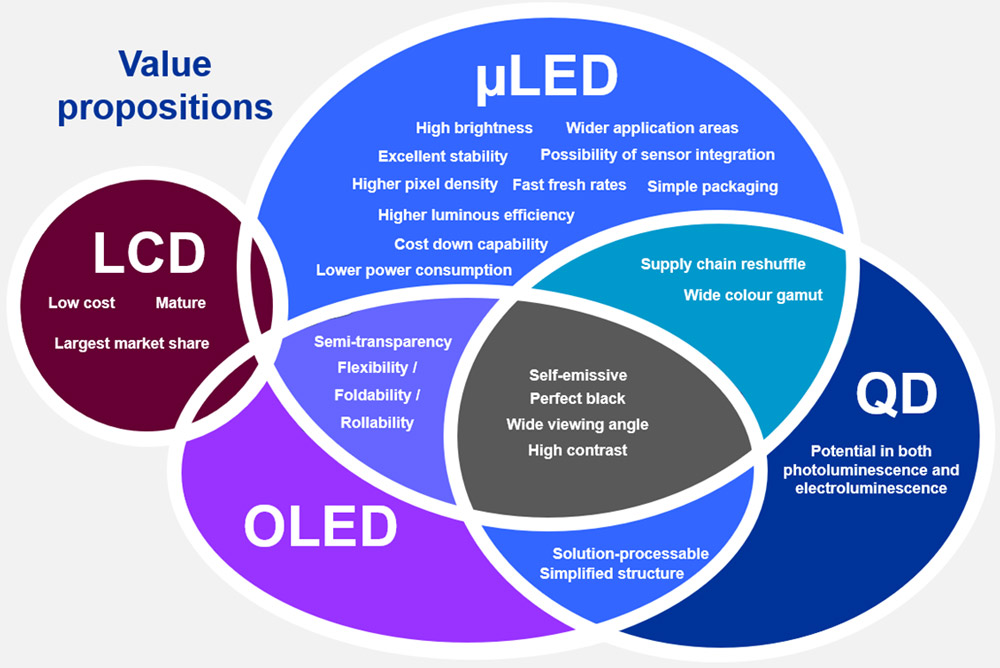

Picture: Value propositions of various display technologies. Source: IDTechEx.

Each technology has features to attract end-users, but some of the value propositions can be provided by alternatives such as LCD, OLED and QD technology rather than micro-LEDs alone. However, there are some value propositions unique to micro-LED displays.

However, not all the value propositions of micro-LED displays can be realized based on the existing technology maturity and cost expectations, such as low power consumption (the external quantum efficiencies of very tiny micro-LEDs are low, and final device power consumption can be much higher), extremely high resolution (similarly, very tiny micro-LEDs are not mature and therefore it is very difficult and/or costly to achieve extremely high-resolution micro-LED displays), etc. In addition, based on their current status, some value propositions may not be so significant for specific applications, considering their much higher cost. One example is the extremely long lifetime for mobile phone applications: Users may change their phone every 2-3 years, making the long lifetime less attractive considering the costs.

Therefore, whether micro-LED displays can replace OLEDs or not, at least in the short to medium term, is a very application-dependent question, notes IDTechEx.

The report has therefore analyzed the potential markets from two aspects:

- replacement in the existing display market, and

- creating a new display market.

For the former, eight applications are addressed the most: augmented/mixed reality (AR/MR), virtual reality (VR), large video displays, TVs and monitors, automotive displays, mobile phones, smartwatches and wearables, tablets, and laptops.

Picture: Replacement in existing application markets.

For example, LCD displays (which dominate the current display market) are applied in almost all displays under 65”. LCDs have their intrinsic limitation for going to larger size. OLEDs are taking an increasing market share mainly in smartphone displays. QD-LCDs are marketed as premium TVs and are accepted by an increasing number of consumers. LED displays are already used in huge public displays. To compete with them, micro-LEDs should identify their unique value proposition – or combination of value propositions – in order to offer advantages, says IDTechEx.

In terms of cost, the cost of the front plane of a typical micro-LED display is dependent on the number of LEDs, rater than area, which is different from OLED and LCD displays. This is why fabricating a smartphone with the same resolution as a TV may result in a similar cost projection, rather than orders of magnitude lower expectation.

Therefore, it is important to understand the different technological approaches behind each application and to get a clear assessment of their possibilities and opportunities.

Creating a new display market requires features that cannot be enabled (or can hardly be enabled) by alternatives. Typical examples include displays with customized shapes and displays with integrated sensors. The emerging new displays expand our imagination beyond existing display technology and help to achieve ubiquitous displays, concludes IDTechEx.