News: Markets

30 April 2021

Global 5G smartphone shipments soar 458% YoY to 134 million in Q1

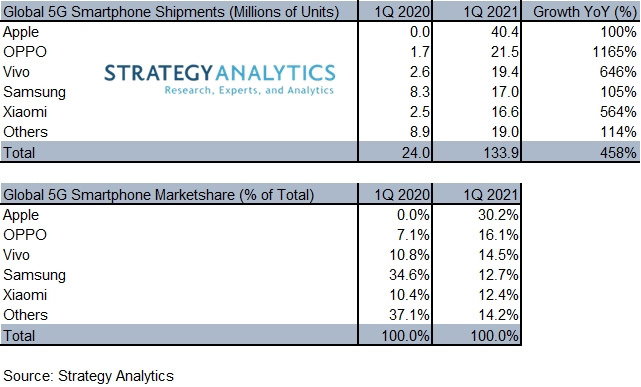

Global 5G smartphone shipments soared 458% year-on-year from 24 million units in Q1/2020 to a record 133.9 million in first-quarter 2021, according to market research firm Strategy Analytics.

China’s rapid adoption of 5G technology is powering demand. “Huge demand in China, a strong push from Apple iPhone, and a wave of value-priced Android models fueled a record quarter for 5G smartphone shipments,” notes associate director Ville-Petteri Ukonaho.

Apple and China’s domestic trio of OPPO, Vivo and Xiaomi benefitted most as demand exploded. OPPO, Vivo and Xiaomi closed on Apple, capturing 16.1%, 14.5% and 12.4% global market share in Q1, respectively.

Graphic: Global 5G smartphone shipments and marketshare for top five vendors (numbers are rounded).

Apple shipped a record 40.4 million 5G iPhones worldwide in Q1/2021, building on its strong performance of 52 million shipments globally in Q4/2020. “Apple iPhone is the clear 5G leader, with a 30.2% 5G smartphone market share globally in the quarter,” states director Ken Hyers. “Apple iPhone 12 5G is proving wildly popular across China, Europe and the United States, due to its sleek hardware design and surprisingly competitive pricing.”

OPPO captured 16.1% global 5G smartphone market share in Q1/2021, more than doubling its share from 7.1% in Q1/2020. “OPPO has leapt ahead of domestic competitors Vivo and Xiaomi, taking advantage of Huawei’s collapse in 5G smartphones to capture share,” notes senior analyst Yiwen Wu. “OPPO’s A55 5G and Reno 5 5G have become hugely popular in China.”

Vivo increased its global 5G smartphone share from 10.8% in Q1/2020 to 14.5% in Q1/2021 (taking third place) as its shipment volumes rose by 646% year-on-year from just 2.6 million to 19.4 million.

Samsung’s global 5G smartphones shipments more than doubled from 8.3 million in Q1/2020 to 17 million in Q1/2021. However, its 5G smartphone market share fell from 34.6% in Q1/2020 to 12.7% in Q1/2021. “The surge in 5G volumes in China, allied with the Apple factor, inevitably had a negative impact on share despite impressive product diversity from Samsung in 5G,” comments director Woody Oh.

Rounding out the top five global 5G smartphone vendors on volume, Xiaomi’s shipments rose from 2.5 million in Q1/2020 to 16.6 million in Q1/2021, boosting its market share from 10.4% to 12.4%..