News: Markets

1 December 2021

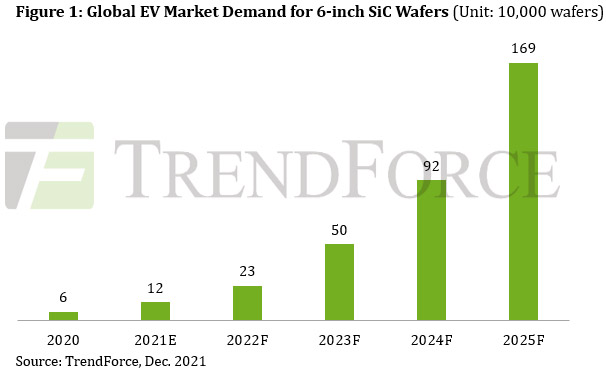

Annual 6-inch SiC wafer demand for EVs to reach 1.69 million units in 2025

The demand for longer driving ranges and shorter charging times for electric vehicles (EVs) has intensified the rush of automakers towards high-voltage EV platforms, with various major automakers releasing models featuring 800V charging architectures, such as the Porsche Taycan, Audi Q6 e-tron, and Hyundai Ioniq 5. Due to the rising penetration rate of EVs and the trend towards high-voltage 800V EV architectures, demand from the global automotive market for 6-inch silicon carbide (SiC) wafers will grow to 1.69 million units in 2025, forecasts market research firm TrendForce.

The arrival of the 800V EV charging architecture will bring about a total replacement of silicon insulated-gate bipolar transistor (IGBT) modules with SiC power devices, which will become a standard component in mainstream EV VFDs (variable-frequency drives), TrendForce says. As such, major automotive component suppliers generally favor SiC components. In particular, tier-1 supplier Delphi has already begun mass-producing 800V SiC inverters, while others such as BorgWarner, ZF and Vitesco are also making rapid progress with their respective solutions.

At the moment, EVs have become a core application of SiC power devices. For example, SiC usage in on-board chargers (OBC) and DC-to-DC converters has been relatively mature, whereas the mass production of SiC-based VFDs has yet to reach a large scale. Power semiconductor suppliers including STMicroelectronics, Infineon, Wolfspeed and Rohm have started collaborating with tier-1 suppliers and automakers in order to accelerate SiC deployment in automotive applications.

TrendForce notes that the upstream supply of SiC substrate materials will become the primary bottleneck of SiC power device production, since SiC substrates involve complex manufacturing processes, high technical barriers to entry, and slow epitaxial growth. The vast majority of n-type SiC substrates used for power semiconductor devices are 6-inches in diameter. Although major IDMs such as Wolfspeed have been making good progress in 8-inch SiC wafer development, more time is required for not only raising yield rate but also transitioning power semiconductor fabs from 6-inch production lines to 8-inch production lines. Hence, 6-inch SiC substrates will likely remain the mainstream for at least five more years, expects TrendForce. On the other hand, with the EV market undergoing explosive growth and SiC power devices seeing increased adoption in automotive applications, SiC costs will in turn directly determine the pace of 800V charging architecture deployment in EVs, concludes TrendForce.