News: Markets

14 December 2021

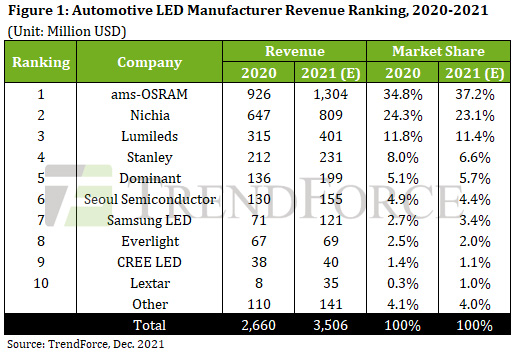

Automotive LED market growing 31.8% to $3.51bn in 2021

The global penetration rate of LED headlights exceeds 60% in 2021, with penetration in new energy vehicles (NEV) exceeding 90%, according to TrendForce’s ‘2020-2021 Global Automotive LED Product Trend and Regional Market Analysis’.

Influenced by growth momentum from increasing automotive market shipments and the rising penetration rate of LED lighting, the global automotive LED market is forecasted to grow 31.8% to $3.51bn in 2021. This demonstrates that LED headlights and automotive display LED products remain the main driving force for growth in the automotive LED market.

Although the automotive semiconductor shortage has led to manufacturing bottlenecks among some car makers, since they have asked LED producers to continue production, the purchase order status of major automotive LED makers will not be affected before the end of 2021. Among the 2021 revenue rankings of automotive LED manufacturers, the top three companies remain ams-OSRAM, Nichia and Lumileds, account for as much as 71.7% market share combined.

In terms of automotive lighting, ams-OSRAM has leveraged stable product quality, excellent lighting efficiency and cost performance to make it the supplier of choice for the world’s high-end cars and new energy vehicles, including high-flying Tesla among its customers. This year, ams-OSRAM’s automotive LED revenue grew rapidly and has an opportunity to reach $1.304bn by year’s end for an annual growth rate of about 40.9%. Samsung LED’s PixCell LED has also been successfully integrated into the Tesla Model 3 and Model Y, boosting its automotive LED revenue growth to as much as $121m, with market share expected to increase to 3.4%.

In terms of automotive display backlighting (including dashboard and central console displays), not only are more and more car models equipped with automotive display products, the standard is moving towards larger displays with the current mainstream automotive panel product size at 12.3-inches. Further taking into account features popular in the current market such as HDR, local dimming and wide color gamut shows that automotive LED market demand will maintain a rapid growth trend in the next five years. This will benefit the revenue of Nichia and Stanley, with this year’s market share for these two companies expected to reach 23.1% and 6.6%, respectively.

Relying on the high brightness and compact size of their WICOP product, Seoul Semiconductor’s penetration rate of the automotive headlight market has reached 10%, and WICOP has been adopted by car makers including Changan Automobile, SAIC-GM-Wuling, and Nio. Revenue is forecast to reach $155m, with a market share of about 4.4%. Notably, benefiting from European customer orders, Dominant has the highest annual revenue growth out of the top ten companies in the industry, at 46.3%.