News: Markets

11 June 2021

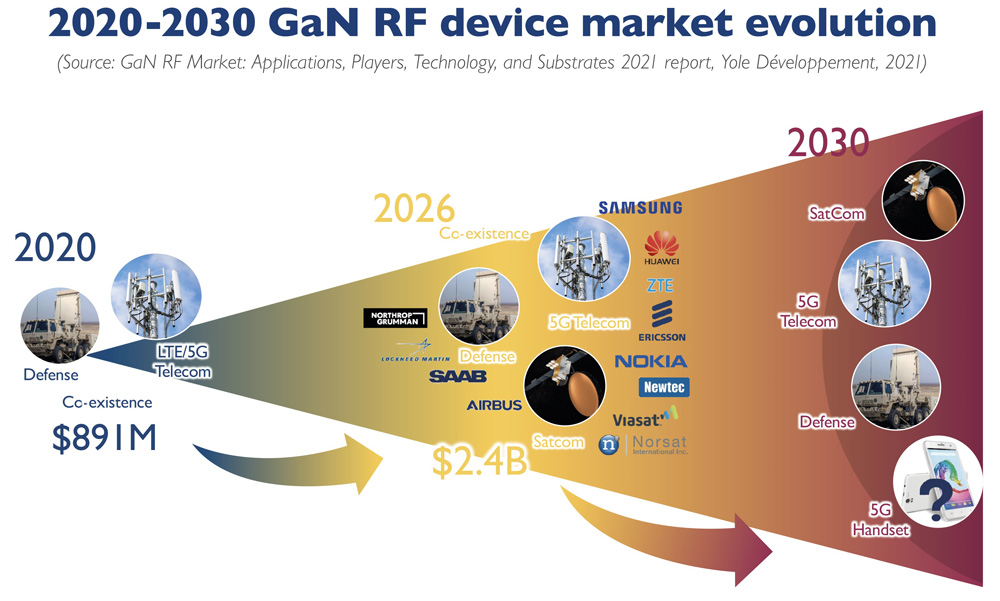

GaN RF device market growing at 18% CAGR from $891m in 2020 to $2.4bn in 2026

The gallium nitride (GaN) radio-frequency (RF) device market is rising at a compound annual growth rate (CAGR) 18% from $891m in 2020 to more than $2.4bn by 2026, forecasts market analyst firm Yole Développement in its report ‘GaN RF Market: Applications, Players, Technology, and Substrates 2021’. The market will be dominated by defense and 5G telecom infrastructure applications, representing 49% and 41% of the entire market by 2026, respectively, it is forecasted. In particular, the GaN-based macro/micro-cell sector will represent more than 95% of the GaN telecom infrastructure market in 2026.

In the RF GaN industry, everything started with GaN-on-SiC (gallium nitride on silicon carbide) technology. Launched more 20 years ago, GaN-on-SiC is now a serious rival to silicon LDMOS and gallium arsenide (GaAs) in RF power applications. Dominated by GaN-on-SiC technology, vertical integration of the supply chain has been preferred in both defense and 5G telecom applications. “In view of the emerging GaN RF market, notable investments in recent years have been shaping the future relationship between demand and supply, which is important to watch closely,” says Ezgi Dogmus PhD, team lead analyst in Compound Semiconductor & Emerging Substrates activity within the Power & Wireless Division. “GaN-on-SiC is the main technology platform. The market leader at the device level, SEDI [Sumitomo Electric Device Innovations], has partnered with the leading SiC wafer supplier, II-VI, for vertical integration,” she adds.

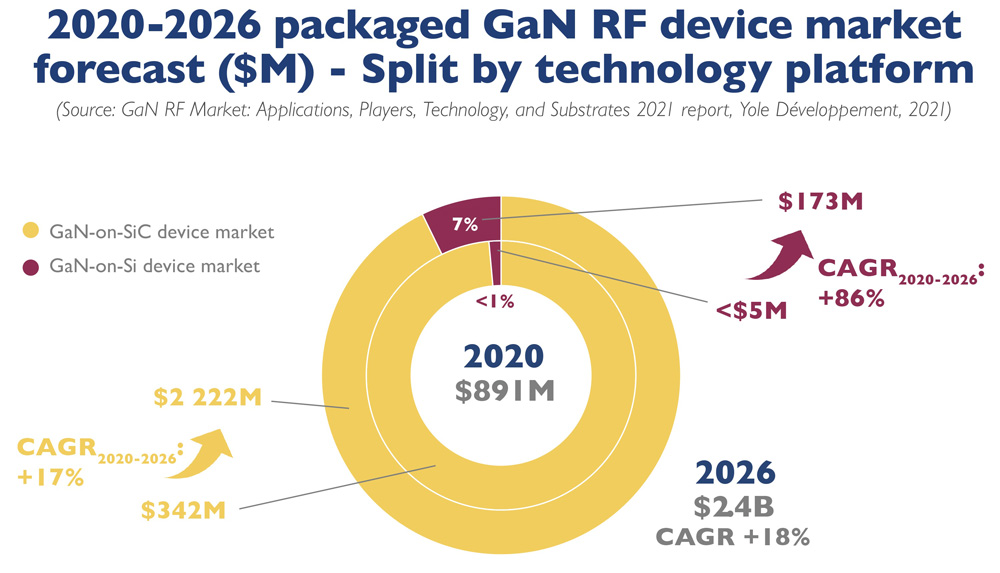

Driven by the 5G telecom and defense segments, GaN-on-SiC technology is still preferred in terms of high power density and thermal conductivity. In addition to its deep penetration in military radar, GaN-on-SiC has also been the choice of telecom OEMs such as Huawei, Nokia, Samsung for 5G massive MIMO infrastructures. Due to their high bandwidth and efficiency, GaN-on-SiC devices keep taking share from LDMOS in the 5G market and are starting to benefit from the 6” wafer platform transition. In this context, the GaN-on-SiC device market is growing at 17% CAGR from $342m in 2020 to $2.222bn in 2026, it is reckoned.

In 2020, NXP opened the world’s first 6”-wafer GaN-on-SiC fab, in Arizona, USA. The transition from 4” to 6” substrates for GaN-on-SiC is ongoing and expected to accelerate in the coming years. At the foundry level, major actors like Taiwan’s WIN Semiconductor are expanding their capacity to fulfill growing market demand. In addition, there is strong motivation for technology independence in the Chinese ecosystem, for example at SICC, CETC, HiWafer and Sanan IC. In particular, China’s SICC has invested in a new 6” plant in Shanghai.

“However, as a key challenger, GaN-on-Si is still in the game, promising cost-efficient and scalable solutions,” notes Poshun Chiu, technology & market analyst specializing in Compound Semiconductor and Emerging Substrates. “Despite the tiny market volume as of second-quarter 2021, GaN-on-Si PAs attract smartphone OEMs owing to their large bandwidth and small form factor,” adds Chiu. “Its adoption in some sub-6GHz 5G handset models is likely soon, following the significant technology progress of innovative players. This would certainly mark a milestone for the GaN-on-Si RF industry.”

GaN-on-Si keeps attracting newcomers. “As MACOM-STMicroelectronics’ development on 6” platform is ongoing, GlobalFoundries and Raytheon recently announced a partnership to target 5G wireless applications, defense and beyond,” notes Selsabil Sejil PhD, technology & market analyst, specialized in Compound Semiconductors and Emerging Substrates. “To serve increasing demand, newcomers have been joining with newly built capability.”

The recent entry of foundries and synergy with the emerging power electronics GaN-on-Si industry can also help GaN-on-Si RF to gain momentum in the longer term, says Yole. Driven by handsets but also defense and 5G telecom infrastructure applications, the GaN-on-Si device market is growing at a CAGR of 86% from less than $5m in 2020 to $173m in 2026, reckons Yole.