News: Markets

25 March 2021

Automotive LED revenue to grow 13.7% to nearly $3bn in 2021

The COVID-19 pandemic heavily impacted the global automotive market and in turn damaged the automotive LED industry in first-half 2020, according to TrendForce’s latest investigations. In second-half 2020 however, the gradual recovery of vehicle sales as well as the development of NEVs (new energy vehicles) provided some upward momentum for the automotive LED market, which reached $2.572bn for full-year 2020, down 3.7% year-on-year.

Automotive LED revenue for 2021 is projected to grow 13.7% year-on-year to $2.926bn, due to the increasing demand for automotive headlights and display panels. As auto-makers continue to incorporate LED lighting solutions into new car models, the penetration rate of automotive LEDs will continue to see a corresponding increase too.

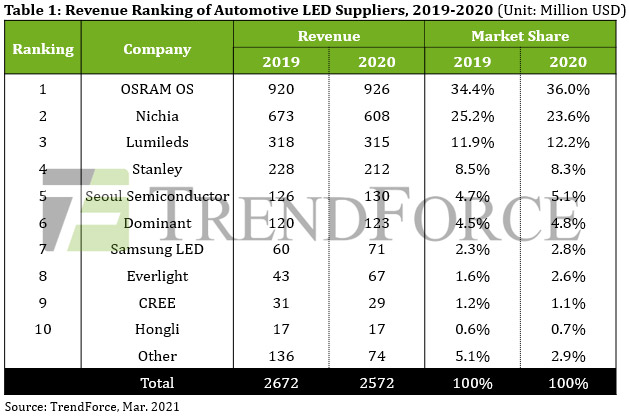

TrendForce analyst Joanne Wu indicates that, in the ranking of automotive LED players by revenue for 2020, Osram Opto Semiconductors, Nichia, and Lumileds remained the top three largest automotive LED suppliers, respectively, with a combined market share of 71.9%. In particular, European and American auto-makers favored Osram’s solutions for their high-end vehicle models and NEVs due to the high quality of Osram products. Adoption by these auto-makers subsequently became the main revenue driver of Osram’s automotive LED business.

On the other hand, the pandemic caused Japanese auto-makers to suspend their operations and therefore had a direct impact on the revenues and market shares of Japanese LED suppliers in 2020. Nichia and Stanley saw their revenues decline by 9.8% and 7% year-on-year, respectively, and they were the two suppliers among the top 10 last year to have shown relatively noticeable declines.

Seoul Semiconductor’s nPola and Wicop LED products were adopted by Chinese auto-makers, including CCAG, SAIC-GM and NIO, due to these products’ high brightness and compact sizes. Seoul Semiconductor’s market share reached 5.1% in 2020.

Finally, not only did other suppliers, including Samsung LED and Cree, deliver consistent performances in the automotive aftermarket (AM) and performance market (PM) segments, but they also gradually began to enter the automotive original equipment manufacturer (OEM) lighting market. Samsung LED and Cree each took seventh and ninth place in the 2020 ranking, with market shares of 2.8% and 1.1%, respectively.

On the whole, TrendForce finds that automotive demand has been recovering since fourth-quarter 2020. Accordingly, LED suppliers indicate that their order bookings appear bullish throughout 2021, meaning that most LED suppliers now need to extend their product lead-times in response. At the same time, LED players indicate that double booking may occur in the near future. They will hence take decisions in the light of the actual order booking quantity to see the possibility of increasing prices.