News: Markets

18 March 2021

Power semiconductor device market for xEVs growing at 25.7% CAGR to $5.6bn in 2026

With the plug-in hybrid electric vehicle (PHEV) and battery electric vehicle (BEV) markets estimated to be increasing at compound annual growth rates (CAGRs) of 37.3% and 44%, respectively, during 2020-2026, the converter market for all electric vehicles (xEV, spanning MHEV, HEV, PHEV, BEV, FCEV) is rising at a CAGR of 27.7%, to more than $28.8bn in 2026, estimates market analyst firm Yole Développement in its report ‘Power Electronics for E-Mobility 2021’.

In particular, the main inverter market is expected to grow at a CAGR of 26.9% to $19.5bn by 2026, representing 67% of the total electric vehicle/hybrid electric vehicle (EV/HEV) converter market.

“There are basically three converter types in an electric car: the main inverter, DC/DC and OBC (on-board charger),” notes Ana Villamor, technology & market analyst, Power Electronics. “The main inverter is the largest market among the different converters due to the higher power levels, leading also to the highest content of power semiconductors.”

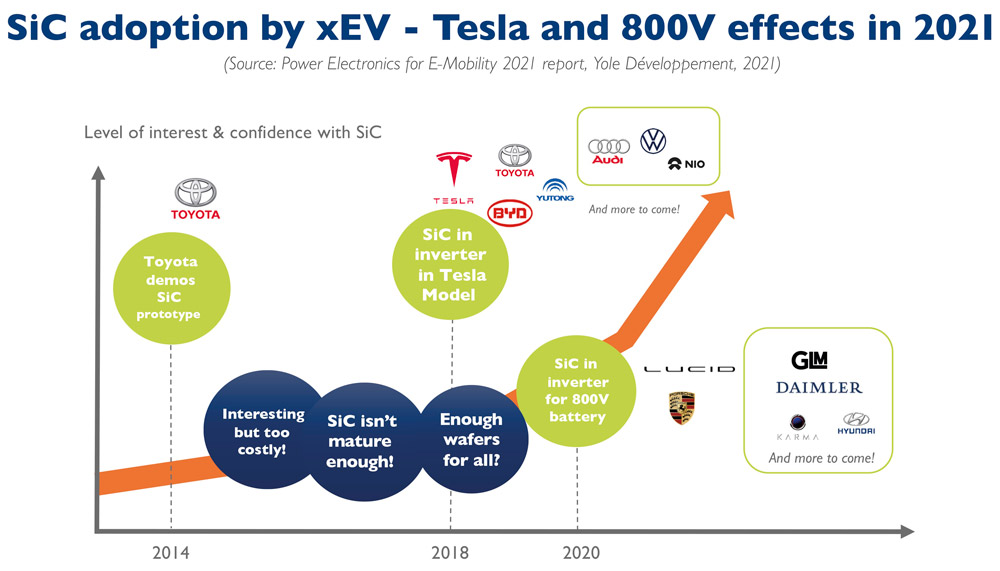

The power semiconductor market for xEVs is expected to triple between 2020 and 2026, growing at a 25.7% CAGR to $5.6bn, driven by a major technology battle between insulated-gate bipolar transistor (IGBT) and silicon carbide (SiC) modules. Indeed, SiC modules are presently still about three times the cost of a 650V IGBT module, but this difference will shrink when larger volumes are produced, with the transition to 8-inch wafers, and with the penetration of 1200V devices for higher battery voltages.

![]()

The EV/HEV supply chain continues to be impacted by the increased demand and technology trends. However, the leading semiconductor manufacturers for EVs/HEVs remain the same as for other power applications. They include Infineon Technologies, STMicroelectronics, Hitachi, Mitsubishi Electric, and ON Semiconductor. Other companies, tier-1s, OEMs, power semiconductor manufacturers and pure module newcomers are now offering power modules for EVs/HEVs. A similar situation exists with battery design and manufacturing, where OEMs such as Tesla and GM are further trying to control their supply chains.

“Competition at OEM level has also opened two main fronts: on the one hand, there are the traditional OEMs with established markets and known brands that are transforming their business towards electric vehicles. On the other hand, pure EV OEMs are popping up in the different regions of the world (such as NIO, Rivian, Rimac, Xpeng, and Hozon), some of which are rapidly increasing their volumes year after year (led by Tesla),” says Milan Rosina, Yole’s principal analyst, Power Electronics & Batteries.

The new car models being launched often offer better performance/cost ratio, and this has led to a continuous reshaping of the top 10 vehicle sales.

SiC is now walking the EV/HEV red carpet, says Yole. Over the last couple of years (and especially since Tesla introduced SiC in its Model 3 main inverter), there has been much noise around SiC adoption in EV/HEV. But not all converters or all types of electrification are suitable for this expensive material, Yole notes. Without a doubt, the battery electric vehicle (BEV) is the winner due to the requirements of a long driving range and fast charging time (km driven by charge time). Therefore, the increased cost of the converter is repaid, as the efficiency of the converter will improve, allowing battery savings. It is no surprise then that the use of SiC in the main inverter has become a common goal for the leading OEMs, with players such as Daimler and Hyundai soon including it in their main inverters. Who will be next?

Today, there is already a good portfolio of SiC devices, with SiC dies coming from Infineon Technologies, Cree (Wolfspeed), and STMicroelectronics. Many semiconductor players are targeting SiC modules for EV applications, and the SiC module market is expected to reach 32% of the total EV/HEV semiconductor market by 2026, Yole forecasts.

www.i-micronews.com/products/power-electronics-for-e-mobility-2021