News: Markets

5 May 2021

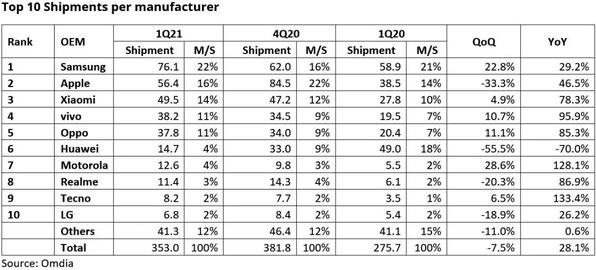

Smartphone shipments grow 28.1% YoY to 353 million in Q1

Global smartphone shipments grew 28.1% year-on-year (YoY) from 275.7 million units in first-quarter 2020 to 353 million units in first-quarter 2021, reckons Omdia, demonstrating that the smartphone form factor continues to be a key piece of technology for users worldwide.

While there is significant recovery, 2021 marks a period of much transition, and Huawei’s role in the market will continue to change, says the market research firm. LG’s announcement that it is exiting the market will impact multiple OEMs competing in the mid-range segment, all in the context of a component shortage.

Graphic: Smartphone shipments (in millions) and market shares for the top 10 manufacturers.

Samsung took the top spot, shipping 76.1 million units, up 22.8% quarter-on-quarter from 62 million in Q4/2020 and up 29.2% year-on-year from 58.9 million in Q1/2020. An early update to the Galaxy S line allowed Samsung to take market share from Apple in Q1/2020 and put a focus on its own flagships as well as its latest range of devices in the A series.

Apple continues to benefit from the delayed role out of its iPhone 12 range. A blockbuster Q4/2020 was followed by the shipment of 56.4 million units in Q1/2021, up 46.5% year-on-year from 38.5 million in Q1/2020, as Apple continues to dominate the premium smartphone market.

Xiaomi reached third place in Q1/2021, shipping 49.5 million units – up 78.3% from 27.8 million in Q1/2020. Shipments also grew by 4.9% quarter-on-quarter, from 47.2 million in Q4/2020. Xiaomi is solidifying third position, as Huawei is declining continuously compared with the competition.

Oppo and vivo continue to battle for fourth and fifth place in the global rankings. In Q1/2021, vivo shipped 38.2 million units (up 10.7% on Q4/2020’s 34.5 million and 95.9% on Q1/2020’s 19.5 million). This is slightly more than Oppo’s 37.8 million units (up 11.11% on Q4/2020’s 34 million and 85.3% on Q1/2020’s 20.4 million). Both firms are rapidly replacing Huawei in the China local market.

Huawei fell out of the top five global smartphone OEMs in Q1/2021, shipping 14.7 million units, down 55.5% on 33 million in Q4/2020 and 70% on 49 million in Q1/2020. Even after one quarter under a new US administration, there are no signs that Huawei’s technology ban on US components and software is ending any time soon, notes Omdia. The global component shortage is adding additional pressure on the firm, as suppliers are looking towards other OEMs for stable business.

The previous Huawei sub-brand Honor shipped 3.6 million units in Q1/2021 – its first as an independent entity.

Motorola increased its shipments to 12.6 million units in Q1/2021, up 28.6% on 9.8 million in Q4/2020 and 128.1% on 5.5 million in Q1/2020. LG’s exist from the smartphone business will open up opportunities for Motorola to further increase shipments throughout 2021, as both companies focus on the North America, Latin America and Caribbean regions, Omdia notes.

Realme grew shipments by 86.9% to 11.4 million units, up from 6.1 million in Q1/2020 – enough for 8th place globally, despite its shipments falling by 20.3% quarter-on-quarter from 14.3 million in Q4/2020.

Transsion holdings brand Tecno shipments were 8.2 million units in Q1/2021, up 6.5% on 7.7 million in Q4/2021 and 133.4% on 3.5 million in Q1/2020. The Transsion family of brands is focused on markets in Africa, where there is still big demand for feature-phone replacement as well as Huawei’s vacancy, notes Omdia.

Rounding out the top 10 is LG, which will leave the smartphone market by summer 2021. Its shipments grew by 26.2% year-on-year from 5.4 million units in Q1/2020 to 6.8 million units in Q1/2021, but this is down quarter-over-quarter by 18.9% from 8.4 million in Q4/2020.

“The smartphone market continues to show resiliency in the face of multiple challenges,” comments principal analyst Gerrit Schneemann. “The global component supply shortage is looming large over the market. On the other hand, two well-known smartphone brands will disappear from the global smartphone market this year, in Huawei and LG, opening the door for other brands to reach new markets and buyers.”