News: Markets

17 November 2021

Smartphone production to return to pre-pandemic level in 2022

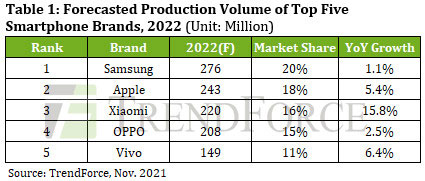

TrendForce expects the smartphone industry to rebound and post marginal growth next year, assuming that economic activities worldwide will mostly return to normal by then. The main trend drivers in the smartphone market next year are still going to be the usual device replacement cycle and the additional demand from emerging markets. TrendForce expects annual smartphone production for 2022 to reach about 1.39 billion units and the year-on-year growth rate hitting 3.8%.

Expanding market share challenging due to fierce competition

Samsung’s smartphone production is expected to grow by 1.1% year-on-year to 276 million units in 2022. The firm continues to reorganize and extend its product series. The integration of the Galaxy Note series with the Foldable series, the continuation of the S-Pen etc, are some of the moves that Samsung has taken to maintain its market share in the high-end segment. Moreover, Samsung has increased the outsourcing portion of its device manufacturing in order to make its mid-range and low-end models more cost competitive.

However, advances in device design and manufacturing will only intensify the competition in developed markets. In emerging markets, demand will continue to concentrate on entry-level models. Hence, Samsung will have increasing difficulty in growing its market share, as most of its range does not target the demand for entry-level products. This also means that retaining its leading 20% market share will become more challenging for the brand, reckons TrendForce.

Apple is set to release the latest model in its iPhone SE lineup (the third-generation SE), featuring a 4.7-inch display, A15 SoC (system-on-chip), and 5G support, by the end of first-quarter 2022. Other than these features, the rest of the new SE’s hardware specifications will be similar to those of the second-gen SE. The new SE can hence be seen as an invaluable asset with which Apple is attempting to enter the mid-range 5G smartphone segment. In second-half 2022, the firm will keep to its tradition of announcing four new models, two of which will feature a 6.1-inch display, while the other two will feature a 6.7-inch display. Although the release of these five new handsets will likely help Apple to increase its market share next year, this increase will be constrained by the fact that Apple will have to raise the retail price of its smartphones in order to keep up with rising component prices and to ensure some profitability. TrendForce therefore expects Apple’s smartphone production to grow by 5.4% year-on-year to 243 million units in 2022 (the second highest volume among all smartphone brands, at 18%).

Given that demand is unlikely to increase by a significant margin in the domestic Chinese smartphone market next year, the three major Chinese brands (OPPO, Xiaomi and Vivo) will depend primarily on overseas sales for their market share growth.

TrendForce notes that its calculation of Xiaomi’s production volume also includes handsets released by the brand’s subsidiaries Mi, Redmi, POCO and Black Shark. Due to Xiaomi’s relatively early expansion in the overseas markets, as the global spread of the COVID-19 pandemic is gradually brought under control the firm’s overseas sales growth is expected to benefit, helping Xiaomi’s smartphone production to grow by 15.8% year-on-year to 220 million units (the third highest market share by volume, at 16%).

TrendForce expects annual smartphone production for fourth-ranked OPPO group (which sells its smartphones globally under three brands: OPPO, Realme and OnePlus) to grow by 2.5% year-on-year to 208 million units in 2022. Regarding product planning, OPPO is relatively similar to Xiaomi, as both brands differentiate between various markets and client bases through subsidiaries. Likewise, in recent years OPPO has actively expanded its peripheral ecosystem businesses, such as software services and additional consumer items, in order to improve its profitability for the year.

Finally, fifth-rank Vivo’s smartphone production will grow by 6.4% year-on-year to almost 150 million handsets in 2020. This brand depends heavily on its customers’ cyclical replacement demand for its sales. Therefore, while the Chinese smartphone market (Vivo’s primary sales region) becomes increasingly saturated, the brand’s room for growth in 2020 will also be relatively limited. In addition, as HONOR will also aggressively look to capture market share in China, the production volumes of both OPPO and Vivo will be further constrained next year, forecasts TrendForce.

Annual 5G smartphone production for 2022 to reach about 660 million units despite slowing growth rate

Due to the Chinese government’s active push for 5G commercialization for the past two years, the global market share of 5G smartphones will likely hit 37.4% in 2021, with about 500 million units produced throughout this year, says TrendForce. Going forward, now that the market share of 5G smartphones has surpassed 80% in China, the smartphone industry will shift its focus of 5G development to other regional markets, the firm reckons. However, because countries vary in the progress of 5G infrastructure build-out, and 5G service plan fees are higher than 4G fees, the growth of 5G market share now appears to be slowing. TrendForce therefore expects 5G smartphone production for 2022 to reach about 660 million units, translating to 47.5% market share for 5G handsets in the overall smartphone market.

On the other hand, the growing market share of 5G smartphones also generates corresponding growing demand for components. Given the increased shipment in servers, Internet of Things (IoT) devices and electric vehicles (EVs), foundries will find it even harder to manufacture enough components for 5G handsets since foundry capacities are already stretched to their limits, says TrendForce. This also means that the market share of smartphone brands will depend on how successful they are in booking foundry capacities.

Smartphone brands’ scramble for foundry capacities, however, may in turn result in overbookings or uneven allocation of capacities to components, further exacerbating the mismatched availability of smartphone components. Hence, if the actual demand from smartphone buyers falls short of expectations, TrendForce believes that smartphone brands may be forced to adjust their inventories once again in second-half 2022.

Smartphone production falls a record 11% to 1.25bn units in 2020 as Huawei exits top-six ranking