News: Markets

29 November 2021

ALD equipment market growing at 12% CAGR to $680m in 2026

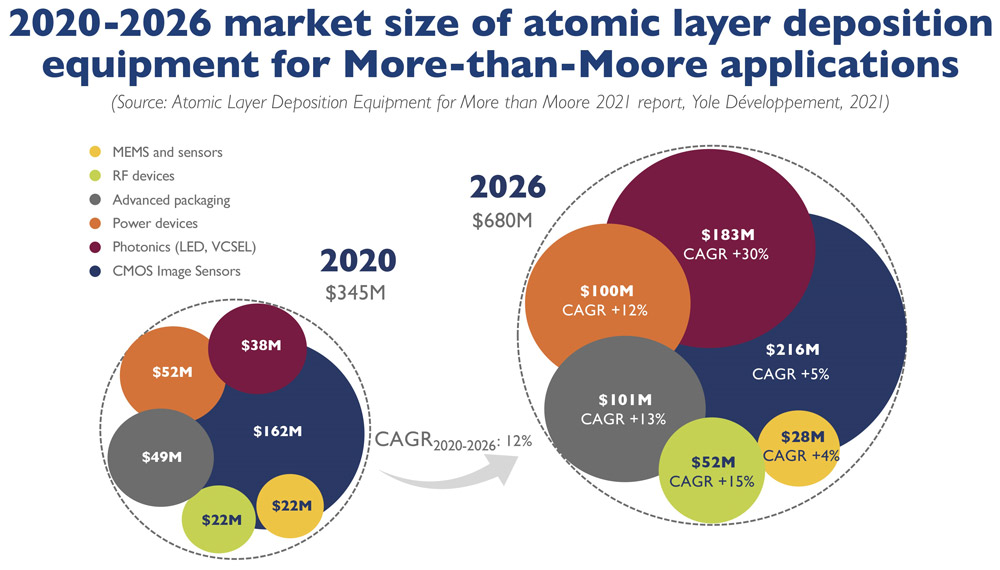

The atomic layer deposition (ALD) equipment market for More than Moore (MtM) device manufacturing totaled $345m in 2020 – dominated by CMOS image sensors (CIS), with 47% share – and is estimated to be rising at a compound annual growth rate (CAGR) of 12% to $680m in 2026, according to the report ‘Atomic Layer Deposition Equipment for More than Moore’ from market analyst firm Yole Développement.

The ALD equipment market for non-CIS More than Moore applications is really taking off now for commercial device manufacturing, says Yole, which gives two main reasons for this high growth.

Firstly, manufacturing sites are gearing up for the production of More than Moore devices that are gaining importance across all the megatrends: for example, compound semiconductor-based power devices, in particular gallium nitride (GaN) and silicon carbide (SiC), as well as photonic devices, including mini-LEDs and micro-LEDs. Their manufacturing is rocketing for automotive and consumer applications.

Specifically, CAGRs over 2020-2026 are expected to be 30% for the production of photonics devices, and 12% and 15% respectively for power and radio frequency (RF) devices. CAGRs will be 4% for micro-electro-mechanical systems (MEMS) and sensors and just 5% for CIS. Growth is further strengthened by the high wafer production volume of CIS devices, silicon power electronics, and advanced packaging – mainly wafer-level encapsulation – used across all More than Moore applications.

Secondly, the global semiconductor market is favorable. Chip shortages across all markets and More than Moore devices have pushed manufacturers to announce fab capacity expansion worldwide. “The worldwide fab capacity expansion is accelerating the industrial adoption of ALD equipment,” notes Taguhi Yeghoyan Ph.D., technology & market analyst, Semiconductor Manufacturing.

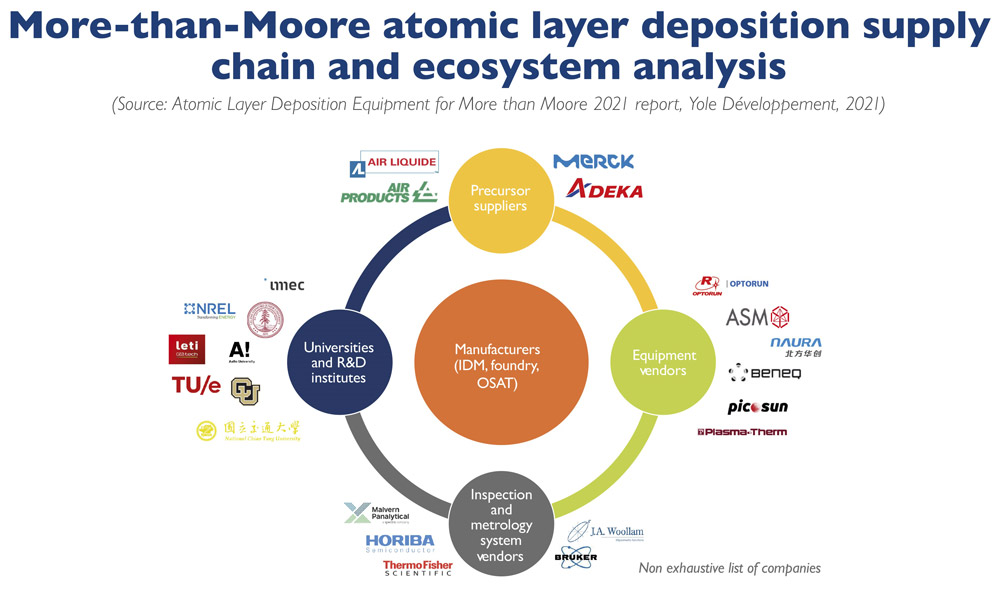

“This is an excellent opportunity to deploy new materials and processes that improve device performance,” adds Yeghoyan. “The ALD ecosystem and supply chain actors, traditionally tightly interrelated, now collaborate even more to accelerate ALD adoption. These include ALD process developers such as academic and R&D institutes, precursor suppliers (off-shelf and customized), equipment subpart providers, as well as inspection and metrology system providers.”

Moreover, fab expansions concern not only the leading manufacturing players but also smaller production sites, giving emerging ALD equipment vendors a growth opportunity, says Yole.

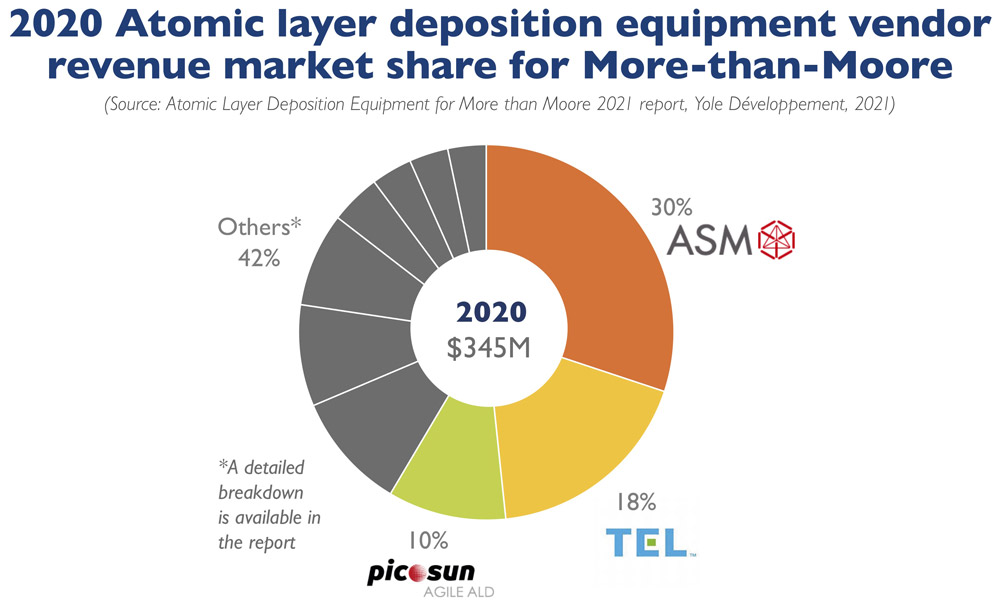

The 2020 ALD equipment market was led by 300mm platforms. Yole identifies the following leading ALD players: ASM International with 30% market share, and Tokyo Electron Ltd (TEL) with 18% market share, as well as NAURA. All these players offer 300mm platforms with high average selling price (ASP) as well as high throughput.

These players are followed by Picosun, specialized in 200mm platforms, which has 10% market share. However, the company is closely followed by Optorun, Beneq, Plasma-Therm, Oxford Instruments, and Veeco, among others.

Moreover, in response to the chip and equipment shortages, equipment vendors previously active only in ALD research are now developing their machines for volume production. All in all, the ongoing global semiconductor market upside gives an optimistic prospect for More than Moore ALD equipment vendors’ revenues, believes Yole. However, the ALD market is competitive, and market shares can change significantly in the coming years.