News: Suppliers

16 September 2021

IQE’s first-half 2021 GaAs revenue grows 30%, offsetting drops for GaN-on-SiC and Photonics

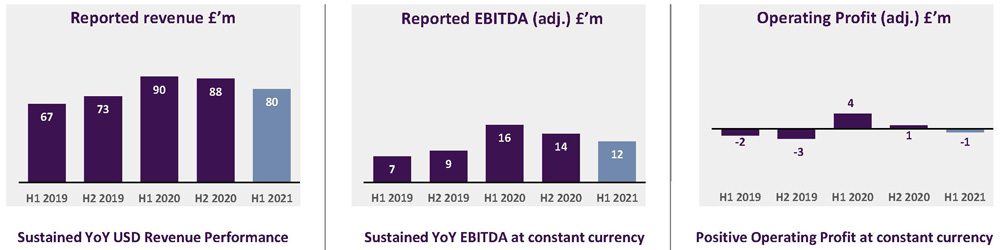

For first-half 2021, epiwafer and substrate maker IQE plc of Cardiff, UK has reported revenue of £79.5m, down 11.5% on first-half 2020’s record £89.9m. However, after adjusting for a significant foreign exchange (FX) headwind of £8.1m, revenue was £87.7m on a constant-currency basis (down only 2.5%), as trading remained robust across each of the firm’s primary business segments.

Sustained wireless handset-related growth

Wireless revenue has fallen by 8.6% from £45.5m to $41.6m. However, on a constant-currency basis, this is £45.9m, up 0.9% year-on-year. This includes gallium arsenide (GaAs) rising by 30% (to 84% of Wireless revenue) due to strong demand for epiwafers used in power amplifiers for 5G handsets and WiFi 6/6E routers. However, for gallium nitride on silicon carbide (GaN-on-SiC) for 5G infrastructure products there was a 53% year-on-year reduction (to 16% of Wireless revenue), reflecting global 5G deployment cycles, in particular lower numbers of massive MIMO (mMIMO) deployments in Asia compared with 2020.

Photonics revenue fell 16.1% from £43.4m to £36.4m (or £40.1m, down just 7.6%, on a constant-currency basis). IQE has maintained a strong market share in vertical-cavity surface-emitting lasers (VCSELs), with volume gains in world-facing light detection & ranging (LiDAR) applications, offset by a reduction in VCSEL revenue of 26% year-on-year due to smaller chip sizes required for facial recognition technology. However, the firm has also seen continued strong demand for advanced sensing for defence and security applications. Of Photonics revenue, VCSELs comprised 48%, Infrared products 38%, and indium phosphide (InP) 14%.

CMOS++ revenue has risen from £0.95m to £1.5m, or £1.7m (up 74%) on a constant-currency basis.

Operating loss has been cut from £5m in first-half 2020 to £1.9m. However, this is a £2.2m profit on a constant-currency basis.

Adjusted EBITDA (adjusted earnings before interest, tax, depreciation and amortization) was £11.6m, down from first-half 2020’s £16.3m, but level year-on-year on a constant-currency basis (after accounting for a foreign exchange headwind of £4.7m).

Adjusted net cash inflow generated from operations was £9.1m, down from first-half 2020’s £16.2m but representing 78% conversion of adjusted EBITDA.

Property, plant & equipment (PP&E) capital expenditure (CapEx) was £6.1m in first-half 2021, including the first payment on three new Aixtron G4 metal-organic chemical vapor deposition (MOCVD) reactors for IQE Taiwan. In addition, capitalized development expenditure was £1.8m. In total, net cash used in investing activities was £8.1m.

Net cash used in financing activities totalled £4.8m (comprising £3.1m in repayment of borrowings and £2m in payment of lease liabilities).

Hence, overall (compared with cash generation of £8.3m in first-half 2020 and £16m in full-year 2020), cash and cash equivalents fell by £3.9m during first-half 2021 from £24.7m to £20.6m (although this is still up on £17.4m at the end of first-half 2020). This is net of bank loans (repayable over a period to 29 August 2024) of £19.7m (cut from £24.8m at the end of first-half 2020 and £22.7m at the end of 2020).

Diversification of 5G infrastructure and other opportunities

During first-half 2021, orders were placed for three new Aixtron G4 MOCVD reactors and three refurbished Aixtron G3 reactors (for delivery in second-half 2021) to increase wireless GaAs capacity at IQE Taiwan by over 20%, underpinning further anticipated growth in 2022 and beyond. Also, on 18 August a Taiwan Court determination was received relating to the acquisition of minority shareholdings in IQE Taiwan. The matter will be finalized upon resolution of an appeal by a small number of shareholders.

IQE says it has seen increasing interest from several chip foundries in gallium nitride on silicon (GaN-on-Si) technologies, with joint development programs progressing in second-half 2021 to develop a diversified and cost-effective offering to the RF infrastructure market, with potential longer-term applicability to power electronics and 5G mmWave.

Also, after the end of first-half 2021, IQE signed a multi-year strategic partnership with a major semiconductor foundry to develop epiwafers for 5G small cells.

Photonics technology developments

IQE says it has reported strong development progress on long-wavelength VCSELs for below-screen applications and for advanced sensing in healthcare applications. In particular, it has achieved key power and reliability milestones for its IQDN-VCSEL technology for advanced sensing applications at longer wavelengths (1100-1600nm) on 150mm GaAs substrates.

The firm has also expanded its VCSEL portfolio with the turnkey IQVCSEL product line, which is aimed at accelerating the ability of customers to introduce new products, expanding the VCSEL market.

“Results reflect the resilience of our business and highlight the ongoing commitment and hard work of our people who have, despite additional headwinds, largely sustained the record levels of performance at IQE that we reported a year ago,” comments outgoing CEO Dr Drew Nelson.

Board updates

“In November 2020 the company announced the search for my successor and my intention to continue in an ambassadorial and advisory role at IQE,” says Nelson. As announced in November 2020, Nelson will transition to non-executive director with the title of president. “I look forward to supporting the company in the next stage of IQE’s development in my role as president & non-executive board member, while also helping drive the development of the Compound Semiconductor Cluster,” says Nelson.

The process for recruiting a new CEO is nearing completion, with a preferred candidate identified who possesses relevant international semiconductor market experience. Discussions are ongoing with the aim of concluding the appointment process.

To prepare IQE for the appointment of a new CEO, Phil Smith has been appointed interim executive chairman. “As part of my expanded role, I will focus on the execution of IQE’s strategy and preparing the business for the arrival of the incoming CEO,” says Smith.

IQE has appointed Victoria Hull as non-executive director and incoming Remuneration Committee Chair, and appointee to the Audit & Risk and Nominations Committee. Sir David Grant is retiring from the board and his position as Remuneration Committee Chair on 18 September.

Outlook for full-year 2021 and beyond

In Wireless, the market for GaAs power amplifiers is expected to continue to be strong through second-half 2021 and grow further in 2022, driven by continued 5G penetration of the smartphone handset market and by WiFi 6 & 6E.

The market for GaN for 5G infrastructure has been weak in first-half 2021 due to the nature of global 5G deployments. This is expected to continue in third-quarter 2021. However, IQE sees potential opportunities for higher volumes in Q4 ahead of an anticipated return to growth in 2022.

In Photonics, production of VCSELs and advanced sensing for defence and security markets is expected to continue at relatively stable levels, with possible volume opportunities in VCSELs in Q4 related to the success of handset launches.

IQE notes that a significant foreign exchange headwind is being experienced in 2021 on a reported basis, as the firm’s revenues are predominantly earned in US$ but are reported in GBP. However, on a constant-currency basis, full-year 2021 revenue is expected to be similar to 2020. At this level, adjusted EBITDA is also expected to be similar on a constant-currency basis.

IQE reiterates its guidance for full-year 2021 capital expenditure (CapEx) on property, plant & equipment (PP&E) of £20-30m, as investments are made in tool capacity to underpin anticipated growth in both Wireless and Photonics products in 2022 and beyond. A total of nine new, refurbished or re-commissioned tools will be coming online at the end of 2021/beginning of 2022.

IQE says that capitalization of development costs is expected to be £5-8m for full-year 2021 as it continues to invest in its IT transformation and in future products to meet anticipated growing demand for compound semiconductors driven by the macro trends of 5G and connected devices.

IQE reaches milestones with IQDN-VCSELs for long-wavelength sensing on 150mm GaAs

IQE's IQepiMo delivers improved BAW filter performance for 5G

IQE’s revenue grows 25% in 2020, exceeding guidance of 20%

IQE develops IQGeVCSEL 150 technology

IQE acquires outstanding stake in IQE Taiwan