News: Markets

29 April 2022

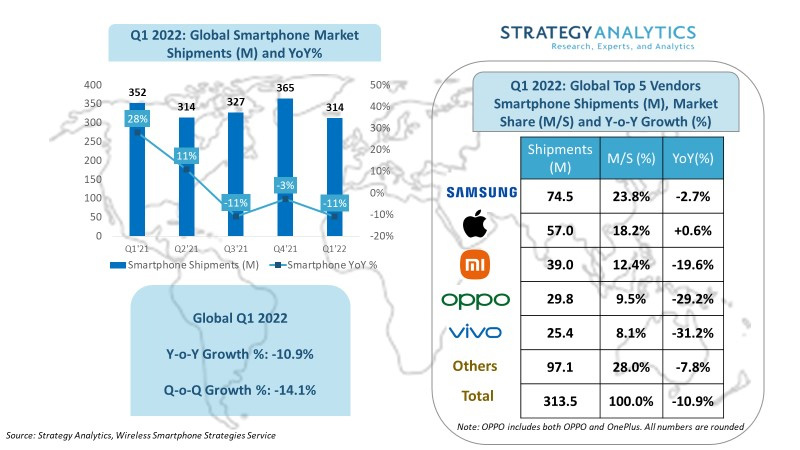

Smartphone shipments fall year-on-year for third consecutive quarter, by 11% to 314 million in Q1/2022

Global smartphone shipments fell by 11% year-on-year to 314 million units in first-quarter 2022 (the third consecutive quarter of annual decline by smartphone volumes), according to market research firm Strategy Analytics.

“Factory constraints and component shortages continued to restrict smartphone supply in the first quarter of this year,” notes senior director Linda Sui. “Meanwhile, unfavorable economic conditions, geopolitical issues, as well as COVID-19 disruption (China rolling lockdown etc) continued to weaken consumers’ demand on smartphones and other non-essential products.”

Samsung’s 75 million smartphone shipments yielded the top market share of 24% (its highest first-quarter performance over the past five years, since 2017). “Demand was strong for the newly launched flagship Galaxy S22 series, especially the higher-priced S22 Ultra model,” says Woody Oh, director at Strategy Analytics. “Meanwhile, Samsung continue to ramp up the mass-market A series in multiple markets.

Apple shipped 57 million iPhones (up 1% year-on-year), yielding 18% market share (ranking second). “Apple had a good quarter, led by iPhone 13 series and the newly launched iPhone SE (2022), which starts to become a volume driver in lower segment,” notes Oh. “Apple also captured the highest first-quarter market share since 2013, at the expense of leading Chinese brands, who are hampered by the sluggish home market.”

Nevertheless, Xiaomi, OPPO (including OnePlus) and vivo remained in the top five. Xiaomi shipped 39 million smartphones, yielding third place with 12% market share (down from 14% a year ago). “Xiaomi suffered from the geopolitical uncertainties in Europe,” says senior analyst Yiwen Wu. “China and India market also delivered a mixed bag for the Chinese brand.” OPPO (OnePlus) held fourth place, with 10% market share. Vivo remained fifth, with 8% market share. “OPPO (OnePlus) and Vivo both lost ground in all key markets except Latin America, as 5G competition from Honor and other smartphone competitors intensified sharply in China and other markets,” adds Wu.

“Global competition among other major smartphone brands, beyond the top-five, was fierce during Q1/2022,” comments executive director Neil Mawston. “Honor, Realme, Lenovo-Motorola and Transsion all outperformed the overall market but delivered different patterns. Honor held firm in China and continued to ramp up in overseas markets. Realme continued the upwards track in all regions, but China pulled back the overall performance. Lenovo-Motorola gained share in the North America but the momentum in Central Latin America has been disrupted by other Chinese brands. Transsion faced the intensified competition from Samsung in Africa region, posting the annual decline in the region for the first time over the past two years,” he adds.

Strategy Analytics forecasts that global smartphone shipments to contract by 1-2% year-on-year in full-year 2022. “This year will be a tale of two halves,” expects Sui. “Geopolitical issues, component shortages, price inflation, exchange rate volatility, and COVID disruption will continue to weigh on the smartphone market during the first half of 2022, before the situation eases in the second half due to Covid vaccines, interest rate rises by central banks, and less supply disruption at factories.”

Apple iPhone tops smartphone market in Q4/2021, but Samsung remains top for full year