News: Suppliers

1 August 2022

Aixtron’s Q2 revenue up 51% year-on-year, driven by demand from SiC and GaN power electronics

Deposition equipment maker Aixtron SE of Herzogenrath, near Aachen, Germany has reported 63% growth in revenue (equipment & after-sales), from €117.2m in first-half 2021 to €191.1m in first-half 2022.

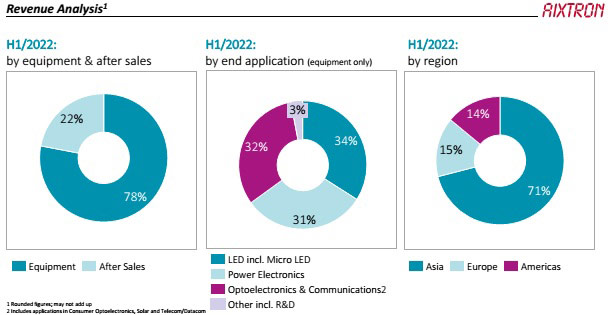

Of total revenue, 78% came from equipment sales (€148.6m, up 62% on €91.6m in first-half 2021), while 22% came from after-sales service & spare parts (€42.4m, up 65% on €25.7m in first-half 2021).

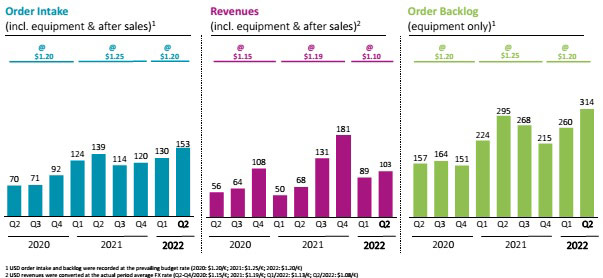

Second-quarter 2022 revenue was €102.5m, up 16% on $88.6m in Q1/2022 and up 51% on €67.7m in Q2/2021.

Of the equipment revenue, metal-organic chemical vapor deposition (MOCVD)/chemical vapor deposition (CVD) equipment for making gallium nitride (GaN)- and silicon carbide (SiC)-based power electronics devices comprised 29% (with SiC growing strongly); MOCVD equipment for making optoelectronics devices (telecoms/datacoms and 3D sensing lasers for consumer electronics, solar, and wireless/RF communications) comprised 24% (with optical data transmission and 5G applications growing strongly); and MOCVD equipment for making LEDs comprised 43% (mainly traditional red LEDs, but also micro-LED applications).

On a regional basis for first-half 2022 revenue, 70% came from Asia (up from 62% in first-half 2021), 16% from Europe (down from 32%) and 14% from the Americas (up from just 6%).

Net profit more than doubles year-on-year

First-half 2022 gross margin was level year-on-year at 39%. However, Q2/2022 gross margin of 37% is down from Q2/2021’s 41%, driven by a comparatively low-margin product mix (from the delivery of equipment for producing traditional red LEDs) as well as one-off costs incurred from projects to optimize production and supply chain processes.

Operating expenses rose from €40.2m in first-half 2021 to €42.3m in first-half 2022, due to increased R&D expenses and higher variable-compensation components. However, quarterly operating expenses have been cut from €21.7m in Q1/2022 to €20.6m in Q2/2022, due to €1.1m lower R&D expenses.

The operating result (EBIT, earnings before interest and taxes) increased year-on-year from €4.9m (EBIT margin of 4%) in first-half 2021 to €31.4m (16% margin) in first-half 2022. Quarterly EBIT has more than tripled year-on-year from €5.6m (8% margin) in Q2/2021 and €14.2m (16% margin) in Q1/2022 to €17.2m (17% margin) in Q2/2022.

Net profit rose from €11.5m in first-half 2021 (10% of revenue) to €31.1m (16% of revenue) in first-half 2022. Quarterly net profit has more than doubled, from €7.7m (11% of revenue) in Q2/2021 then €13.8m (16% of revenue) in Q1/2022) to €17.3m (17% of revenue) in Q2/2022.

Inventories boosted to prepare for higher business volume

Despite quarterly operating cash flow of -€27.6m in Q2/2022, first-half 2022 operating cash flow was €35.4m.

Capital expenditure (CapEx) was €8.9m in first-half 2022, including €4.2m in Q2/2022.

Free cash flow was hence €26.4m in first-half 2022 (almost halving from €46.1m in in first-half 2021) – including just €4m in Q2/2022 – as the increase in advance payments received for customer orders was outweighed by the corresponding increase in inventories (from €120.6m to €161.6m during first-half 2022) in preparation for the higher business volume in the coming quarters.

At the annual general meeting (AGM) of shareholders on 25 May Aixtron proposed a dividend payment of €0.30 per share (up from €0.11 per share in 2021), totalling €33.7m (a payout ratio of 35% of the firm’s net income).

Cash and cash equivalents including financial assets hence fell from €352.5m at end-December 2021 to €346.2m at end-June.

Aixtron says that its financial strength is underlined by its high equity ratio of 78% at the end of June (up from 73% at end-June 2021). Meanwhile, staffing has risen by 8% from 718 to 772. So, structural strengthening of the organization for further growth is reckoned to be well on track.

“We were able to grow as planned despite the challenging market environment with supply chains remaining constrained,” says chief financial officer Dr Christian Danninger. “In addition, we are driving process improvements along the entire organization in order to prepare Aixtron SE for the expected future growth.”

Highest quarterly order intake since Q2/2011

Order intake (including equipment and after-sales) has grown by 7% year-on-year from €263.3m in first-half 2021 to €282.8m in first-half 2022.

In particular, Q2/2022 order intake was €152.6m, up 17.2% on even last quarter’s strong €130.2m and up 10% on €139m a year ago (and Aixtron’s highest quarterly order intake since Q2/2011).

“Many years of research work are now paying off,” says CEO Dr Felix Grawert. “This quarter marks another milestone as we are not only showing continued strong growth on a broad basis in our addressed markets [particularly SiC- and GaN-based power electronics], but especially with the first order for our equipment for the volume production of micro-LEDs.”

Equipment order backlog at the end of June was €314.4m, up 20.7% on €260.4m at the end of March. Most of the order backlog is due for delivery in 2022.

Growth guidance 2022 confirmed

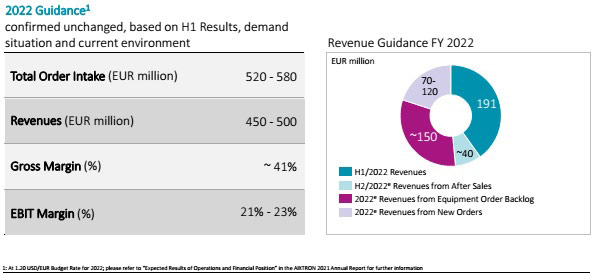

Based on a budget rate of $1.20/€ (versus $1.25/€ in 2021), due to the good business development in first-half 2022 and in view of the expectation of a positive development of demand for the remainder of 2022, Aixtron expects double-digit growth in full-year order intake to €520-580m for 2022.

Based on the first-half 2022 revenue of €191.1m plus a forecasted €40m in after-sales revenue, joined by equipment order backlog of €150m (as of end-June) plus a forecasted €70-120m in new order intake (convertible into revenue during 2022), Aixtron still expects double-digit growth in full-year revenue to €450-500m in 2022.

Full-year gross margin should be about 41% and EBIT margin should be 21-23% for 2022 (again reiterating the guidance given in February).

“Overall, the current global crisis situations and market developments continue to only have a minor impact on our business,” notes Aixtron. “Logistics and supply chains are still challenging, but in our view continue to be manageable.”

Aixtron expands MOCVD market share to 75% in 2021

Aixtron grows revenue 59% and orders 65% in 2021, driven by power electronics

Aixtron’s revenue almost doubles in Q3/2021

Aixtron doubles EBIT in first-half 2021 as revenue grows 21% year-on-year